Consumers in the United States are proving resourceful as they meet inflation’s challenge head on.

And that resourcefulness has led them to embrace a broad range of strategies to juggle their everyday financial lives — belt-tightening is a potent tool, yes, but far from the only one.

There’s one headline number that bears testament to the success of the multi-pronged strategy: As estimated by PYMNTS and LendingClub, the percentage of households that have been living paycheck to paycheck has actually declined, to 60% from a previous reading of 64% a year ago. The numbers are, of course, stubbornly high … but at least they are headed in the right direction.

As to what they’re doing:

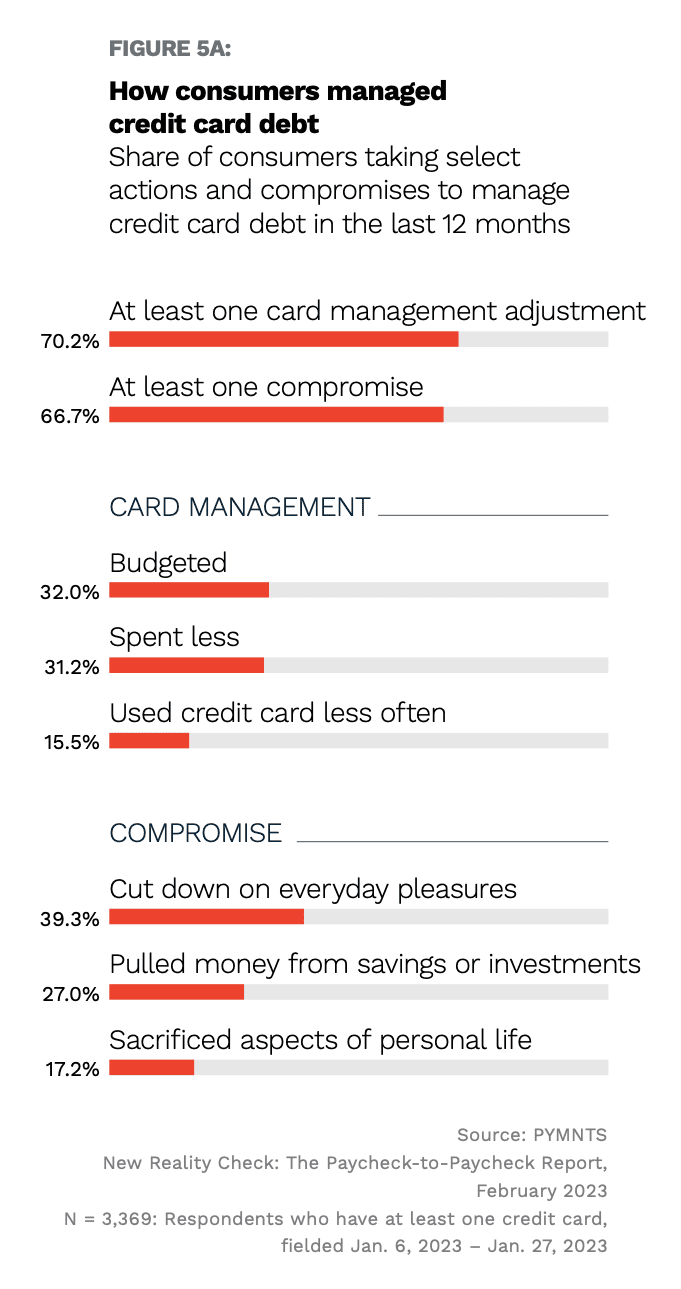

In the paycheck-to-paycheck economy, one of the most obvious ways to reduce the impact of inflation and rising rates, which makes debt more expensive, is to re-calibrate credit card spending. The share of cardholders adjusting how they use credit cards rises to 90% among those with issues paying bills and 81% among those without issues paying bills. We found that budgeting and reducing spending were common strategies: 32% of cardholders adjusted their budgets, and 31% lowered their spending. Sacrifice is the strategy here, where consumers have cut down on everyday pleasures and are using the cards less often, as seen in the chart at right.

