Accounting for nearly 20% of annual retail sales, the holiday season, which spans November and December, is a critical period for both merchants and consumers.

For consumers, installment plans, including buy now, pay later (BNPL) options and installment plans offered by credit cards and store-branded cards, are expected to play a significant role in their holiday shopping strategies. These plans enable shoppers to divide their expenses into a predetermined number of payments, often with minimal or zero interest charges.

In fact, more than three-quarters of shoppers are planning to use these installment plans more heavily this holiday season, with 41% of shoppers expected to increase their use of installment plans for holiday purchases. These are some of the key findings detailed in “The Role of Installment Plans in the 2023 Holiday Shopping Season,” a recent report by PYMNTS Intelligence.

Notably, younger consumers, particularly Generation Z and millennials, are more likely to rely on these plans. Among those planning to increase their use of installment plans, 73% are at least somewhat likely to choose a merchant that offers installment plans using their existing credit cards over one that does not.

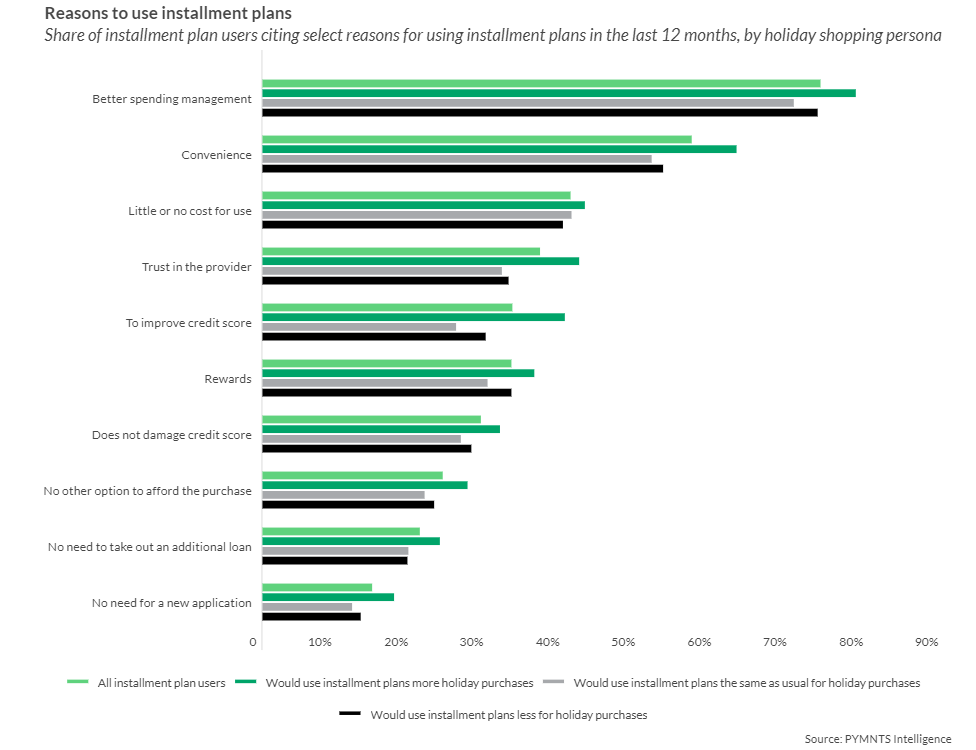

Better spending management is cited as the primary reason for the increased usage of installment plans during the holiday season, with 74% of consumers citing this as a reason to use one. This share increases to 78% among installment plan users who plan to increase their use of this method during the holidays.

Convenience comes up next, cited by nearly 60% of all installment plan users and 63% of those who intend to increase its usage. Trust in the provider, improved credit scores, and rewards are also important factors driving consumers to choose installment plans. However, only a small percentage of users (24%) say they use these plans for purchases because they cannot otherwise pay for their purchases.

When it comes to the types of purchases made using installment plans during the holiday season, clothing and accessories top the list. Other popular categories include groceries, home furnishings, appliances and consumer electronics.

Against this backdrop, merchants can benefit from offering installment plan options to their customers. The survey found that 22% of surveyed shoppers would be very or extremely likely to switch from a merchant that does not provide installment plans using their existing credit cards to one that does. Among consumers planning to increase their use of installment plans, 38% would be highly likely to switch to a merchant that offers this option.

Overall, installment plans are expected to play a significant role in consumers’ holiday shopping strategies, and merchants can gain a competitive advantage by offering installment plan options to shoppers who are willing to switch away from retailers that do not provide this payment method.