Consumers are now saving less money for the proverbial rainy day than they were a year ago.

The personal savings rate in January was 3.8%, which was higher than December’s 3.7% but still below the 4.8% consumers were socking away last summer.

The trend may not ring immediate alarm bells, but it could prove problematic down the road should consumers run into unexpected expenses, and the likelihood that the average American will face a financial emergency is significant.

The PYMNTS Intelligence report “The Credit Accessibility Series: Unexpected Expenses and the Demand for External Financing” drew from a 2023 survey of 2,521 U.S. consumers. It found that 56% of them had recently been hit with pricey and unexpected expenses that cost them, on average, $5,500.

Things were even more dire for key demographic segments profiled in the study. Seven in 10 Generation Z consumers found themselves facing financial emergencies that cost nearly as much as or more than their average $3,400 nest egg. Those who had been rejected for at least one credit application and labeled “credit marginalized” faced even steeper financial challenges, with 80% saying they had recently been hit with unforeseen expenses that exceeded the average $4,400 they had on hand.

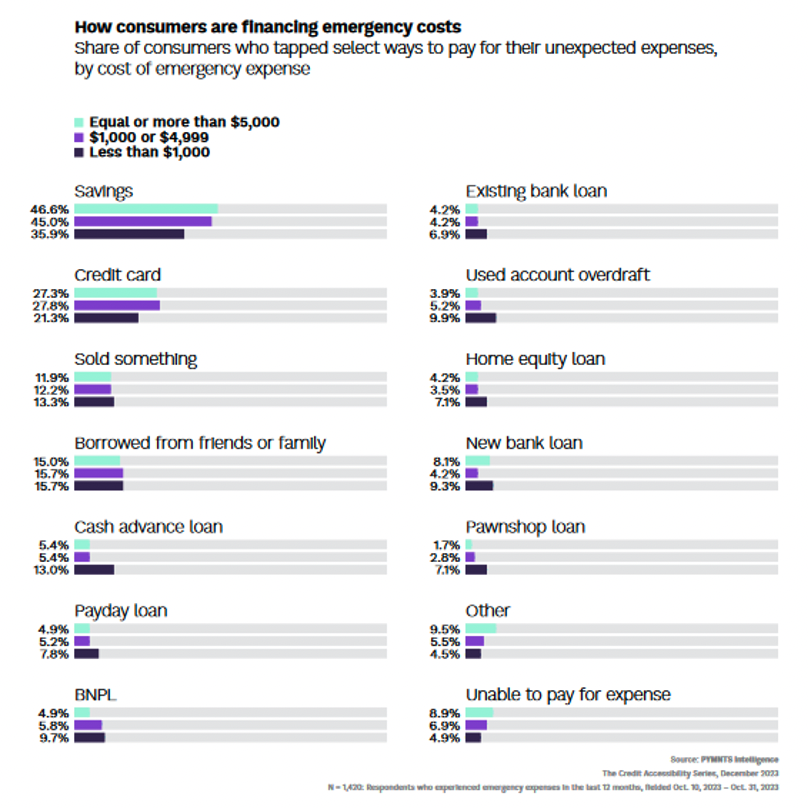

The survey also found that when savings were limited — or not on hand at all — many consumers turned to credit to counter financial emergencies.

When faced with unexpected expenses costing less than $1,000, 36% of all respondents used cash savings to pay the bill. Meanwhile, 21% sought credit cards; 13% used cash advance loans; 10% opted for buy now, pay later options; and 10% relied on overdraft loans.

Even when respondents had small cash reserves on hand, many chose to pay for smaller emergencies with credit. Thirty-eight percent of those with savings balances of less than $5,000 preferred using credit to cover unexpected expenses, while 28% of those without any savings said credit was their go-to solution.

Unfortunately for many consumers, the primary outcome of unforeseen expenses is a drop in credit scores. Thirty percent of those surveyed said they saw their credit scores sink following unexpected outlays. More than 80% of credit-marginalized respondents said their already-limited ability to access credit declined even further following unforeseen expenses, suggesting that this backup plan may itself need a backup plan.