Over the past year, as new strains of COVID have come and gone and rising vaccination rates have gradually restored much of what used to be considered normal daily routines, another stealthy creature has been steadily building strength and lurking in the wings: inflation.

After touching a 30-year high of 6.2% in October, and now projected by economists to approach 7% this Friday (Dec. 10) when the November CPI data are released, the bite of rising prices is not only historic and substantial — it’s become impossible to ignore.

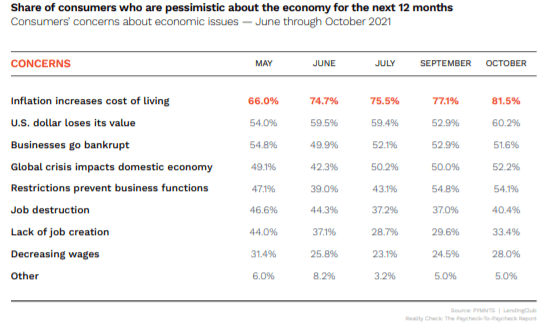

In fact, PYMNTS’ latest survey of over 2,300 U.S. consumers for Reality Check: The Paycheck-to-Paycheck Report, done in collaboration with LendingClub, showed that inflation is now the top-of-mind concern for eight in 10 consumers.

Get the report: Reality Check: The Paycheck-to-Paycheck Report

Get the report: Reality Check: The Paycheck-to-Paycheck Report

As shocking as these latest survey findings are, the sense of alarm over the increased cost of living has been steadily rising all year. And although official government data have only worsened since the results were tabulated, most consumers make their own real-time economic assessments based on what they see and buy every single day.

Even the nation’s top economic leaders, including Federal Reserve Chairman Jay Powell and Treasury Secretary Janet Yellen, have publicly revised their opinions on inflation as something more than a temporary or transitory threat.

But even though the federal response is heightened but calm, the daily pain and worries felt by ordinary citizens in the trenches is taking a toll on their wallets, while also undermining their confidence. And in an economy where 75% of the GDP is derived from consumer consumption, confidence may not be everything — but it is certainly the main thing.

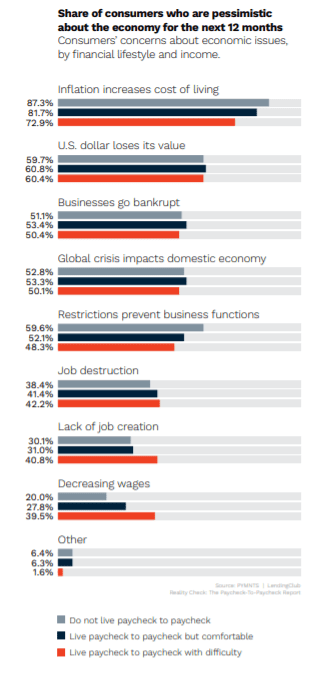

According to PYMNTS’ new report, the impact of rising prices may be most harmful for weaker consumers or those living paycheck to paycheck, but was actually cited more frequently as a concern by those who are living comfortably. In fact, while 73% of struggling paycheck-to-paycheck consumers see inflation as a primary concern, the economic pessimism was most pronounced among those households that are not stretching to pay their bills, with a staggering 87% of respondents mentioning concerns about rising prices.

“Such widespread economic pessimism does not come out of nowhere, and sticker shock may be a key culprit,” the report concluded. “Consumers are never fond of going to the store and finding out that everything is more expensive, and it is no wonder that the proportion of respondents who are highly concerned about inflation increased to 81% in October.”

So Now What?

As much as current inflation data is at a generational high, anyone over 50 can remember double-digit inflation spikes, especially at the gas pumps, in the mid-1970s. Prior to that, a brief post-World War II patch of price increases and debt saw official inflation spike to 20%.

But for most of the country, who have lived through two economic crashes in the past decade and have become accustomed to low-single-digit rates for mortgages and many loans, the indiscriminate attack of inflation is a new phenomenon.

While reassurances have been made from the White House to Wall Street and around the world that prices will start to come down sometime next year, the sentiment and financial staying power of most consumers is more focused on surviving until the end of the month.