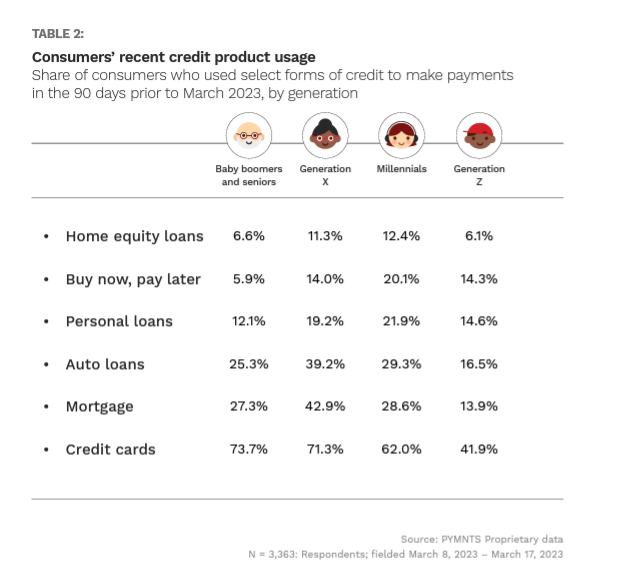

Compared to other generations, the share of baby boomers and seniors who use buy now, pay later (BNPL) options barely makes a blip. The same may be said when comparing the age demographic’s light use of BNPL to their heavy use of credit cards, reflected in the accompanying chart from the PYMNTS collaboration with Sezzle, “The Credit Economy: How Younger Consumers Make Credit Decisions.”

Here, we see that of surveyed baby boomers and seniors, who were born before 1964, only 6% used BNPL in the 90 days prior to being surveyed. This represents the lowest use across generations. Also reflected in the chart is the nearly three-quarters of the age cohort using credit cards in the 90 days prior to being surveyed, representing the highest use across age demographics.

One reason for this disparity is the credit card numbers in the chart reflect both revolving balances and those paid in full, with the latter not incurring interest or other fees if paid off at the end of the month. Baby boomers’ and seniors’ higher savings cushions suggest that this age cohort could be paying their balances in full.

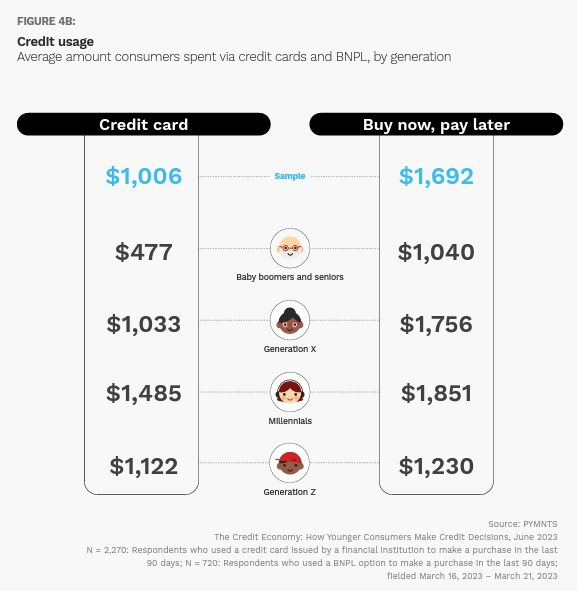

When baby boomers and seniors do use BNPL, they do so for much higher costing average purchases than they use their credit cards for, as indicated in the chart. While the average amount baby boomers and seniors put on their card was $477, BNPL purchases averaged $1,040. With their 6% usage rate, it seems that this age cohort reserves using BNPL for the occasional, higher-priced purchase.

This use of credit products for budgetary convenience and not as a strategy to make ends meet could also be driving the demographics’ limited use of BNPL as well. Like Gen Z, baby boomers and seniors seem to view BNPL as a tool for nonessential purchases, noted in PYMNTS’ collaboration with i2c, “The Credit Accessibility Series: BNPL’s Wide-Ranging Impact on Consumers and Merchants.”

As found in our research, if BNPL were unavailable for a given purchase, 26% of baby boomers and seniors would opt not to buy the item. Other surveyed selected options — such as delaying other due payments or using cash advance loans — would imply that the item was a necessary purchase. However, the finding that one-quarter of these consumers would opt to not purchase the item at all implies that these prospective BNPL purchases may be discretionary.