Gen Z Shows Resilience to Inflation but Adjusts Shopping Habits

Gen Z, born in the late 1990s, is considered the first digitally native generation, with a greater inclination toward online shopping and digital activities and an adopter of social media for shopping and browsing brands.

Growing up during economic uncertainty, Gen Z is often more budget-conscious and seeks value for money. As a result, they are more likely to compare prices online, look for discounts and choose brands that offer good quality at affordable prices.

Lately, to stretch their budget, they often turn to credit products, with credit cards being their primary option, but with buy now, pay later (BNPL) gaining popularity.

Financial Situation

Due to inflation and economic instability, most consumers of all age groups say they are worse off than in 2022, except for Gen Z. According to PYMNTS Intelligence’s latest “Paycheck to Paycheck Report,” 41% of consumers from this generation state that their financial situation has improved this year compared to 2022, while 31% say the contrary.

Gen Z consumers are also the most likely to cite increased income this year, which has been reflected in their level of spending on certain occasions. For instance, as found in other PYMNTS Intelligence research, Gen Z is the generation that is most likely to increase spending on gifts during the holiday season, with a 55% increase as compared to last year.

Inflation Impact

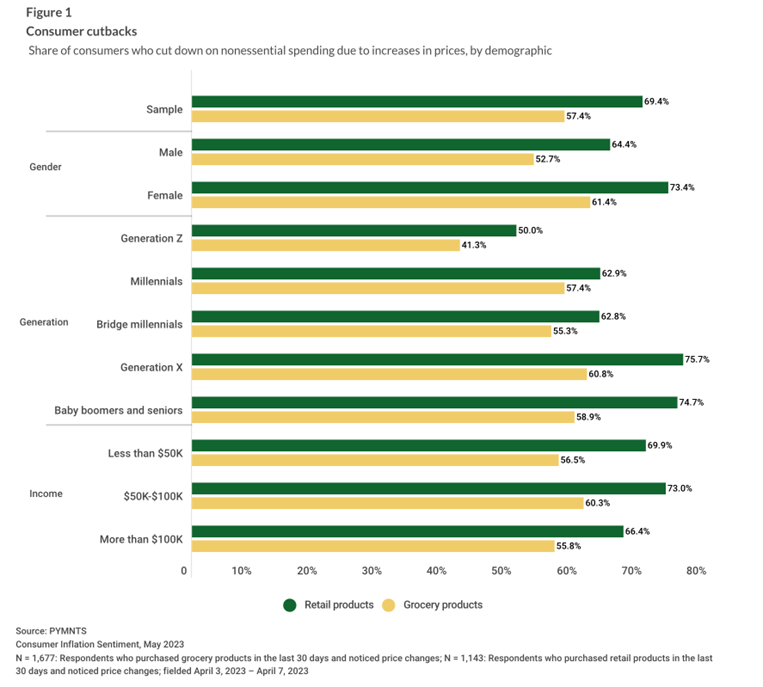

Despite their resilience to a challenging economic environment, inflation has also affected Gen Z, and many of them have been forced to adapt their shopping habits on several fronts. The generalized cutback in spending on both essential and nonessential products is common to all age groups, although to a lesser extent in the case of Gen Zers. Nevertheless, the cutback is significant.

Specifically, 41% of Gen Z shoppers made grocery spending cutbacks, and 50% tightened their budgets in retail products, as per additional PYMNTS Intelligence data.

Moreover, consumers across all income groups are cutting back on spending due to tips driving up the cost of goods and services. Younger consumers are particularly likely to hold this view. Twenty-seven percent of Generation Z agreed with the statement, “I have cut back on spending because tipping makes things cost too much.”

Social Media and eCommerce

Being fully digital natives, it’s unsurprising that Gen Z shoppers are the most inclined to use social media for browsing and shopping because they find products more attractive there.

According to PYMNTS Intelligence data, 68% of Gen Z consumers searched for products on social media, and 22% ultimately completed a purchase, the highest shopping rate across all generations. This trend doesn’t appear to be temporary, as 3 out of 4 Gen Z consumers plan to make purchases on social media, compared to less than half of the overall sample.

Instagram and TikTok are the go-to social networks for browsing and purchasing products for this generation, with clothing, apparel, and beauty products being the most sought-after.

