Fifty-nine percent of Generation Z consumers tell PYMNTS Intelligence they now live paycheck to paycheck. But it’s not only younger consumers who are having a tough time making ends meet.

Our report — which is based on surveys with more than 3,400 U.S. consumers — found that, thanks in a large part to ongoing inflationary pressures, more than half of U.S. consumers are struggling to keep pace with their monthly expenses.

As of March, 58% of all U.S. consumers live paycheck to paycheck, a reality many Americans must grapple with regardless of their income levels.

Forty-one percent of consumers earning more than $100,000 said they live from one paycheck to the next, along with 75% of those earning less than $50,000 annually and 62% of middle-income consumers, who earn between $50,000 and $100,000 annually.

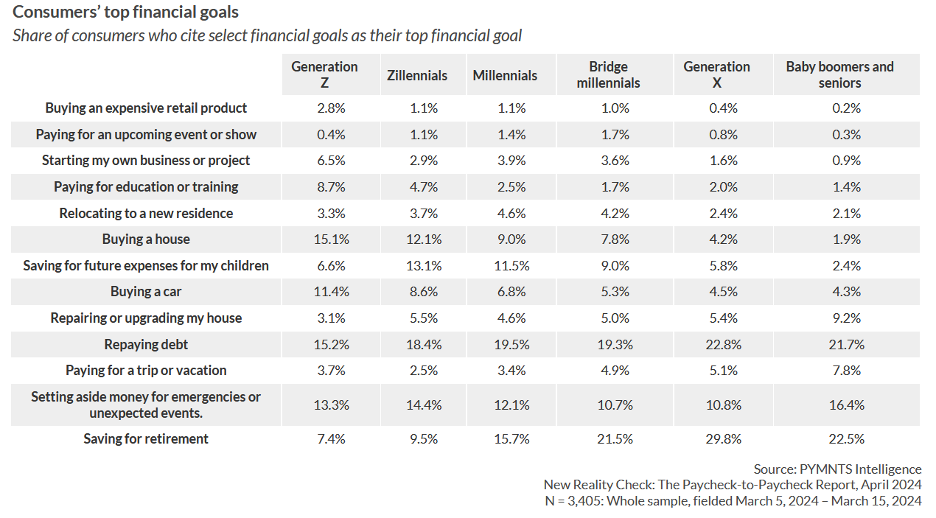

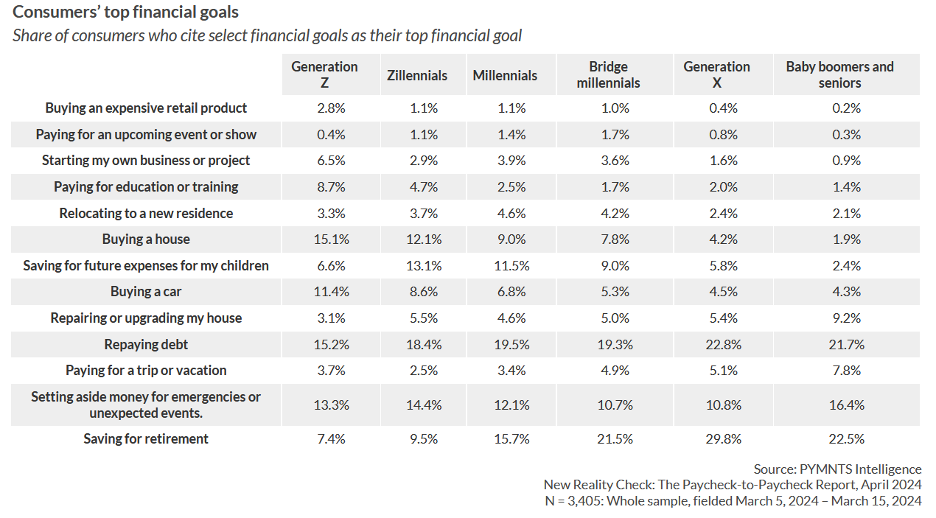

Living from one paycheck to the next doesn’t just contribute to immediate day-to-day stress: it can also temporarily or permanently suspend future financial goals. And most Americans have such goals. As the chart above illustrates, despite any immediate financial anguish they are feeling, consumers across all age brackets continue to keep their eyes on the prize.

Advertisement: Scroll to Continue

Saving for retirement is a top priority among older consumers, with 23% of baby boomers and seniors identifying it as their leading goal. Thirty percent of Gen X consumers, 22% of bridge millennials, 16% of millennials are similarly driven.

Just 7.4% of Gen Z consumers told us saving for retirement is a top financial goal, which is understandable given that plans that are likely to come to fruition sooner — such as setting aside money for emergencies (13%) and buying a house (15%) — are bigger priorities right now.

Fifteen percent of Gen Z also said repaying debt is a priority. In fact, paying down debt is one overarching goal across all generations. Twenty-two percent of baby boomers and seniors prioritize paying down debt. So do 23% of Gen X consumers, 20% of bridge millennials and millennials, and nearly 19% of zillennials.

In other words, paying down debt appears to be a priority for a significant number of Americans — one that could continue to take center stage if inflation rises, further impeding other goals.