As consumers adjust their spending in response to grocery inflation, shoppers are challenged to make difficult decisions about their food spending. Yet, fewer than half of all consumers are willing to trade down from their favorite merchants.

According to data from the latest installment of PYMNTS’ Consumer Inflation Sentiment series, “Consumer Inflation Sentiment Report: Consumers Cut Back by Trading Down,” which drew from an April survey of more than 2,000 U.S. consumers, consumers estimate grocery inflation to be around 22%, nearly three times the government-measured rate. Consequently, many are making changes to how they shop.

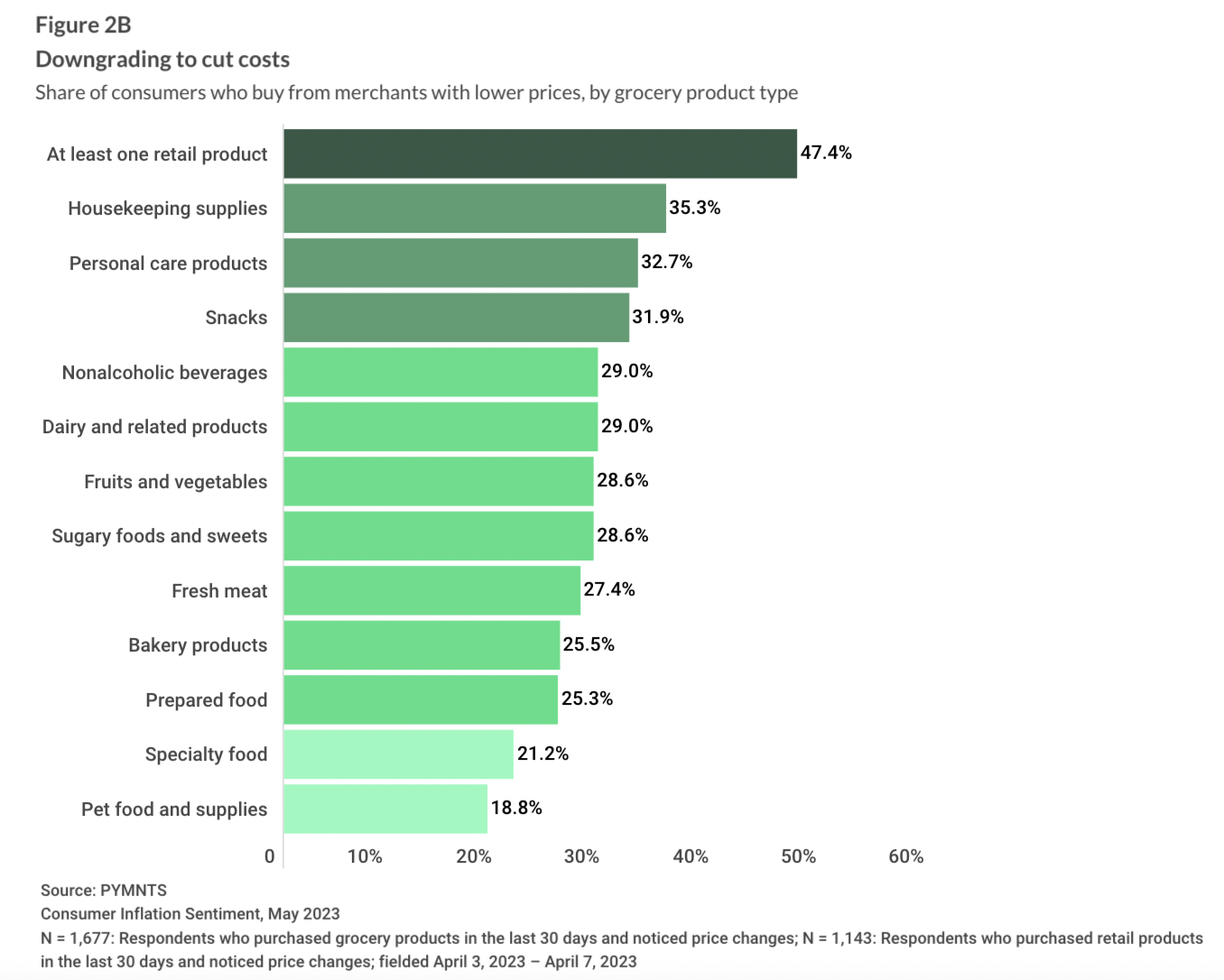

The study found that 57% of consumers have cut down on nonessential grocery spending, but only 47% have switched to making purchases from merchants with lower prices for even one grocery product.

Indeed, Kroger, the country’s largest pure-play grocer, has noted that consumers are increasingly opting for its lower-priced private-label products.

“The Our Brands portfolio allows us to offer exciting products at great value while driving incremental sales and improving margins,” Rodney McMullen, chairman and CEO of The Kroger Company, told analysts on the grocer’s last earnings call back in March. “Our Brands’ quality and value proposition is especially important when inflation is affecting so many of our customers’ lives. … Our goal is to help every customer find high-quality, affordable products they love, from pantry staples to fresh food to ready-to-eat restaurant-quality meals.”

That said, some grocery shoppers are trading down for merchants as well. For instance, the world’s largest grocer, Walmart, shared on its earnings call earlier this month that it has been gaining share from higher-priced grocery retailers.

“Share gains in grocery continued, including from higher-income households, as our strong price gaps resonate with customers who are increasingly prioritizing value and convenience,” Walmart Executive Vice President and Chief Financial Officer John David Rainey told analysts.