These findings align with data collected by PYMNTS Intelligence. Earlier in the year we asked U.S. consumers how comfortable they were spending money given the current economic climate. Most said they were comfortable, but 6 in 10 said they check the price tags before buying anything.

The latest edition of PYMNTS Intelligence’s Paycheck-to-Paycheck Report, “High-Income Consumers Lead Surprising New Data on Side Hustles,“ confirms that most Americans are getting by financially, albeit with a deep-seated sense of economic anxiety.

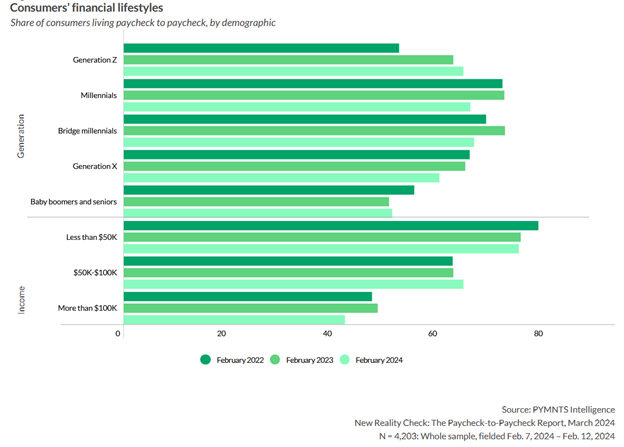

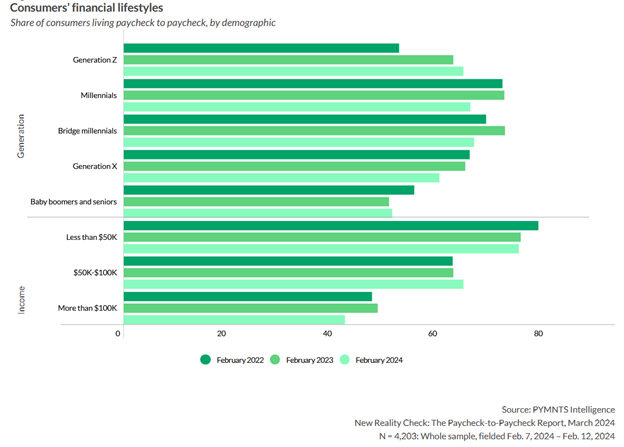

The report, which was based on both recent surveys with 4,203 U.S. consumers in February as well as years of historical data, reveals that 59% of consumers now live paycheck to paycheck. Granted, this finding reflects a slight year-over-year drop from 2023, when 62% consumers said they lived from one paycheck to the next, but the overarching data shows the percentage of consumers living paycheck to paycheck hasn’t changed significantly since spring 2020.

And, at first glance, news of a three percentage-point drop in the number of paycheck-to-paycheck consumers might be interpreted as a sign the U.S. economy is moving in the right direction. But the report also reveals the main reason for this drop is that fewer affluent consumers now live paycheck to paycheck than a year ago.

As the figure above shows, the share of those earning more than $100,000 a year who say they get by paycheck to paycheck dropped from 48% last year to 42%. But the share of paycheck-to-paycheck consumers in the low-income (less than $50,000 annually) and middle-income ($50,000 to $100,000 annually) brackets remains relatively steady, even going all the way back to February 2022.

Advertisement: Scroll to Continue

When viewed through a generational lens, the data shows many U.S. consumers appear frozen in time. Although fewer Gen Z respondents now live paycheck to paycheck, little has changed in the last year for most millennials, bridge millennials and Gen X respondents. Meanwhile, more baby boomers and seniors are feeling a financial pinch compared to how they fared in previous years.

As the name of the new report, “High-Income Consumers Lead Surprising New Data on Side Hustles” implies, one reason affluent consumers might be doing better financially this year compared to last is that more of them have taken on side work to supplement their incomes.

But it’s not just affluent consumers who are expanding their earnings with side work. Faced with rising housing, energy and grocery costs, more and more people are picking up extra income by reselling items, taking on freelance gigs or making and selling artisan products.

As of February 2024, 22% of workers had a side job in the three months prior to completing our survey. Some may assume that living paycheck to paycheck would inspire more consumers to apply for a side job, however, PYMNTS Intelligence found that those with issues paying bills are actually less likely to hold down side jobs this year (23%) than last year (29%).

That may be seen as good news, indicating financial stability, but 30% of workers who are now earning supplemental incomes told us losing their side hustles would have a highly negative impact on their financial stability. Worse still: 40% of those living paycheck to paycheck who already struggle to pay their bills told us they are highly dependent on their supplemental incomes to make ends meet. Last year, only 38% of them reported being highly dependent on side hustles.