60% of Renters Report Financial Health in Jeopardy Over High Housing Costs

For many Americans, owning a home or renting an apartment signifies financial stability and maturity, with Americans traditionally leaving home early and never looking back. But home ownership — the cornerstone of the American Dream — is increasingly out of reach, as 18 million people have given up on buying a home since inflation began to spike in January 2021.

For “Consumer Inflation Sentiment: Rising Housing Costs Deflate Economic Optimism,” PYMNTS surveyed 2,017 United States consumers to learn more about how rising housing costs impact their financial health and well-being.

• Housing costs have been consistently accelerating since the start of 2022, a rise that is currently outpacing the overall inflation rate.

The pace of year-over-year rent increases accelerated quarterly throughout 2022, reaching 7.5% in December. Rent prices grew 2.3% in Q4 2022 alone, contrasting with an inflation rate that began to stabilize in the second half of 2022. The overall inflation rate for prices decreased to 6.5% in December 2022 and is now below its December 2021 mark.

The pace of year-over-year rent increases accelerated quarterly throughout 2022, reaching 7.5% in December. Rent prices grew 2.3% in Q4 2022 alone, contrasting with an inflation rate that began to stabilize in the second half of 2022. The overall inflation rate for prices decreased to 6.5% in December 2022 and is now below its December 2021 mark.

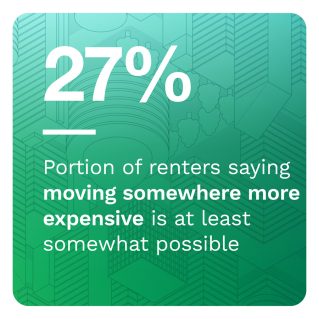

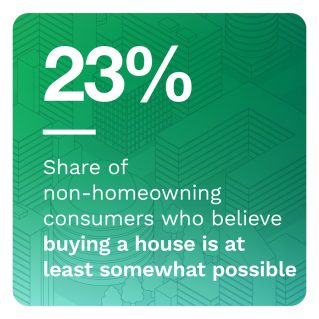

The number of consumers who said homeownership is possible for them has dropped by 24% in the last two years. Currently, 23% of non-homeowners said buying a house is within reach, but in January 2021, 30% said this. Half of Generation Z consumers said purchasing themselves a home was within reach in 2021, while just 39% do now.

Just 28% of consumers own a home free and clear, meaning nearly three-quarters are exposed to the effects of increasing rents, interest rates and other housing costs.

• Nearly one in three renters said housing costs have become highly detrimental to their financial health.

• Nearly one in three renters said housing costs have become highly detrimental to their financial health.

The impact of increasing housing prices is not felt evenly among consumers. Data shows that homeowners and the wealthy are less likely to feel the pinch than those who rent or are less affluent. Renters are twice as likely to say housing costs are very or extremely detrimental to their financial lifestyle than homeowners who pay mortgages.

Sixty percent of renters said these payments negatively impact their financial health, with 29% of renters saying this influence is very or extremely negative. Lower-income consumers are the most likely to report that housing costs have very or extremely negative impacts on their financial health, with 34% of these consumers saying so.

To learn more about how rising housing costs and inflation are squeezing consumers, download the report.