They say if you’ve got your health, you’ve got it all. What about financial health? The term “living paycheck-to-paycheck” conjures images of adversity, but PYMNTS research found a more nuanced reality behind this phenomenon.

To a surprising extent, those who are “making ends meets” may be college-educated and earning salaries over $100,000. They are found in major metros and rural communities, working for global conglomerates or local small businesses. The fact is that being light soon after payday is a widespread issue affecting millions.

Here’s a snapshot of the paycheck-to-paycheck consumer that may bust a few myths around who these folks are, where they are, and the shifting definitions of “paycheck-to-paycheck” life.

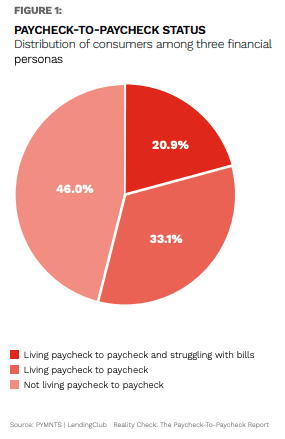

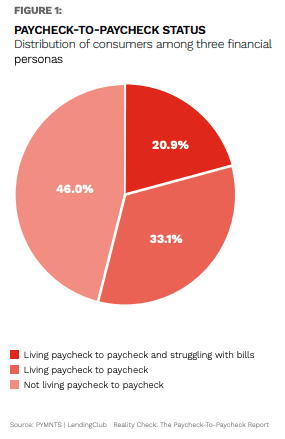

- 54% of All US Consumers Are Living Paycheck to Paycheck

Finding that 125 million Americans meet the criteria for paycheck-to-paycheck living, PYMNTS research noted that “A key distinction separates this massive population into two groups, however: whether consumers are typically able to pay their bills easily. Just over 60% of the paycheck-to-paycheck population is able to pay their bills comfortably, while close to 40% struggle to keep up.”

Get the study: The Paycheck-to-Paycheck Report

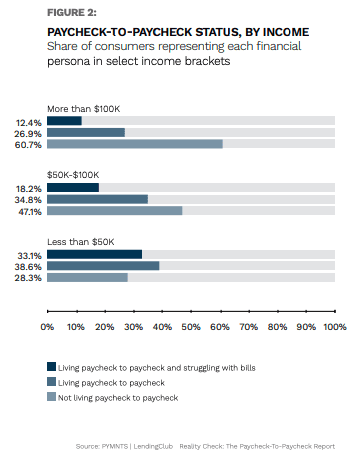

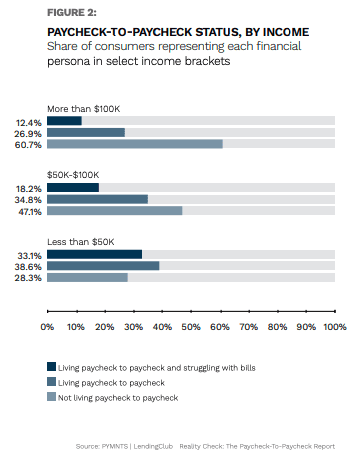

39% of Consumers Earning More Than $100K a Year Live Paycheck to Paycheck

39% of Consumers Earning More Than $100K a Year Live Paycheck to Paycheck

Earnings no longer play a central role in paycheck-to-paycheck living, and PYMNTS data found that surprising numbers of strong earners still spend every cent, and even come up short on bills every month.Finding that nearly 40% of consumers with six-figure incomes are living this way, PYMNTS calculated that it projects “to roughly 32 million consumers throughout the country who earn more than $100,000 per year but still would not be able to continue paying their monthly bills for long if their paychecks stopped coming in or if they found themselves having to pay an unexpected medical or emergency expense. Eleven million say their finances are so tight that they already struggle to pay their monthly bills.”

Get the study: The Paycheck-To-Paycheck Report 2

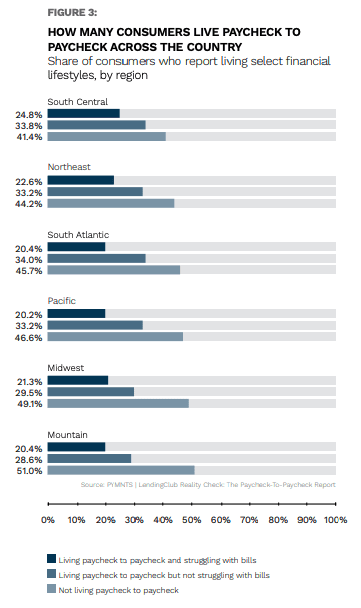

Three Times More City Dwellers Than Suburbanites Live Paycheck to Paycheck

Three Times More City Dwellers Than Suburbanites Live Paycheck to Paycheck

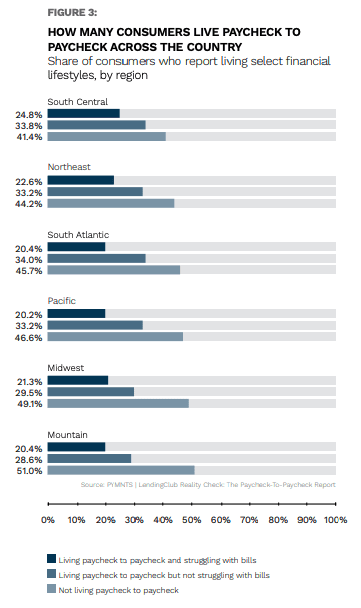

City life is expensive and getting more so all the time. PYMNTS research found that 63% of all consumers living in metropolitan areas live paycheck to paycheck, which is nearly a quarter more than those living in rural areas.Looking at the distribution of those saying they live paycheck to paycheck, PYMNTS found that 59% of residents of the South Central states report stretching paychecks, with the next highest grouping — 56% — found in the northeastern U.S. The Midwest and Mountain States must know something others don’t as they come in at 51% and 49%, respectively. Just over 53% of residents in Pacific States are living paycheck to paycheck.

