David’s Bridal Marries Security And Omnichannel Payments To Build Consumer Trust

Consumers heading to brick-and-mortar stores after spending many months sequestered indoors are taking their newfound digital-first shopping and payment habits with them. The use of online or mobile-enabled payment methods at the physical point of sale (POS) has steadily expanded recently, with consumers’ interest in peer-to-peer (P2P) and other apps growing rapidly.

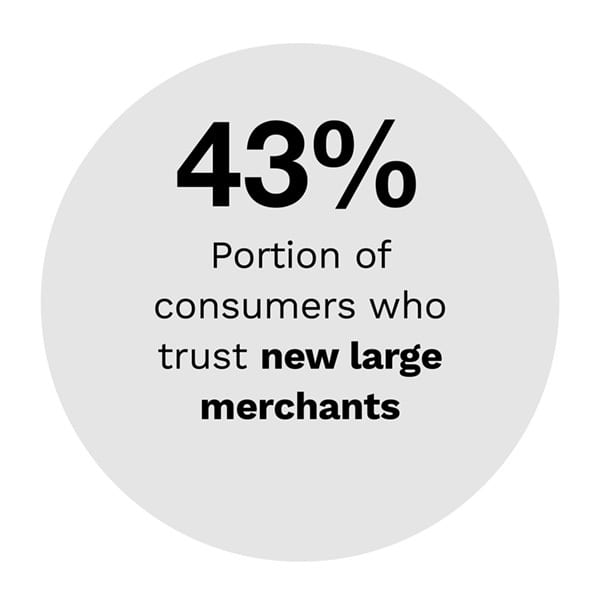

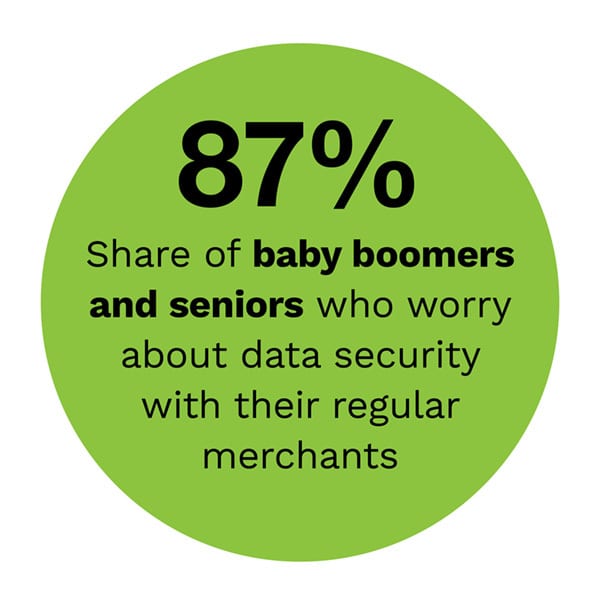

Brick-and-mortar merchants are quickly adjusting to consumers’ evolving preferences, while online re tailers are competing to engage customers and stand out from the crowd. Retailers operating in each of these channels — or across both — must be especially sure to meet consumers’ payment requirements, but this comes with its own challenges. Customers expect security in addition to speed and efficiency, and they are placing more value on the privacy and protection of their personal information when interacting with merchants. Retailers must adequately address shoppers’ data safety concerns to retain their trust.

tailers are competing to engage customers and stand out from the crowd. Retailers operating in each of these channels — or across both — must be especially sure to meet consumers’ payment requirements, but this comes with its own challenges. Customers expect security in addition to speed and efficiency, and they are placing more value on the privacy and protection of their personal information when interacting with merchants. Retailers must adequately address shoppers’ data safety concerns to retain their trust.

In the July Anatomy Of A Consumer Payment Playbook: The Security And Consumer Trust Edition, PYMNTS analyzes how the events of the past year have altered consumers’ retail expectations as well as how merchants can keep their trust. It also analyzes why robust security and digital identification measures are necessary in this regard.

David’s Bridal On Fostering Customer Trust With Seamless Security And Omnichannel Convenience

Fostering Customer Trust With Seamless Security And Omnichannel Convenience

Precision is key in the wedding industry as merchants work to meet customers’ individual needs. Creating satisfaction among these shoppers means merchants must keep a close eye on developing trends, including how consumers want to shop and pay. Customers accustomed to seamless online transactions want the same ease at brick-and-mortar stores, and they also expect physical retail’s personal touch to translate online. This makes creating a friction-free omnichannel experience key, explained Danny Luczak, chief technology officer for wedding retailer David’s Bridal. To learn why building security into the consumer experience is becoming critical to retaining consumers’ trust in an omnichannel world, visit the Playbook’s Feature Story.

Deep Dive: The Consumer Trust Deficit And How Robust Login And Payment Security Can Help Build Trust

Online spending exploded 44 percent year o ver year in 2020 as U.S. consumers, stuck largely indoors, headed to digital channels to make purchases. Customers expected these transactions to occur quickly and seamlessly, but they also expected them to be secure — relying on merchants and their financial partners to safeguard their personal and financial information. Developing this security is thus becoming key to creating and maintaining consumers’ trust, a must for retailers to avoid damaging both their revenues and reputations. To learn more about how implementing strong digital identity verification measures can help merchants retain consumers’ trust, visit the Playbook’s Deep Dive.

ver year in 2020 as U.S. consumers, stuck largely indoors, headed to digital channels to make purchases. Customers expected these transactions to occur quickly and seamlessly, but they also expected them to be secure — relying on merchants and their financial partners to safeguard their personal and financial information. Developing this security is thus becoming key to creating and maintaining consumers’ trust, a must for retailers to avoid damaging both their revenues and reputations. To learn more about how implementing strong digital identity verification measures can help merchants retain consumers’ trust, visit the Playbook’s Deep Dive.

About The Playbook

Anatomy Of A Consumer Payment Playbook, a PYMNTS and FIS collaboration, takes a data-driven look at how consumers’ payments are processed as well as the technologies and innovations that can optimize payment flows. The Playbook series also examines recent trends in the payments space to provide FIs and merchants with a complete guide to the ins and outs of consumer payments and offer them a roadmap for navigating these challenges.