This is just one trend that emerges in PYMNTS Intelligence’s Last Transaction Report, “Younger Consumers Lead Payment Shift From Credit to Debit,” which looks at how people are covering their costs in today’s financial landscape.

Consumer payment preferences serve as a barometer for broader economic conditions and personal financial health. While the report, which is based on surveys with more than 2,600 U.S. consumers, reveals that many older, high-income earning consumers still use credit cards for many everyday purchases, it also shows key consumer segments appear to be more strategic when it comes to spending.

Paying for items with cash and debit cards can reflect a deeper concern about financial stability. And the fact that cash and debit card activity is on the rise for younger and lower-income consumers — up 34% from last year for groceries alone — suggests these two groups are being especially budget-conscious right now.

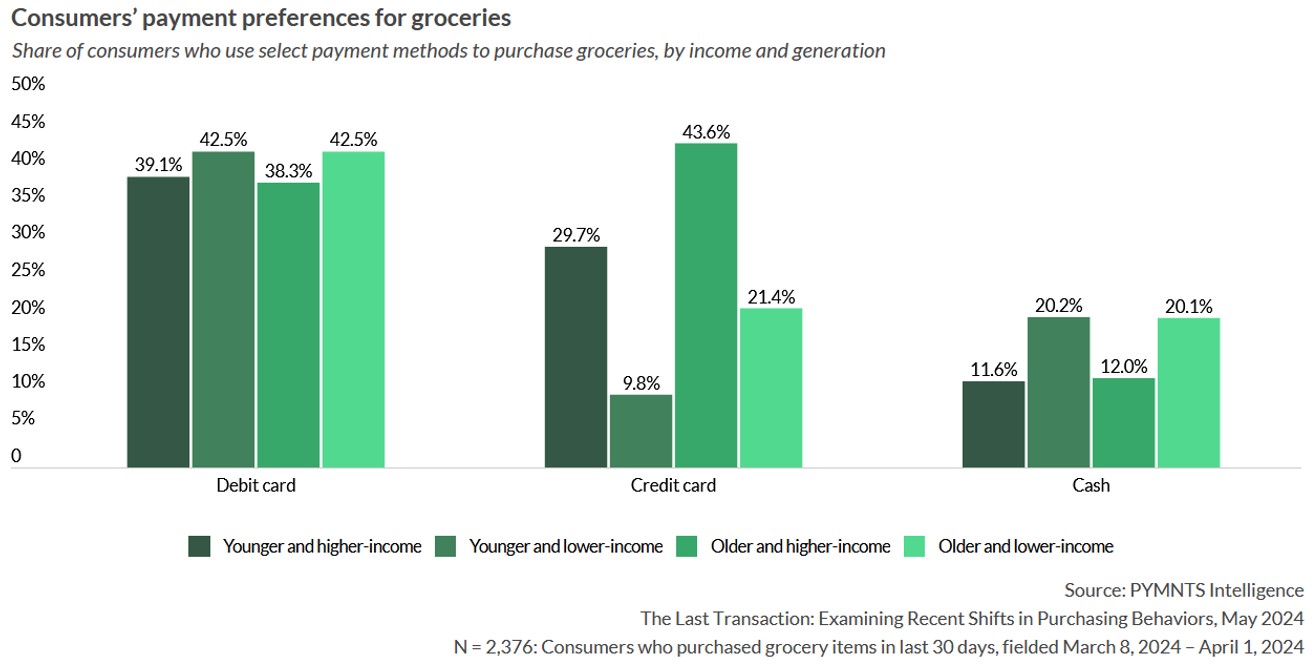

But data shows it’s not just younger and low-income earners who are being circumspect when shopping. Because age and income can mold payment preferences, PYMNTS Intelligence zeroed in on larger generational trends in its research. Within the report’s research, “older consumers” refers to Generation X, baby boomer and senior consumers. The shorthand “younger consumers,” meanwhile, refers to consumers who are Generation Z or millennials. “Higher-income consumers” refers to those earning $100,000 or more annually, while “lower-income consumers,” in this specific analysis, are those who earn less than $100,000 each year.

