Study: Small Businesses Emerge as Prime Candidates for Embedded Lending Products

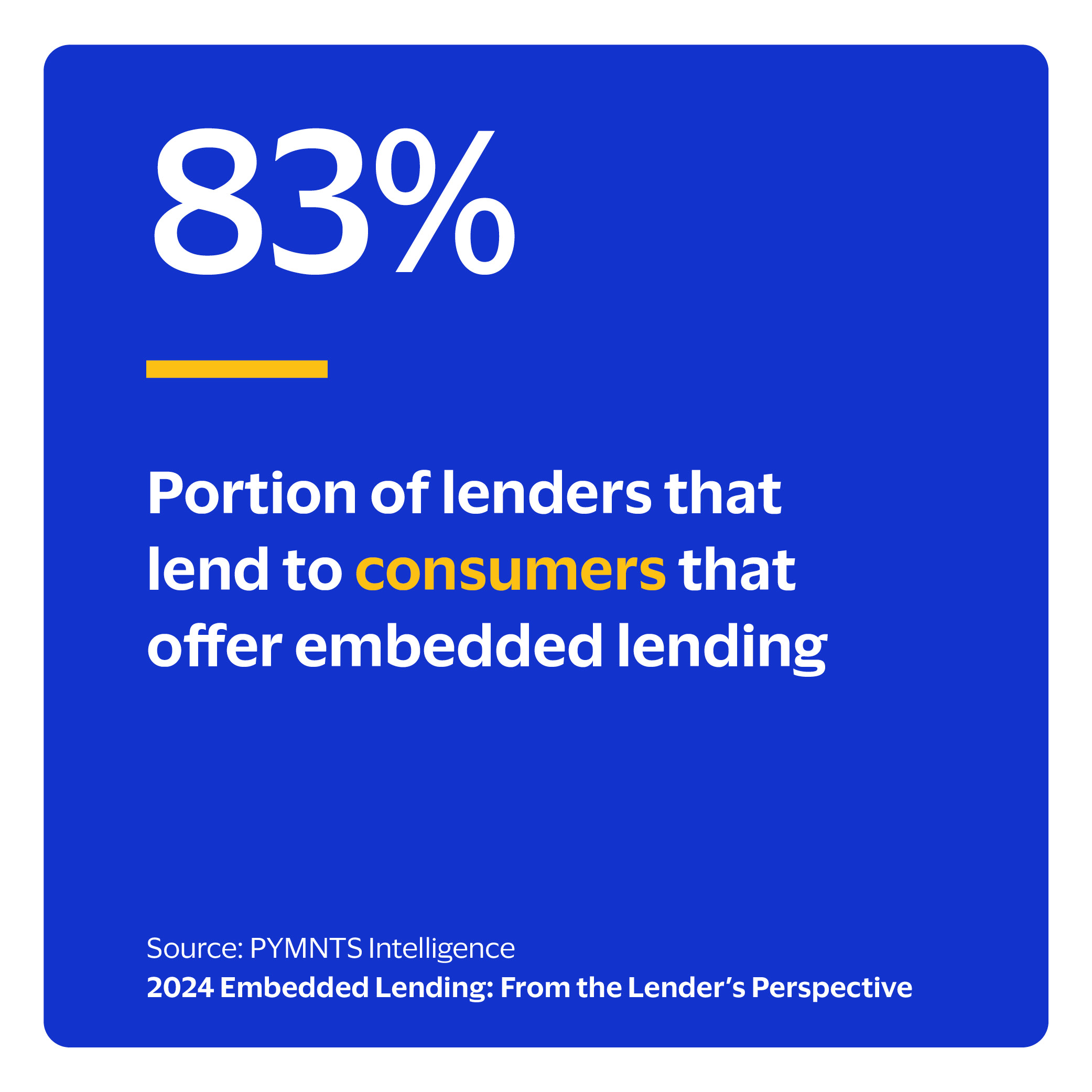

Lenders across major global economies offer embedded lending. However, data suggests that the typical lender that serves consumers or small- to medium-sized businesses (SMBs) has not fully embraced the potential of embedded lending. For example, nearly half of lenders serving SMBs have not entered this space.

Lenders across major global economies offer embedded lending. However, data suggests that the typical lender that serves consumers or small- to medium-sized businesses (SMBs) has not fully embraced the potential of embedded lending. For example, nearly half of lenders serving SMBs have not entered this space.

Roughly 1 in 5 lenders show high interest in launching new embedded lending products in the next two years. One key issue for lenders is a lack of external platform integrations, such as marketplaces or in-store point-of-sale systems.

Roughly 1 in 5 lenders show high interest in launching new embedded lending products in the next two years. One key issue for lenders is a lack of external platform integrations, such as marketplaces or in-store point-of-sale systems.

These are just some of the findings detailed in “Embedded Lending: From the Lender’s Perspective,” a report commissioned by Visa and designed and conducted by PYMNTS Intelligence. This report explores the embedded lending landscape for FinTechs and financial institutions. It draws on a survey of 361 lenders across six major economies: Australia, Germany, India, Japan, the United Kingdom and the United States. The analysis used a sample of at least two-thirds of lenders offering embedded products. The survey was conducted from Feb. 20 to March 15.

Other findings from the study include the following.

Lenders’ interest in offering new products is relatively low and out of step with consumer and SMB demand.

Lenders’ lukewarm interest in offering embedded lending options is out of step with consumers’ and SMBs’ interest in switching to providers that offer them. Among lenders that serve consumers, 22% show high interest in offering new embedded lending products in the next two years. Another 27% are somewhat interested. The trend is similar for lenders lending to SMBs, as 22% express high interest and 29% moderate interest. The report details how interest varies by market.

Lenders’ lukewarm interest in offering embedded lending options is out of step with consumers’ and SMBs’ interest in switching to providers that offer them. Among lenders that serve consumers, 22% show high interest in offering new embedded lending products in the next two years. Another 27% are somewhat interested. The trend is similar for lenders lending to SMBs, as 22% express high interest and 29% moderate interest. The report details how interest varies by market.

Lenders widely underuse external platform integrations for their embedded lending products.

Roughly 4 in 10 lenders already offering these products lack external integrations beyond various first-party or mobile banking channels. Just 58% of lenders that serve consumers have at least one third-party platform integration. Among those serving SMBs, 64% have at least one third-party platform integration. The report explores this growth area for lenders wanting to maximize their offerings.

Technology integration and operational issues are the biggest challenges for lenders not offering embedded lending.

Technology integration and infrastructure challenges represent the most significant obstacle to offering these lending products for one-third of lenders that are not currently offering them. Operational and scalability issues follow at 23%, with risk management and credit assessment close behind at 22%. With large shares of consumers and SMBs interested in switching to lenders offering these products, lenders must address these concerns.

Embedded lending has become important to consumers and SMBs. However, many lenders are not making the most of this opportunity. Download the report to learn more about the opportunities embedded lending can offer to lenders.