The Consumer Financial Protection Bureau (CFPB) recently issued a report listing regulatory concerns around how gaming and virtual reality companies facilitate transactions and collect sensitive data.

As “Banking in Video Games and Virtual Worlds” makes clear, the CFPB sees both industries processing transactions and collecting the kind of information it normally associates with banking and payment systems.

“Games and virtual worlds enable players to store and transfer valuable assets, including in-game currencies,” reads the report. “To leverage … value, gaming companies have begun incorporating financial products and services such as proprietary payment processors and money transmitters.”

But the agency’s concerns go beyond transactions. The report also calls out operators in both industries for gathering financial data, purchasing history, spending thresholds, location data, employment information, biometric data and more.

Many older consumers share the CFPB’s unease about organizations having access to this highly sensitive data, but younger consumers apparently do not.

At least that is what PYMNTS Intelligence found in completing its “Consumer Sentiment About Open Banking Payments,” which examines how receptive consumers are to sharing data in support of open banking, a legal framework permitting secure data sharing among financial institutions (FIs) and third-party FinTechs.

The report, done in collaboration with Trustly, found that although most younger consumers are comfortable sharing financial data under an open banking framework, a significant share of older consumers aren’t — even if it would mean they could get paid faster.

Sixty-four percent of baby boomers and seniors who are not open banking users said security and trust were the main drivers behind their hesitancy. Only 44% of their Gen Z and millennial counterparts share those concerns.

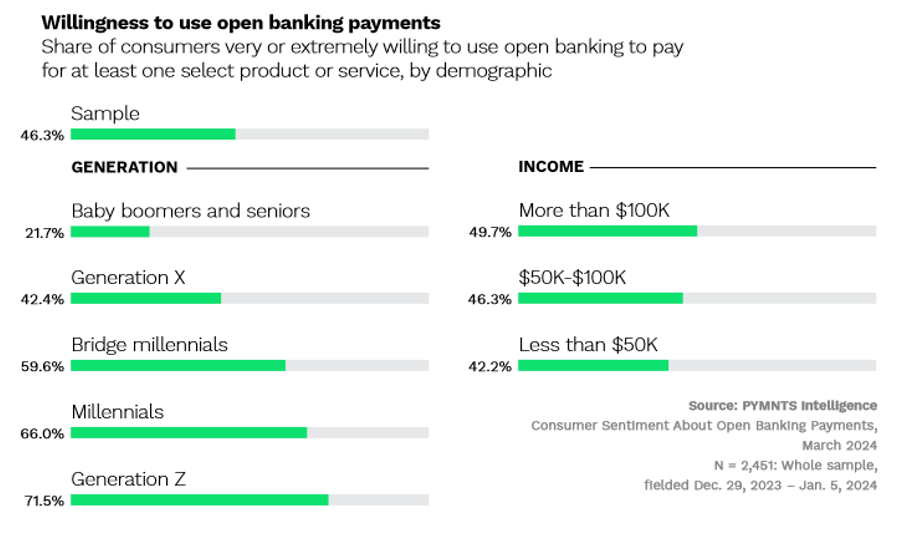

This is particularly notable because younger consumers are a bit more cavalier when it comes to sharing their data. Seventy-two percent of Gen Z and 66% of millennial consumers who surveyed for the PYMNTS study indicated a strong willingness to use open banking payments if it means they can gain benefits such as faster payments. Meanwhile, only 42% of Gen X respondents and 22% of baby boomers and seniors surveyed said the same.

Despite the strong interest younger consumers have in using open banking, few currently use it. Only about 11% of all U.S. adults — approximately 27 million individuals — used open banking payments at least once in the past year. In contrast, an estimated 68 million consumers did things the old-fashioned way, by manually inputting account and routing numbers, while 52 million made payments using their bank’s bill pay services and 26 million used digital wallets.

PYMNTS Intelligence determined that the discrepancy between a willingness to use open-banking supported payments and its actual usage stems largely from a lack of awareness. Of the 89% of consumers who did not use open banking in the last year, 44% indicated they simply weren’t familiar with it.

It should be noted that the CFPB is a proponent of open banking and encourages financial institutions to support the framework. Open banking is all about secure, consented information sharing in an industry — banking — that is highly regulated.

With a reported 80% of Gen Z and half of millennials spending up to 80 hours a week gaming, it’s understandable why the CFPB has now turned its attention to gaming companies and virtual world operators. Both industries have successfully won over the same two consumer segments who share the CFPB’s enthusiasm for open banking, but both operate with little regulatory oversight. For now, anyway.