From retail items to groceries, the inflation monster has consumers looking for any lower-priced port in the storm, and that means finding merchants with pricing to match the purse.

This becomes clear in the PYMNTS report “Consumer Inflation Sentiment: The False Appeal of Deal-Chasing Consumers,” eighth in this series and based on a survey of over 2,100 U.S. consumers.

Even though inflation has moderated somewhat since peaking in July, 70% of grocery shoppers and 67% of retail customers said they see “significant price increases in the next 12 months,” and most don’t see the price picture improving meaningfully until late next year, according to the report.

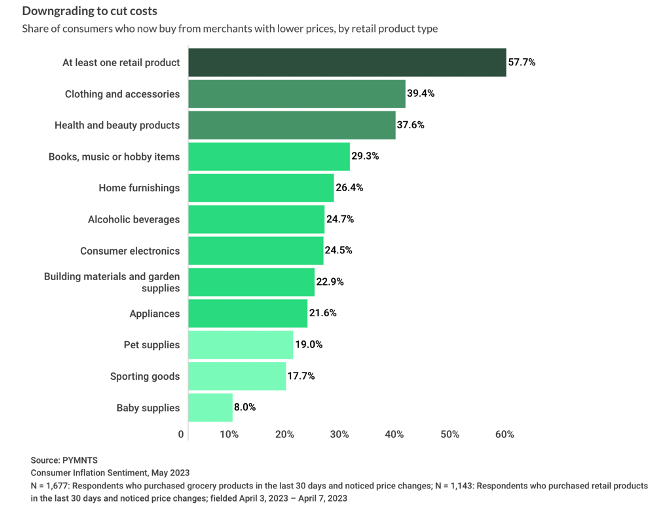

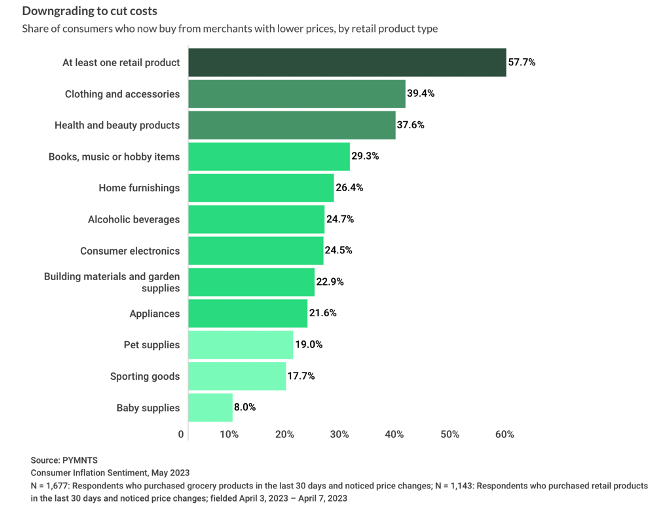

With trade-downs in discretionary retail items easier to live with than similar moves in food, the latest data found that “Consumers are 21% more likely to report making retail cutbacks than grocery cutbacks,” as 69% of survey respondents said they have lowered nonessential spending on retail products. Another 41% of retail shoppers said this has been the most significant change to their shopping habits, and 60% have switched to cheaper retailers “while 35% have sacrificed product quality by switching to cheaper, lower-quality goods.”

Those cutbacks are being felt across categories, as 57% of shoppers have reduced clothing purchases — the retail category is most likely to be slashed from budgets — while 40% have switched to less expensive clothing retailers, and 26% have started buying lower-quality clothing.

Taking a Bite Out of Grocery Budgets

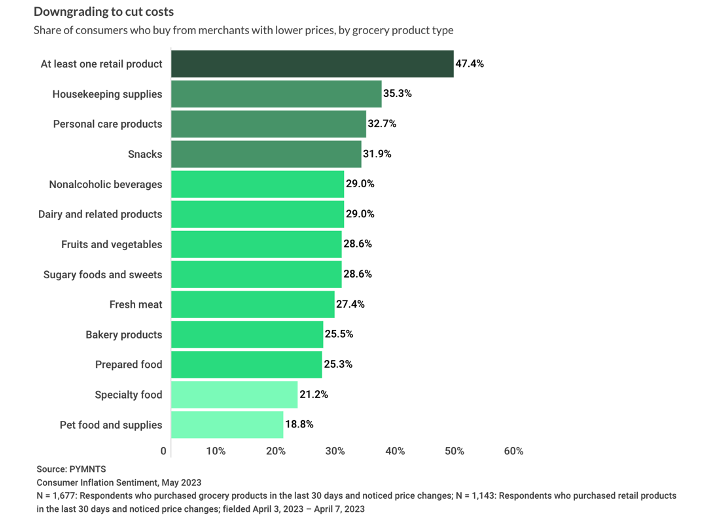

The effects are being felt in food budgets and spending as well, although it’s less “discretionary” than beauty products, clothing or consumer electronics. Even so, the cutbacks and trade-downs in groceries are deep and wide.

Advertisement: Scroll to Continue

“Trading down on quality is the one habit in which grocery shoppers minimize costs even more aggressively than their retail counterparts,” the report found. “Thirty-six percent of grocery shoppers purchase cheaper alternatives of the same products, such as store brands; this share is 35% for retail shoppers.”

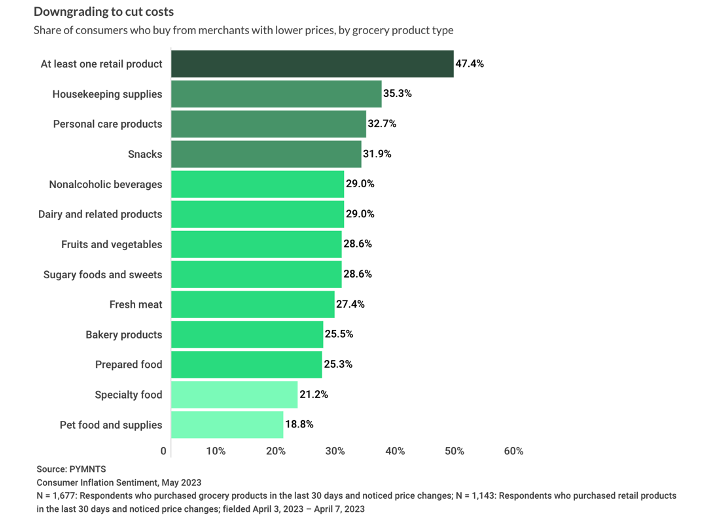

Comestible categories seeing the steepest cuts include “snacks, housekeeping supplies and personal care products; 32%, 35% and 33% of grocery shoppers have switched to less expensive versions, respectively. Nearly half — 47% — of consumers have switched to sellers that offer better prices.”

See all the data: Consumers Cut Back by Trading Down