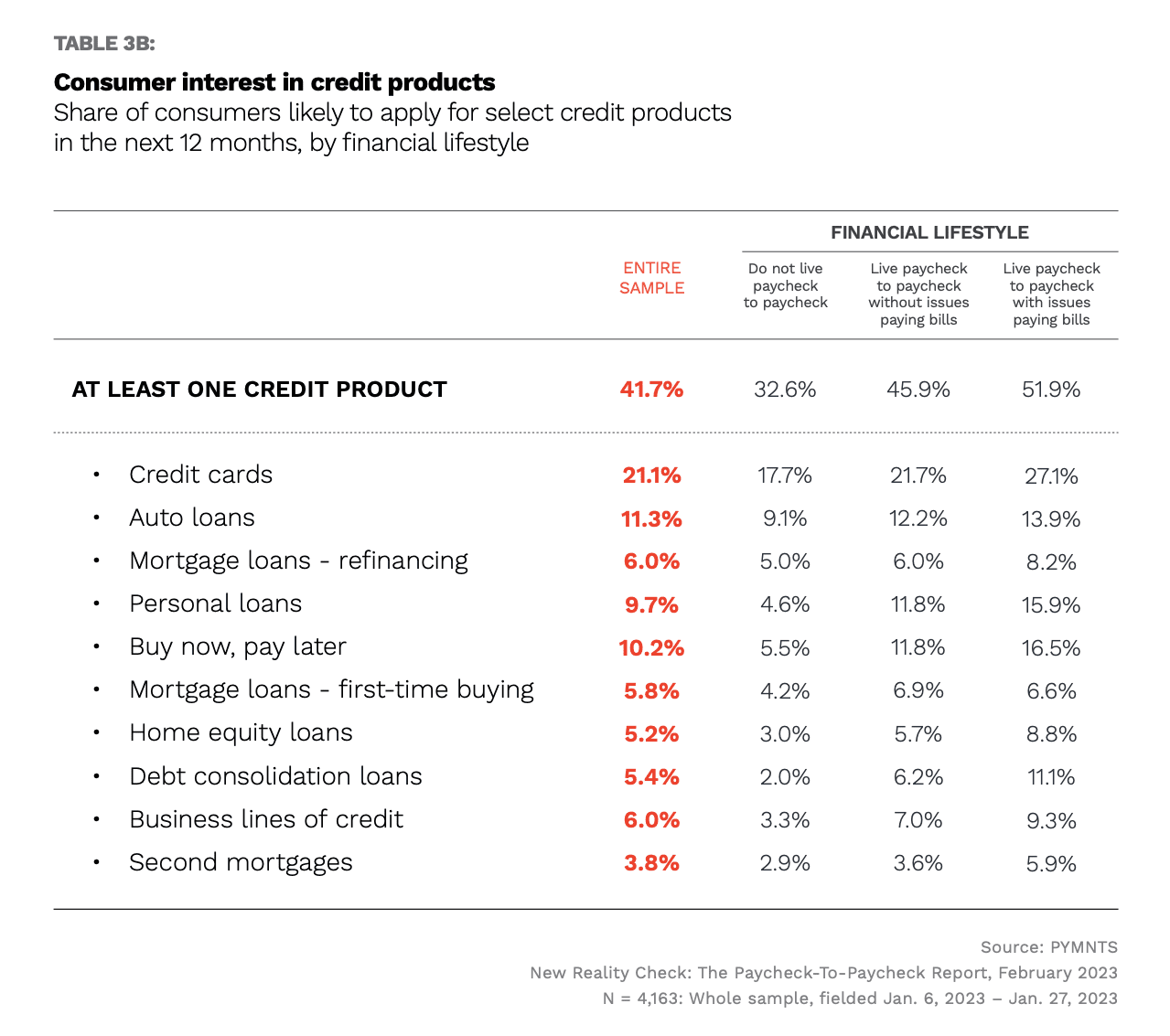

Part of successful inflation-fighting involves planning for the future. And that planning involves consideration of the debt that they can or cannot take on. In the chart below we see that while roughly 42% of consumers plan to apply or at least one credit product, only about 21% are thinking about taking on another credit card, while a relatively significant percentage of struggling paycheck to paycheck consumers (at 11% vs. the overall sample is 5%) see debt consolidation loans as an option.

What we didn’t spend yesterday — well, that gives more financial firepower today. And we found that, overall, only 13% of consumers say that the holiday shopping season added a significant increase to their debt burden. The vast majority of our respondents have not experienced that financial hangover, indicating that the urge to splurge during November and December and into the New Year was contained.

