Unexpected expenses can pack a financial punch for any consumer, but for those who are already dealing with credit-related issues, the blow can be especially devastating.

Take the credit marginalized, for instance: consumers who have been rejected for at least one credit product in the last year. PYMNTS Intelligence data shows they are on a bit of a collision course with financial danger, as they are both 47% more likely than the average consumer to cross paths with an unexpected expense and more than twice as likely to turn to high-interest credit products to provide some relief.

As PYMNTS Intelligence found in completing its recent edition of The Credit Accessibility Series, “Unexpected Expenses and the Demand for External Financing Solutions,” 18% of credit-marginalized consumers turn to cash advance loans to help cover the debt, which is 2.2 times the rate that the average consumer would do so.

The report, which is based on surveys with more than 2,500 U.S. consumers, also found that 14% of credit-marginalized consumers apply for payday loans, which is also more than two times the rate of the average consumer. The credit marginalized are also more likely to turn to home equity loans (12%, or 2.3 times the rate of the average consumer) and pawn shops (11%, which is 2.6 times the average) to offset unexpected debt.

Because these solutions come with higher-than-average interest rates, their overall debt is usually compounded, putting them under additional financial strain. But PYMNTS Intelligence also determined that other ripple effects occur when unexpected expenses hit.

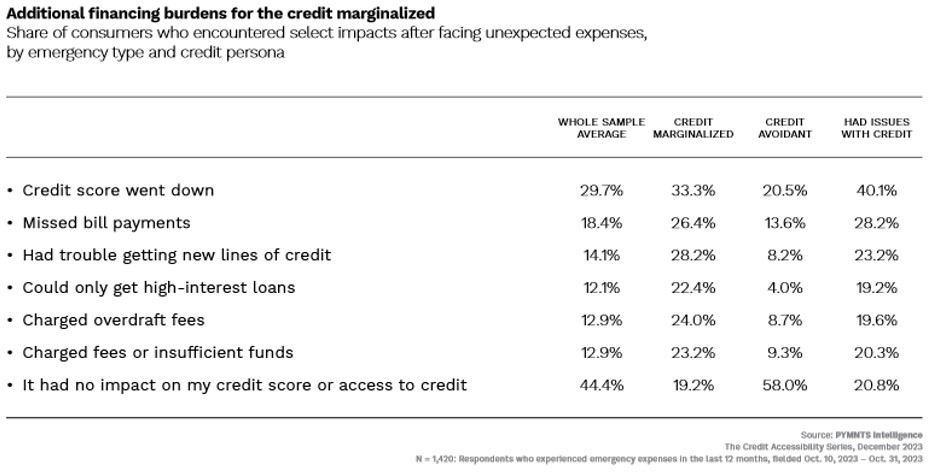

Survey data shows 56% of all consumers and 81% of credit-marginalized consumers who face unexpected costs in the past year also saw further credit issues. The primary effect of unforeseen costs is a decline in credit scores: 30% of consumers with unexpected costs saw their credit scores decline as a result, while more than 33% of credit-marginalized consumers witnessed the same. This might explain why 22% of credit-marginalized consumers could only turn to high-interest loans to help make ends meet. Meanwhile, 24% of this same segment also found themselves f aced with overdraft fees.

PYMNTS Intelligence looked at other consumer segments as well to determine the true impact of unexpected expenses.

For instance, we found that more than 20% of those deemed credit-avoidant consumers — those who willingly or unwillingly abstain from using credit products altogether — also saw their credit scores drop following unexpected costs, while nearly 14% of this segment missed paying other bills as well.

Perhaps most alarming was the fact that 40% of consumers who had no credit issues whatsoever prior to encountering an expense also saw their credit scores fall, underscoring the fact that no consumers are immune from the impact that unexpected expenses can bring.