Fed Says Consumer Credit Decelerated in September; Card APRs Still at Multiyear Highs

All eyes were on the Federal Reserve’s interest rate cut this week.

As widely expected, the central bank delivered a 0.25% trimming to the federal funds rate Thursday (Nov. 7), which will take some time to work through the economy and impact the cost of debt, for everything from corporate loans to credit cards.

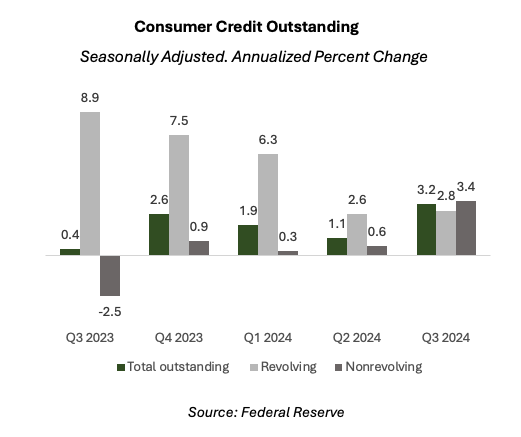

In the meantime, the latest stats on consumer credit — known as the G.19 report — showed Thursday that overall consumer credit, across revolving lines (like credit cards) and non-revolving lines (such as fixed-rate loans like auto loans) increased in September at an annualized 1.4% pace. That’s a deceleration from the 1.8% pace seen in August and below the 6.5% annualized leap recorded for July.

Overall borrowings across all lending tranches were $6 billion in September, which was lower than estimates for as much as a $14.5 billion boost by several financial sites. The August borrowings were $7.6 billion.

As for the debt itself, revolving debt as presented by the Fed includes but is not limited to credit card debt, counting lines of credit such as HELOC. It is debt that allows users to borrow to a pre-determined limit, but also mandates minimum payments.

The Fed estimated in June that as much as 92% of revolving credit is tied to credit cards, so this line item is a good proxy for the card debt shouldered by U.S. households. Non-revolving debt items are fixed loans paid back in equal installments, including everything from mortgages to auto loans to student loans.

Taken on a quarterly basis, the third quarter’s revolving credit metric grew by 2.8%, above the second quarter’s 2.6% rate. However, those two quarters also represented deceleration compared to the first quarter, where revolving debt increased by 6.3%.

Rates Are Still High

Looking at September, revolving credit grew at a pace of 0.9% in annualized terms, having slipped at a 1.9% rate in August, while non-revolving debt grew at a pace of 1.6%, half the increase in August.

PYMNTS Intelligence found that interest rates for key credit categories remain elevated. The stated annual percentage rate (APR) averaged across all credit card accounts at all reporting banks was 21.8% at the end of the most recent quarter, up slightly from the second quarter and more than 5 percentage points than were seen two years ago. Current rates are 43% above the average for the last decade. The cost of other debt has also become more expensive, although not at the pace of cards.

Interest for 24-month personal loans inched up to 12.3% on average in the third quarter of this year, an increase from 11.9% a quarter prior, and 2 percentage points higher than last year.

The volatility in card spending comes as a separate PYMNTS Intelligence report, “Consumers’ Financial Health and Spending Priorities Guide Credit Card Choices,” found that 32% of consumers opened a new credit card in the past year, with 80% of that activity coming from existing card holders.

The report revealed that 75% of financially struggling consumers opted to open general-purpose credit card accounts in that same timeframe. Twelve percent of new and existing account holders said they embraced the new credit lines to access additional credit; another 10% said they did so for emergencies. The data indicated that 25% of financially struggling consumers looked to use those cards in emergency situations.

Meanwhile, PYMNTS Intelligence also found that over 40% of households earning more than $100,000 and living paycheck to paycheck revolve their balances at least occasionally. That means they keep balances on those cards, making only partial payments rather than paying down the balance in full each month.

More than two-thirds of individuals earning up to $100,000 and living paycheck to paycheck revolve their balances.

The average balance of high-income consumers with issues paying their bills stood at nearly $12,000, compared to below $6,000 for mid- and lower-income cohorts.