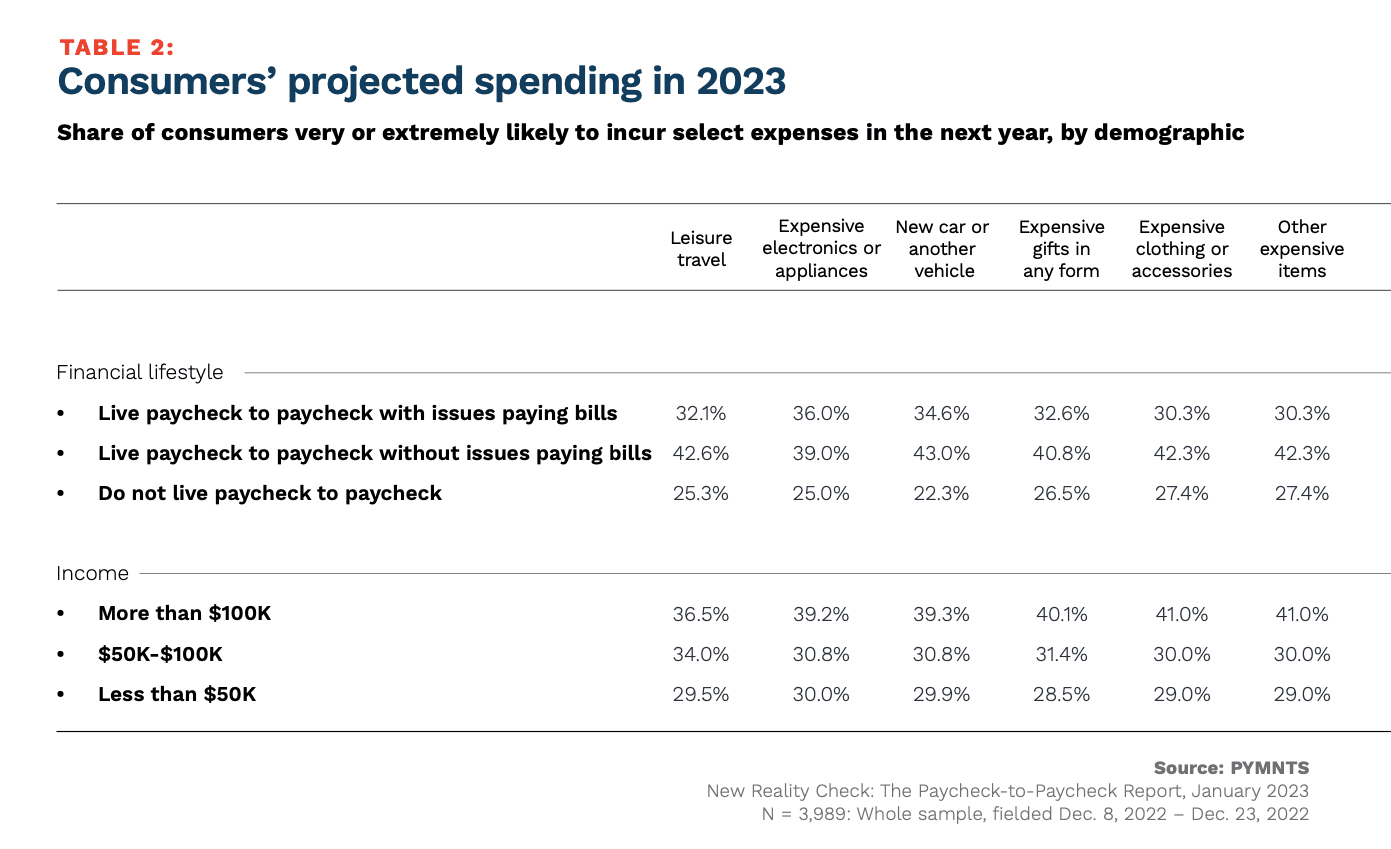

Many consumers have indicated that they will not be opening up their wallets to splurge on large purchases in 2023, which, broadly speaking, include electronics, appliances and leisure travel. Only 35% of consumers said they will incur leisure travel expenses in 2023, and just 24% plan to purchase expensive electronics or appliances in 2023. Less than 20% of consumers in the middle-income bracket — those earning $50,000 to $100,000 annually — expect to purchase big-ticket electronics, clothing or gifts in 2023.

Separately, we’ve found that consumers are trading off between quality and quantity, which is affecting 69% of consumers. The most obvious illustration here lies with groceries. Among grocery shoppers who say they have noticed price changes, 59% have cut down on nonessential grocery items, while 35% are buying cheaper alternatives.