As the first figure illustrates, when shopping for groceries, regardless of their earnings, younger consumers appear to favor their debit cards. Older consumers with lower incomes also prefer to buy groceries with debit cards. Meanwhile, older, high-income earning consumers use credit cards more than any other age group.

Advertisement: Scroll to Continue

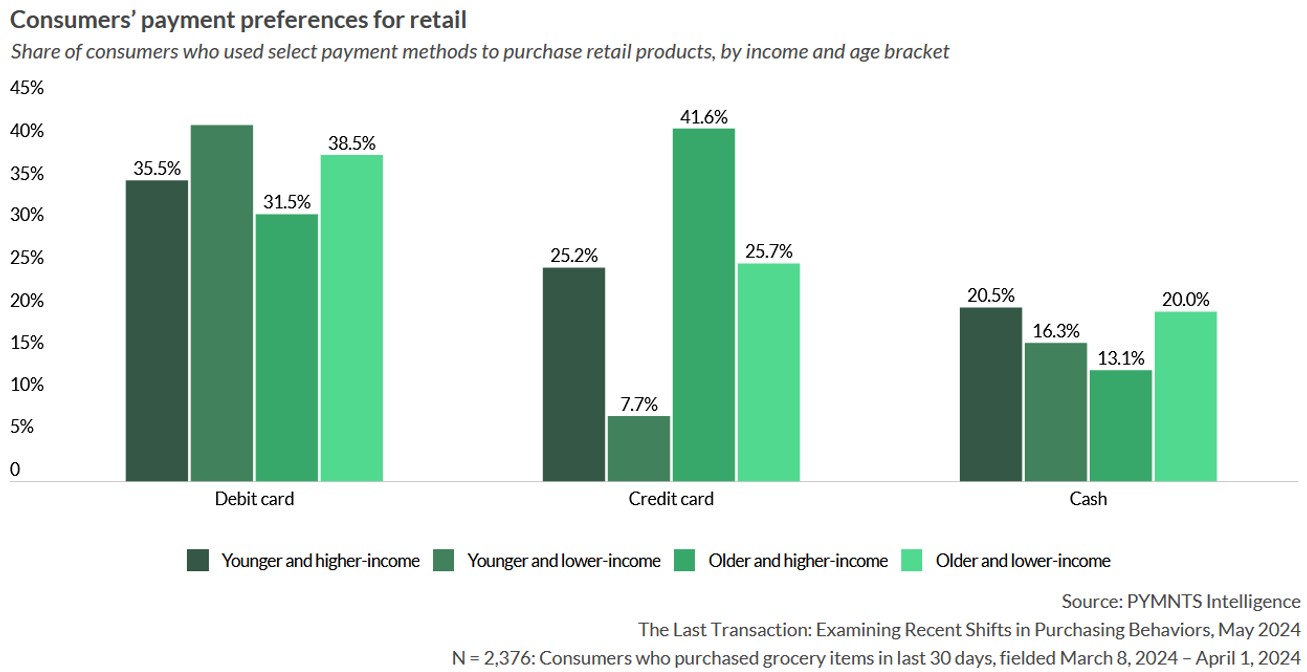

A similar divide unfolds in retail shopping, where 36% of affluent younger shoppers opt for debit payments, in sharp contrast with older adults. Older, high-income consumers use credit cards for 42% of retail purchases. Conversely, only 26% of older consumers with lower incomes utilize credit cards.

Such marked differences in payment method preferences may reflect a general preference for debit cards and cash among low-income and younger consumers, but it also may reflect an overarching aversion to credit card debt — note that 36% of younger, high-income consumers also prefer debit cards when retail shopping.

These growing preferences for debit purchases over credit could reshape payment ecosystems. Merchants and financial institutions should consider adapting to these changes by offering a variety of payment options that include efficient processing of debit transactions and integrated digital wallet solutions. Staying in front of these trends will be necessary to ensure future competitiveness.