In the May study “New Reality Check: The Paycheck-to-Paycheck Report: The Regional Divide Edition,” a PYMNTS and LendingClub collaboration, we’re again confronted with the high cost of living, especially in metro areas and disproportionately concentrated in the West.

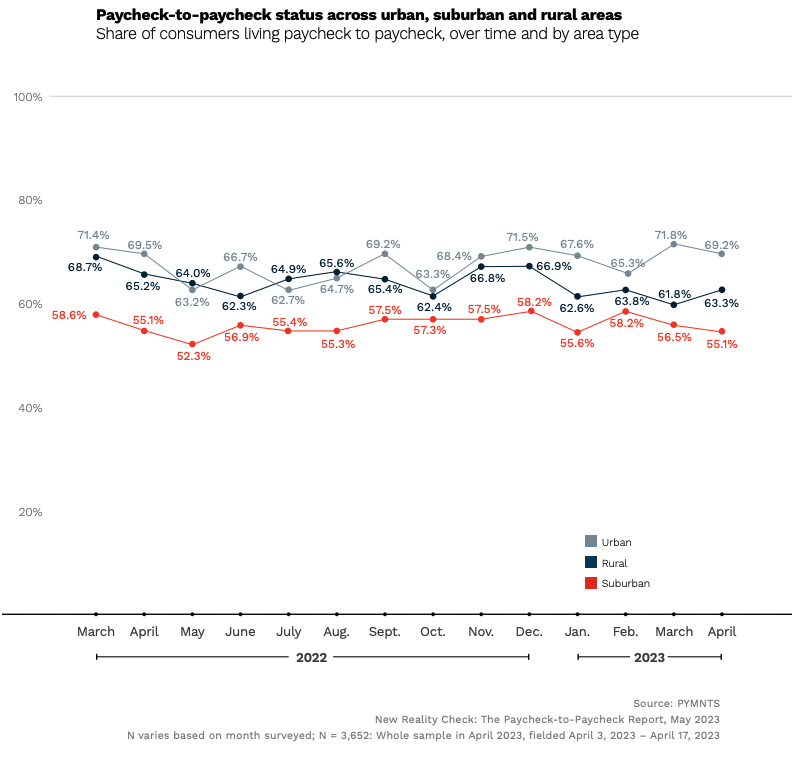

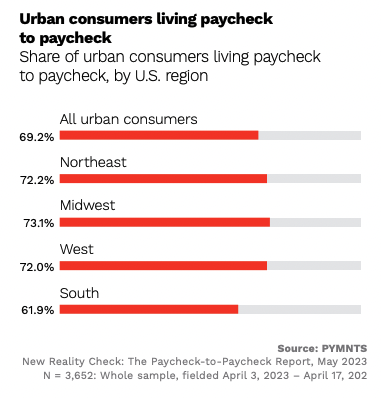

As the study noted, urban consumers are the most likely to live paycheck to paycheck, at 69%, followed by 63% of rural consumers. In comparison, just 55% of suburban consumers live paycheck to paycheck, a 20% difference compared to urban areas.

“A lot of it on the regional concentrations has to do with demographics,” LendingClub Financial Health Officer Anuj Nayar told PYMNTS. “You tend to find that there are more younger people living in cities versus millennials who tend to live in the suburbs, and boomers and seniors, most of whom are retired and living on a fixed income and tend to live in rural areas.”

No Rest in the West

The study found that the share of paycheck-to-paycheck consumers living in the West rose from 59% in April 2022 to 64% in April 2023, indicating that the rising cost of living has affected consumers in this region the most.

Nayar put much of that down to layoffs that tilt toward Silicon Valley, as well as the tech and FinTech sectors, with many of these companies headquartered in California.

Advertisement: Scroll to Continue

He said six of the most expensive U.S. cities are on West Coast, and seven out of the 10 cheapest are in Texas.

“That kind of matches the facts that we got, where the South tends to be cheaper and everything else,” he said. “People don’t realize just how much the layoffs that we’ve seen happen have really affected a lot of western cities and western areas.”

Noting that he recently paid $8 for a carton of eggs in his hometown of San Francisco, Nayar said inflation is the chief driver of paycheck-to-paycheck living now. Aside from groceries, the other hit is being felt in runaway rents and mortgage payments, with interest rates playing a big part.

Homeowners are generally better off, as the study noted that “consumers paying mortgages are much less likely to cite a negative impact. In fact, renters tend to be more negative about the impact of housing costs by an average margin of 20 percentage points.”

But with 30-year mortgage rates hovering above 6% and paychecks already maxed out, this is not a time when most renters will be able to put together the money to become owners.

“It’s a very volatile set of circumstances, and we’ll have to see,” Nayar said, observing that “the average American spends between 35% and 45% of their income on rent or mortgage payments.”

The report noted that 55% of urban dwellers said paying rent has at least a somewhat negative impact on their financial well-being, with 25% saying it has a very negative impact.

Adapting to Inflationary Realities

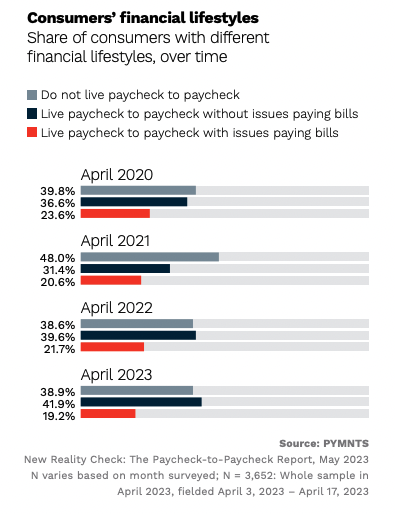

It’s not all bad news in the “New Reality Check: The Paycheck-to-Paycheck Report: The Regional Divide Edition,” as the study found that of the two categories of paycheck-to-paycheck consumers — those who can pay their monthly bills without difficulty and those who struggle to do so — have found ways to better manage their cash flows.

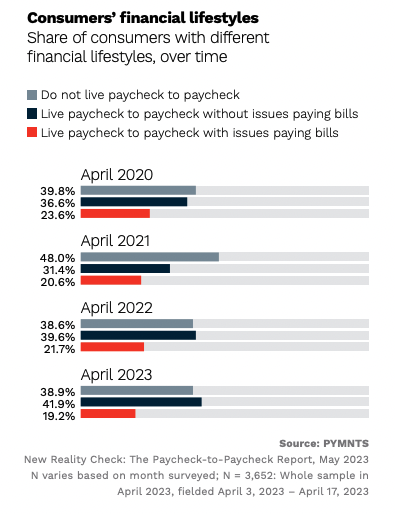

The share of paycheck-to-paycheck consumers with issues paying their bills dropped by more than two percentage points from 22% in April 2022 to 19% this year, per the new data.

“It’s a good thing,” Nayar said. “I think it’s as simple as people are getting smarter about managing their money. All our reports over the last few months have been showing the same thing. People have started to adapt to the recession. They’ve adapted to the new higher rates of inflation, and they’re managing their cash flow better.”

That includes everything from both pulling back on expenses and making other changes to financial lifestyle to things like getting a side job, as was analyzed in the previous report, “New Reality Check: The Paycheck-to-Paycheck Report — The Supplemental Income Edition.”

Living paycheck to paycheck without issues paying bills “is now the dominant lifestyle in the U.S.,” Nayar said. “There’s more of those than there are people not living paycheck to paycheck, and [those with] issues paying bills is slowly going down across the board.”