At the same time, they are also the most likely to express concern about overspending. Thus, when shopping online, they actively seek discounts and promotions.

Payment Preferences

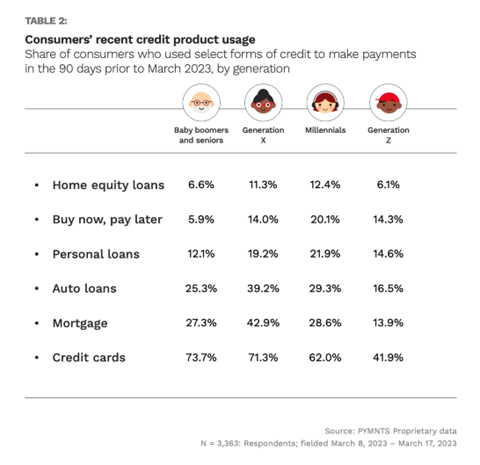

As they are across generations, credit cards are the primary credit product for Gen Z. Nevertheless, they use them less than other generations, as many of them do not have access to credit products at that young age.

Nearly 42% of Gen Z used credit cards for making payments, compared to 74% of baby boomers and seniors, per PYMNTS Intelligence data.

Other than credit cards, BNPL is gaining popularity among this generation, as around 14% already use it. The high credit card rates observed this year could affect Gen Z’s much lower level of card and personal loan use and, in turn, drive BNPL’s broader usage.

PYMNTS Intelligence found that 39% of Gen Z consumers use BNPL to buy clothing, representing the greatest rate of use across purchase products and generations. As electronics is Gen Z members’ second-favorite category to make purchases via BNPL, it seems that the generation is mainly limiting its use of credit products to discretionary items.

Contrary to the prevailing sentiment of financial decline, a substantial portion of Gen Z individuals claim an improvement in their financial situation in comparison to the previous year. However, this financial fortitude does not render them immune to the effects of inflation.

Gen Zers, like others, are compelled to recalibrate their shopping habits. A careful examination reveals that while they exhibit a degree of spending resilience, there are noticeable cutbacks from essential expenditures to retail products. Furthermore, they are more actively browsing online to hunt for discounts and turning to split-pay options to stretch their budget.

Articul8 Launches Domain-Specific GenAI Models Built for Supply Chain Operations

Articul8 has launched a family of GenAI models built to optimize supply chain, manufacturing and industrial process operations.

The new A8-SupplyChain models are domain-specific and have the deep contextual understanding needed to autonomously translate complex technical documentation into structured, actionable sequences, the company said in a Friday (April 4) press release.

“We built A8-SupplyChain specifically to tackle the problems that general-purpose GenAI can’t: delivering accurate, transparent and fully traceable reasoning through complex technical documentation and real-world workflows,” Articul8 Founder and CEO Arun Subramaniyan said in the release. “This is not just another model — it’s a fully autonomous system built specifically for mission-critical environments.”

The A8-SupplyChain models support complex enterprise production environments and platforms, including customers and partners, according to the release.

They can use unstructured data, including PDFs, engineering diagrams, maintenance logs, quality systems and structured tables, the release said.

Because they are trained on high-fidelity technical documentation, the models deliver AI-driven recommendations without extensive manual customization, per the release.

“With A8-SupplyChain, we’re giving aerospace and defense leaders something new: a fully orchestrated system that doesn’t just generate answers — it understands, adapts and drives outcomes,” Subramaniyan said in the release. “This is the next leap forward in enterprise AI — intelligent systems that operate at scale, with context, precision and trust built in.”

Enterprises are turning to AI to automate not just repetitive tasks but also more complex processes like compliance monitoring, fraud detection and supply chain optimization, PYMNTS reported in January.

Articul8 was established in January 2024 by Intel and DigitalBridge Group, which joined forces to create it as an independent company that provides enterprise customers with a secure and vertically optimized GenAI software platform.

The company’s platform enables business to harness the power of AI while keeping their data secure; offers a turnkey GenAI software platform that delivers speed, security and cost-efficiency to large enterprise customers; and supports a range of hybrid infrastructure alternatives, allowing customers to choose cloud, on-premises or hybrid deployment options.

Today, in addition to the new A8-SupplyChain, Articul8 offers domain-specific models for various industries, including energy and semiconductor, according to the Friday press release.