Improving credit scores can have significant financial benefits for consumers by accessing better lending conditions and low interest rates. With improved scores, consumers can increase their available amount of discretionary spending and help ensure they can afford everyday essentials. However, many consumers do not have the right understanding of the credit product they may apply for, which is directly correlated to their money accessibility.

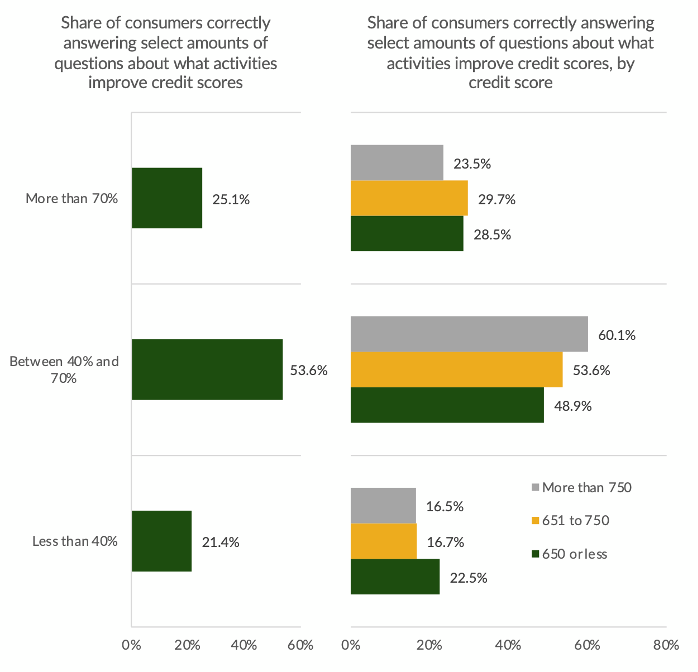

“The Credit Accessibility Series: The Credit Insecure Need More Education,” a PYMNTS Intelligence study done in collaboration with Sezzle, asked more than 2,800 U.S. consumers across different demographics a series of questions to evaluate their knowledge of credit products. Only 1 in 4 answered at least 70% of the questions correctly. Notably, 42% of these high-knowledge consumers are highly interested in user-friendly materials such as credit-building apps to learn how to improve their credit scores, but those with low knowledge are half as likely to have this interest. Moreover, less than half of consumers with low credit scores are inclined to use user-friendly options to improve their credit scores. This knowledge gap highlights the need for better education and awareness among consumers with low credit scores about the potential benefits of using credit products to improve their credit status.

For instance, only 23% of consumers with low credit scores reported using buy now, pay later (BNPL) to purchase retail products, and less than 20% used it specifically to improve their credit scores. This indicates that most consumers don’t see BNPL as a credit product, as they see it as a way to manage cash flow, a view that cuts across age demographics and income levels.

“Budgeting is top of mind for consumers … and BNPL is a budgeting tool,” Sezzle CEO Charlie Youakim told Karen Webster in a recent interview. “For these customers, it becomes essential that some sort of financing is available, but [with BNPL], they’re diverting a flow of funds away from high-cost financing products to a very low-cost financing product.”

To calibrate the impact of getting a better credit score, according to PYMNTS Intelligence research, for deep subprime consumers with credit scores of 579 or less, improving their scores to the near-prime range of 620 to 659 could help them finance an additional $44,000 in purchases. Furthermore, these consumers could achieve up to a 24% reduction in interest rates by improving their credit scores to super-prime.

In conclusion, credit knowledge is closely linked to credit scores, suggesting that financial product vendors should find innovative ways to reach consumers with low credit scores. By empowering consumers with the necessary information and tools, financial product vendors can help bridge the gap and provide solutions for credit insecure individuals and improve their credit status.