Overdrafts and the US Consumer: A 2023 Report

Current economic and financial conditions force consumers to tap overdrafts across income levels and credit personas. One in 5 consumers experienced overdrafts or declined transactions in the last year due to insufficient funds in their bank account. Nearly half of credit marginalized consumers experienced these situations.

PYMNTS’ latest findings reveal that although consumers across demographics rely on overdrafts, the impacts vary widely depending on consumers’ financial and credit positioning.

These are just some of the findings detailed in “The Credit Accessibility Series: How Consumers Use Overdrafts,” a PYMNTS and Sezzle collaboration. This edition examines consumer behaviors and sentiments related to the use of overdrafts. We surveyed a census-balanced panel of 2,848 United States consumers between June 8 and June 21 about their experiences and perceptions.

Other findings from the report include:

Other findings from the report include:

Consumers living paycheck to paycheck are six times more likely to use overdrafts.

PYMNTS’ research finds that 39% of paycheck-to-paycheck consumers who struggled to pay bills experienced transaction declines and overdrafts, compared to 6.3% of those not living paycheck to paycheck. Millennials and the credit marginalized — consumers who experienced at least one credit rejection in the past year — were also especially likely to have attempted transactions without sufficient funds.

Overdraft fees add to consumers’ financial burden.

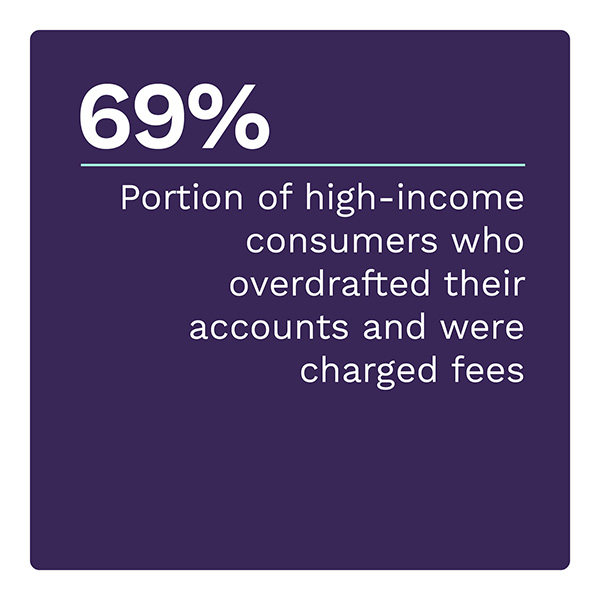

PYMNTS’ data shows that 62% of consumers who attempted a transaction without sufficient funds incurred some type of overdraft fee: 45% of consumers incurred a flat fee, and 27% incurred a fee equal to a percentage of the transaction. However, some consumers incurred a combination of a fixed fee and a percentage charge. The average flat fee consumers faced was $29, and the average percentage charge was 2.9% of the transaction. Across demographics, consumers felt the impact of these fees differently.

Consumers who have difficulty paying their overdraft fees experience additional financial hardships.

Despite the financial flexibility overdrafts give some consumers, their use is nearly synonymous with financial difficulties. Ninety percent of consumers who experienced overdrafts faced further hardship, as did 84% of consumers whose transactions declined. Furthermore, nearly two-thirds of overdrafts led to broader credit accessibility issues.

Overdrafts are a double-edged sword: They help consumers alleviate short-term financial needs but often cause additional financial hardships. Download the report to learn how consumers of all income levels, credit scores and generational groups use overdrafts.