Deep Dive: Why Supporting A Seamless, Device-Agnostic Payments Experience Is Key For Merchants

The ongoing pandemic has motivated consumers to reconsider how they conduct routine payments, prompting many to move away from more established forms of payment at the point-of-sale (POS) such as cash or checks in favor of emerging digital methods. One recent study found that cash transactions now account for only 20 percent of in-store payments worldwide, representing a 32 percent drop since 2019. eCommerce purchases and touchless transactions via mobile wallets or tap-and-pay plastic cards are rising in cash’s place, but — critically for merchants — so are consumers’ expectations.

Customers are now expecting their purchasing experiences to be smooth, seamless and personalized, whether they are shopping online, through their mobile phones or inside brick-and-mortar stores. Shoppers are seeking out merchants that not only offer one or more of these retail channels but also support payments through an expanding number of methods and devices. One-third of all consumers in a recent survey said that their loyalty to everyday stores has changed since the pandemic began, with 36 percent attributing that change to whether retailers support online payments, including shopping via apps such as Instacart or Peapod. Online consumers report similar expectations for payment variety and personalization, expressing a willingness to leave their carts behind if their experiences do not meet these standards. The latter tendency was especially high during the early days of the pandemic, with one global study finding that cart abandonment reached over 94 percent between January and June 2020.

Determining how to meet consumers’ shifting needs is essential for both brick-and-mortar and digital merchants as they seek to engage and retain new customers in an increasingly competitive environment. The following Deep Dive examines how the pandemic has nudged consumers to use a growing variety of devices for routine transactions as well as how this might affect shopping and payment trends in the near future. It also analyzes why it is important for merchants to understand these shifts and outlines what they can do to ensure that they are providing swift, seamless experiences to customers across all devices and channels.

The Rise Of Device-Agnostic Retail

Consumers’ desires to pick and choose from several different payment options or to shop in multiple channels did not originate with the pandemic: Shoppers have been seeking out faster and digital payment alternatives in recent years, especially as smartphone penetration has increased worldwide. Mobile phones have quickly become essential devices for commerce both online and in-store. One recent study found that mobile browsing accounted for 65 percent of eCommerce traffic in 2020 compared to 15 percent in 2012. Another report predicted that mobile-supported digital wallets will account for as much as one-third of all in-store transactions by 2024.

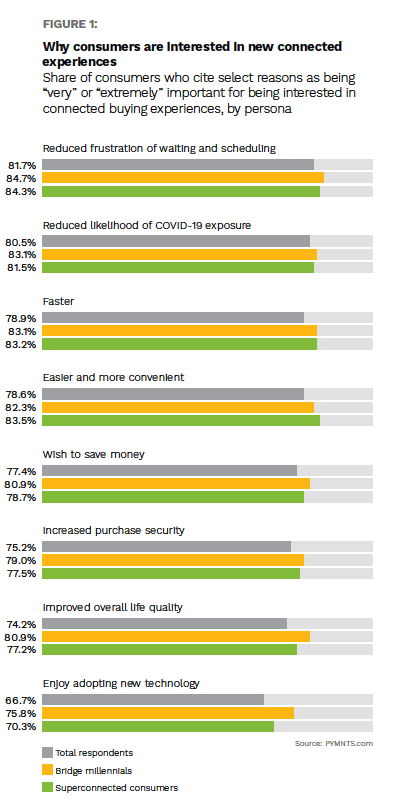

What has changed since the pandemic’s onset is the level of importance consumers attach to digital or mobile payment experiences. Eighty-eight percent of customers in one survey noted they expected companies to accelerate digital initiatives in the wake of the global health crisis, for example. Consumers are also beginning to consider the potential retail benefits of other connected devices, including voice assistants or smart speakers as well as mobile apps and wallets, after spending months sequestered at home due to public health guidelines. One recent PYMNTS study discovered a desire among consumers of all demographics to try out connected buying experiences through new digital devices for a number of reasons, though bridge millennials — the consumer group between 33 and 43 years old — appear to be leading this trend. Approximately 79 percent of all consumers surveyed are interested in connected buying experiences because they believe them to be easier and more convenient, compared to 82 percent of bridge millennials, for example. Sixty-seven percent of consumers are also interested in these experiences because they enjoy adopting new technology, while 76 percent of bridge millennials state the same.

Crafting seamless and device-agnostic shopping experiences at the digital or physical POS is thus crucial for merchants looking to capture and retain consumers’ attention, especially as the latter continues to seek out new connected device or payment experiences.

The Expanding Role Of Voice For Seamless Payments

One set of devices consumers appear to be gravitating toward is voice-activated tools, notably smart speakers. Such devices are rapidly becoming more popular, with one recent PYMNTS report finding that 33 percent of consumers own voice assistants of some kind. That same study also revealed that more than 23 million consumers who own voice-connected speakers are now using them to make purchases, especially for retail products.

This offers a significant opportunity for retailers, as it broadens the world of commerce beyond both the brick-and-mortar store and the digital screen. Consumers are also much more willing to shop from the comfort of their own environments, which they are outfitting with an increasing variety of smart devices, including connected fridges, TVs and cars. Monitoring consumers’ use of these devices as it continues to evolve is therefore essential for retailers aiming to connect with customers where they are.