Brazil might be known for samba, soccer and sugar. But you can now add digital transformation to that list.

According to PYMNTS Intelligence’s recently released landmark report “How the World Does Digital,” this country with a population of 215 million has emerged as the global leader in digital engagement among its consumers.

The nation’s success in digital innovation is underscored by the widespread use of Pix, an instant-payment app launched by Brazil’s central bank in 2020. Additionally, the payment/eCommerce platform “Amazon of Latin America” — Mercado Libre — launched in Brazil in 1999 and is still in widespread use. This adoption is a testament to Brazil’s strong digital infrastructure, with two-thirds of consumers owning smartphones and 92% having access to at least a 4G network.

As the report shows, there are substantial variations in the degree of digital engagement for consumers in different countries based on the average number of activity days per month across the population. The study was based on responses from 67,000 consumers in 11 countries, collected through quarterly surveys in 2023.

The countries surveyed include the United States, the United Kingdom, France, Germany, Italy, the Netherlands, Spain, Australia, Japan, Singapore and Brazil. The sample sizes were statistically representative of the population in each country, considering gender, age, income and education.

To measure digital engagement, the report identified 40 core activities within 11 pillars of digital life, such as banking, shopping and entertainment. Respondents indicated their engagement frequency for these activities (daily, weekly, monthly or not at all). The results were then extrapolated to estimate the number of days consumers engaged in each activity per month. This allowed for a comprehensive comparison across different demographics and countries.

Advertisement: Scroll to Continue

Brazil had the highest number of activity days, at 361 (12 activities per day). The U.K., which was the median country, had 276 activity days (9.2 activities per day) — 77% of Brazil’s score. Japan was the lowest, with just 127 activity days (4.2 activities per day) — barely one-third of Brazil and less than half of the U.K. There is a 234-day spread between Brazil and Japan and a 93-day spread between the second highest, Singapore, and the second from last, Germany.

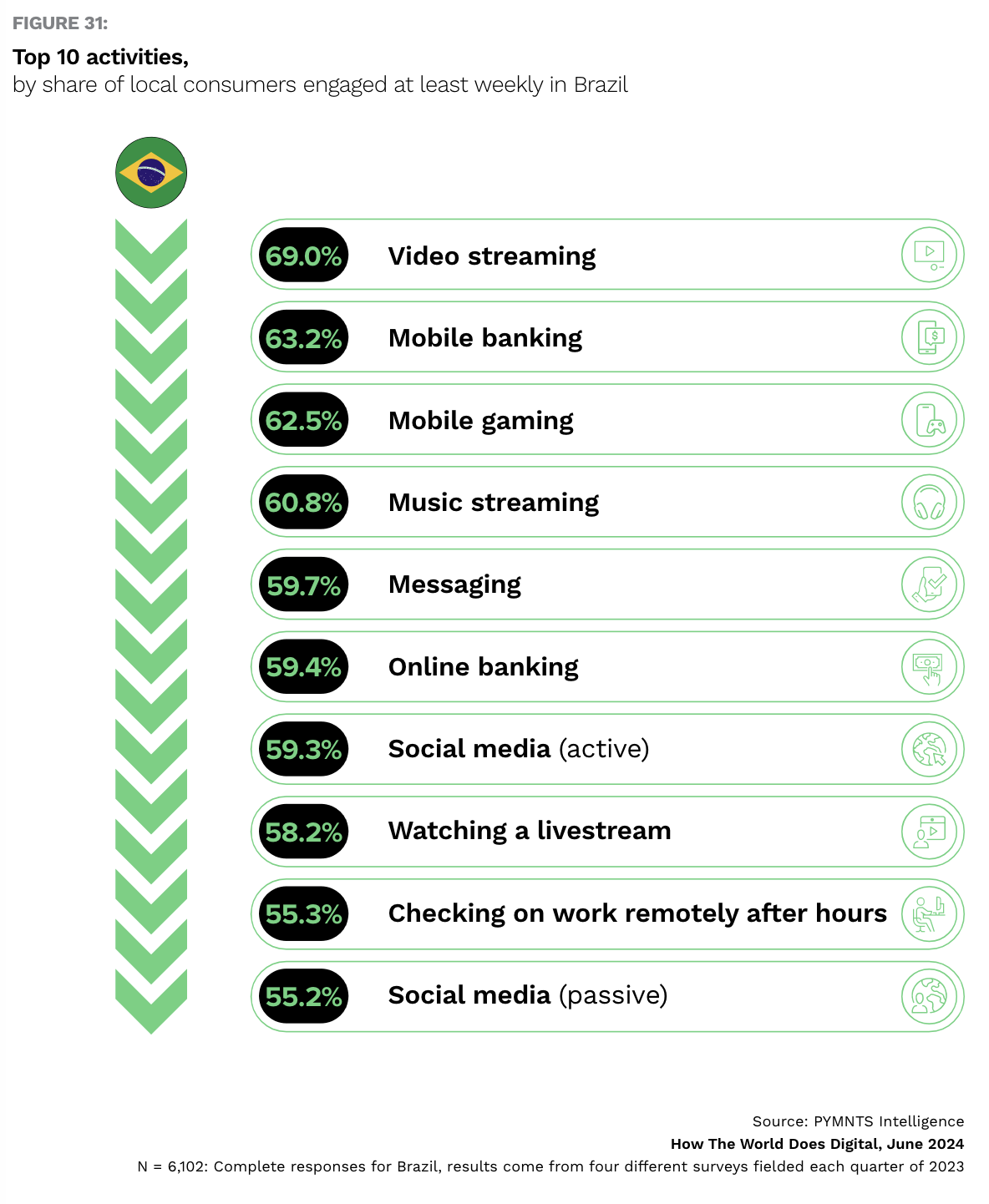

The report found Brazil’s digital engagement spans various activities, as it did in other countries.

Video streaming tops the list, with 69% of consumers engaging in it at least weekly. Mobile banking follows closely, with 63.2% participation, and mobile gaming at 62.5%. Other popular activities include music streaming (60.8%), messaging (59.7%), online banking (59.4%) and active social media use (59.3%). Additionally, a significant portion of consumers engage in watching livestreams (58.2%), checking work remotely after hours (55.3%), and passive social media consumption (55.2%).

Generational and income dynamics further highlight the breadth of digital engagement in Brazil.

Millennials and Generation Z are the most digitally active, with 405 and 411 activity days per month, respectively. Generation X follows with 335 days, and baby boomers with 271 days. High-income earners lead with 456 activity days, compared to 363 for middle-income and 309 for low-income earners.

The digital engagement “winners,” based on total activity days, vary by generation.

French Gen Z users are the most active, with 464.8 activity days per month and about 15.5 activities per day. Millennials in the U.S. lead the entire generation in digital engagement, with 446.7 activity days and 14.9 activities per day. In Brazil, Gen X and baby boomers come out ahead of other countries.