Earnings statistics suggest that consumers are not quite feeling comfortable about freely spending again — at least for retailers of nonessential goods.

Much to the relief of many retailers nationwide, shoppers are generally returning to spend at a rate that’s finally outpacing inflation after many months of limiting themselves to the strict essentials.

However, this spending on more than the bare minimum is hitting discretionary retailers unevenly, with some such as Dick’s Sporting Goods reporting solid profits, while others such as Best Buy are striving to move their profits from the red to the black. The electronics retailer has felt the brunt of inflation’s impact on consumer wallets as big-ticket items, especially those considered unnecessary, were among the first to fall by the wayside as shoppers trimmed back.

True to company projections, sales have dwindled through 2023, including a 10% year over year drop during Q1, leading to the company culling of hundreds of in-store staff. While the retailer reported higher-than-expected financial results for Q2, bringing the year-over-year sales decline down to 6%, further quarters may pass before Best Buy goes back to turning a profit.

Best Buy’s earnings may reflect a broader consumer sentiment about buying big-ticket items in the current economic landscape, per August’s “New Reality Check: The Paycheck-to-Paycheck Report,” a PYMNTS collaboration with LendingClub.

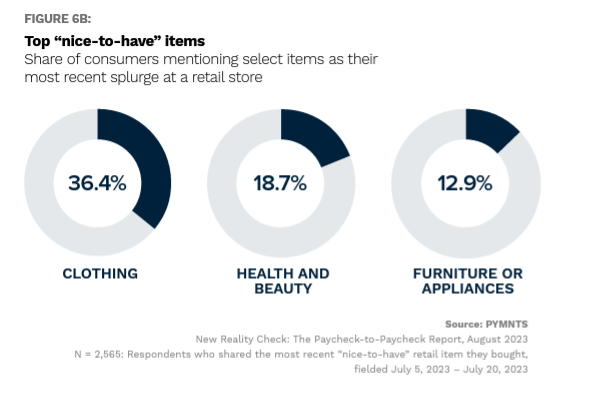

Of all the select “nice-to-have” items surveyed consumers splurged on, furniture and electronics came in last, with only 13% of spending in this category, compared to health and beauty’s 19% and clothing’s 36%.

Indeed, Commerce Department-released data on discretionary consumer spending by segment reflects similar findings, with relatively smaller expenditures such as eating outside the home on the rise, along with apparel items.

At the same time, furniture sales dipped nearly 2% and electronics dropped 1.3%, as other household name merchants reported similarly slipping earnings. Much like the above chart, these numbers point to an uneven recovery across non-essential spending segments.

Some of Best Buy’s struggle to see profits in recent quarters may be attributed to nearly one-third of consumer electronics being bought online these days. While the retailer does see online traffic, and the company app drives 20% of Best Buy’s revenue, Amazon dominates the space, accounting for 37% of U.S. consumer spending in the electronics segment.

While other factors may certainly be at play, earnings by Best Buy and other discretionary-spend focused retailers may reflect consumers’ cautious steps when buying more expensive nonessentials. While shoppers may feel confident in the economy to splurge on some clothes, hesitancy on bigger spend could hint at a continued uncertainty when it comes to their long-term economic future.