Get the study: The Paycheck-To-Paycheck Report 3

The Average Consumer Has Increased Their Savings Threefold Since March 2020 and Now Has $6,200 in the Bank

The Average Consumer Has Increased Their Savings Threefold Since March 2020 and Now Has $6,200 in the Bank

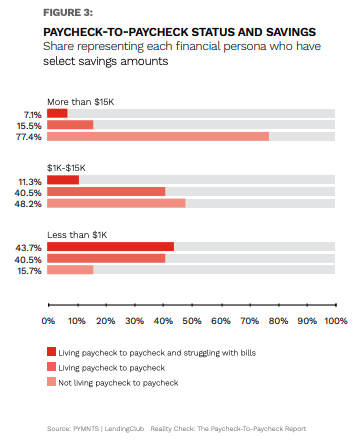

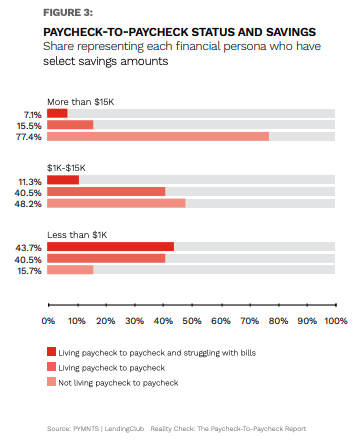

Money in the bank is a good hedge against paycheck-to-paycheck living. By the midpoint of 2021, consumers had three times more savings, on average, than in March 2020. PYMNTS found that 84% of consumers with under $1,000 saved live paycheck to paycheck, and more than half of them struggle with bills. On the flip side, 23% of those with over $15,000 in savings live paycheck to paycheck, and only 7% of them struggle to pay bills.Additionally, 70% of consumers reported having below $15,000 in savings, and roughly one-third said they have under $1,000 put away for a rainy day.

Get the study: The Paycheck-To-Paycheck Report 4

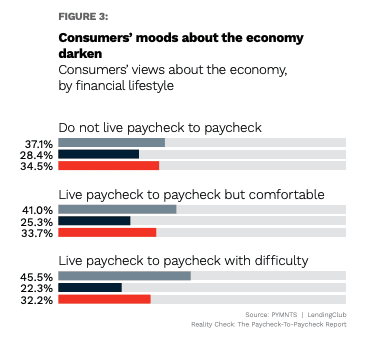

Nearly Half of Paycheck-to-Paycheck Consumers Who Struggle to Pay Bills Are Pessimistic About the Economy

Nearly Half of Paycheck-to-Paycheck Consumers Who Struggle to Pay Bills Are Pessimistic About the Economy

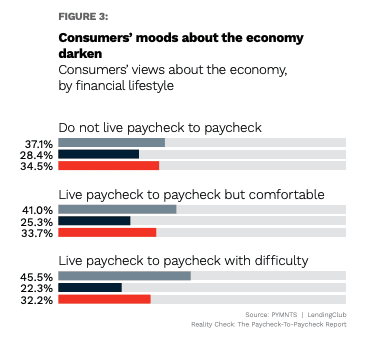

Even as omicron strikes a new wave of COVID-19 fear, infection fears are being displaced by economic ones. In the latest study on this topic, PYMNTS found that consumer pessimism increased from 32% in May to 40% by the end of 2021.Looking at the latest numbers, “46% of the consumers living paycheck to paycheck and struggling to pay their bills say they are pessimistic about the economy, while 32% characterize themselves as optimistic, and 22% say they are essentially neutral.Inflation is now the top concern among 87% of consumers who don’t struggle between paychecks, a sentiment echoed by 73% of those living between checks and struggling.

See also: US Consumers’ Savings Dip from Pandemic-Era Highs

39% of Consumers Earning More Than $100K a Year Live Paycheck to Paycheck

39% of Consumers Earning More Than $100K a Year Live Paycheck to Paycheck Three Times More City Dwellers Than Suburbanites Live Paycheck to Paycheck

Three Times More City Dwellers Than Suburbanites Live Paycheck to Paycheck The Average Consumer Has Increased Their Savings Threefold Since March 2020 and Now Has $6,200 in the Bank

The Average Consumer Has Increased Their Savings Threefold Since March 2020 and Now Has $6,200 in the Bank Nearly Half of Paycheck-to-Paycheck Consumers Who Struggle to Pay Bills Are Pessimistic About the Economy

Nearly Half of Paycheck-to-Paycheck Consumers Who Struggle to Pay Bills Are Pessimistic About the Economy