As consumers go through checkout — either in-store or online — they might be invited to cover the cost of the purchase with a new credit card. Or they may be given the option to use buy now, pay later (BNPL). Or their bank might extend an offer through an app.

Critically, these options would be embedded, so all of this could occur during checkout without sending shoppers to a different site.

Regardless of the many ways embedded lending options are presented to shoppers, PYMNTS Intelligence found that about half of consumers who get them from merchants and financial institutions are highly satisfied with the offers.

That is one key finding included in “The Embedded Lending Opportunity,” which was commissioned by Visa and is based on surveys with more than 8,000 consumers in Australia, Germany, India, Japan, the United Kingdom and the United States.

About half of consumers like the embedded offers they see, which is especially noteworthy given the fact that 43% of consumers said they would consider switching providers to get embedded lending options.

Advertisement: Scroll to Continue

Another key finding: Slightly fewer than 23% of respondents said they would “never” use embedded lending, suggesting that more than three-quarters of consumers would at least consider it.

Taking these insights together — that half of consumers around the globe like embedded lending, that 43% would switch merchants to take advantage of it, and that 75% might be open to it — embedded lending represents a significant opportunity for merchants and financial institutions to broaden their customer base.

For those who need one more reason, consider the following exclusive data PYMNTS Intelligence gathered but didn’t include in the final report.

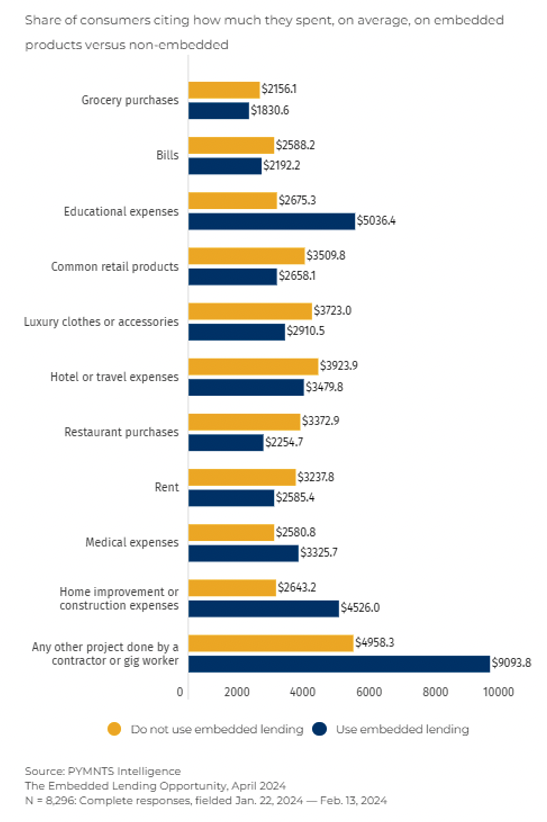

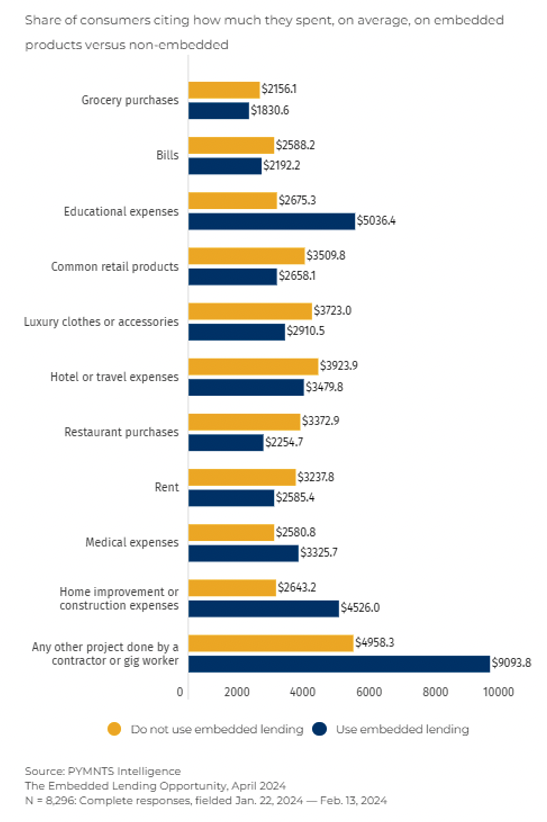

In certain instances, consumers appear willing to spend more money when using embedded lending.

For instance, when paying for educational expenses, consumers using traditional payment methods spent about $2,675, while those opting for embedded lending options spent more than $5,000. Similarly, consumers using embedded lending to pay for medical costs spent $3,325, more than the $2,580 traditional consumers spent. People investing in home improvement projects with embedded lending spent more than $4,500, while only $2,643 was spent by those using traditional payment methods. Perhaps most significant of all: Those who paid a contractor or gig worker with embedded financing spent nearly double.

These findings suggest some consumers see embedded lending as an effective way to offset the short-term financial pressure that comes with certain unplanned expenses — medical emergencies, home fix-up projects or unpredictable educational costs.