While most consumers accept the norm of doing monthly bill pay through a variety of portals, apps and even paper checks, a meaningful number would shell out for the convenience of being able to settle all monthly accounts in a single third-party solution.

For “The One-Stop Bill Pay Report: Beyond the Billing Status Quo,” a PYMNTS and Mastercard collaboration, we surveyed nearly 2,100 United States consumers and found strong support for a one-stop bill pay method, and the willingness to pay for that kind of service.

The “scattershot approach to bill payments has been the status quo for many years, and tired consumers want a reboot,” the study stated, adding that “57% of bill-payers in the United States are open to switching to a centralized, consolidated digital portal, or ‘one-stop shop,’ for managing and paying all their bills. Moreover, nearly one-third of bill-payers would be highly likely to pay for this service.”

PYMNTS research found that 91% of billers said customers complain about billing services, and 34% said consumers feel dissatisfied about their lack of payments choice. That explains not just the demand for a one-stop solution, but the growing inclination to pay for that ease.

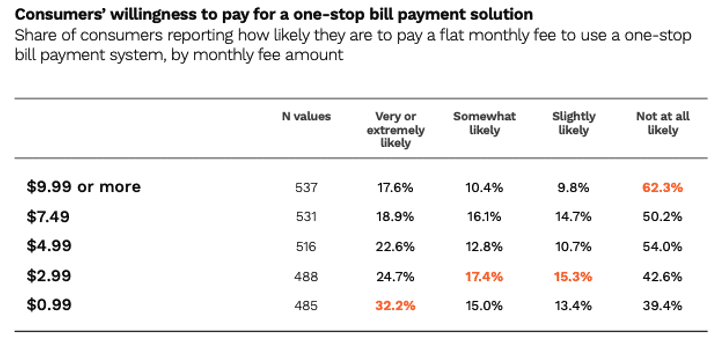

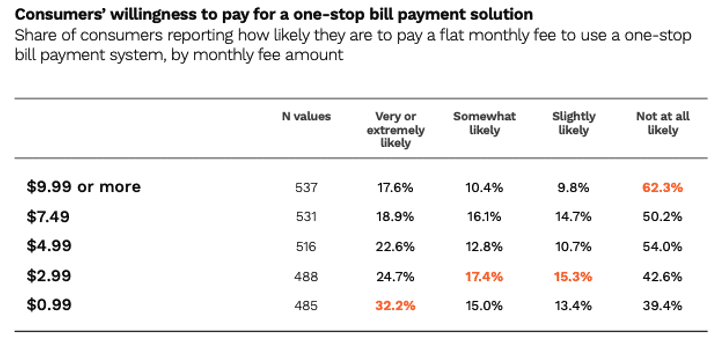

Per the study, 32% of bill-payers “said they are very or extremely likely to pay a monthly fee for a one-stop bill payment solution, and 61% indicated at least some likelihood of doing so. One-quarter would be very or extremely likely to pay a monthly fee of $2.99, and 18% would be as likely to pay $9.99 or more.”