Until recently there was “a consumer” who industry felt it understood, and whose tastes it knew well enough to gauge the market of new products and services. We called it “business as usual,” and it worked remarkably well, with some notable modifications, for the past 70 years or so.

Business roadmaps predating 2020 aren’t much use these days, however, as COVID has altered the terrain. Also outdated now are buyer personae that fail to solve for COVID effects, of which there are many. In chronicling the digital shift since it went into high-gear last spring, PYMNTS has gathered valuable business intelligence on the demands of new digital-first consumers.

In the Great Reopening: Shifting Preferences edition, for example, we discovered the Digital Shifters —four consumer personas forged by the COVID-19 episode — and what’s likely to be their lasting impact on spending, and the near-term prospects of a true economic recovery.

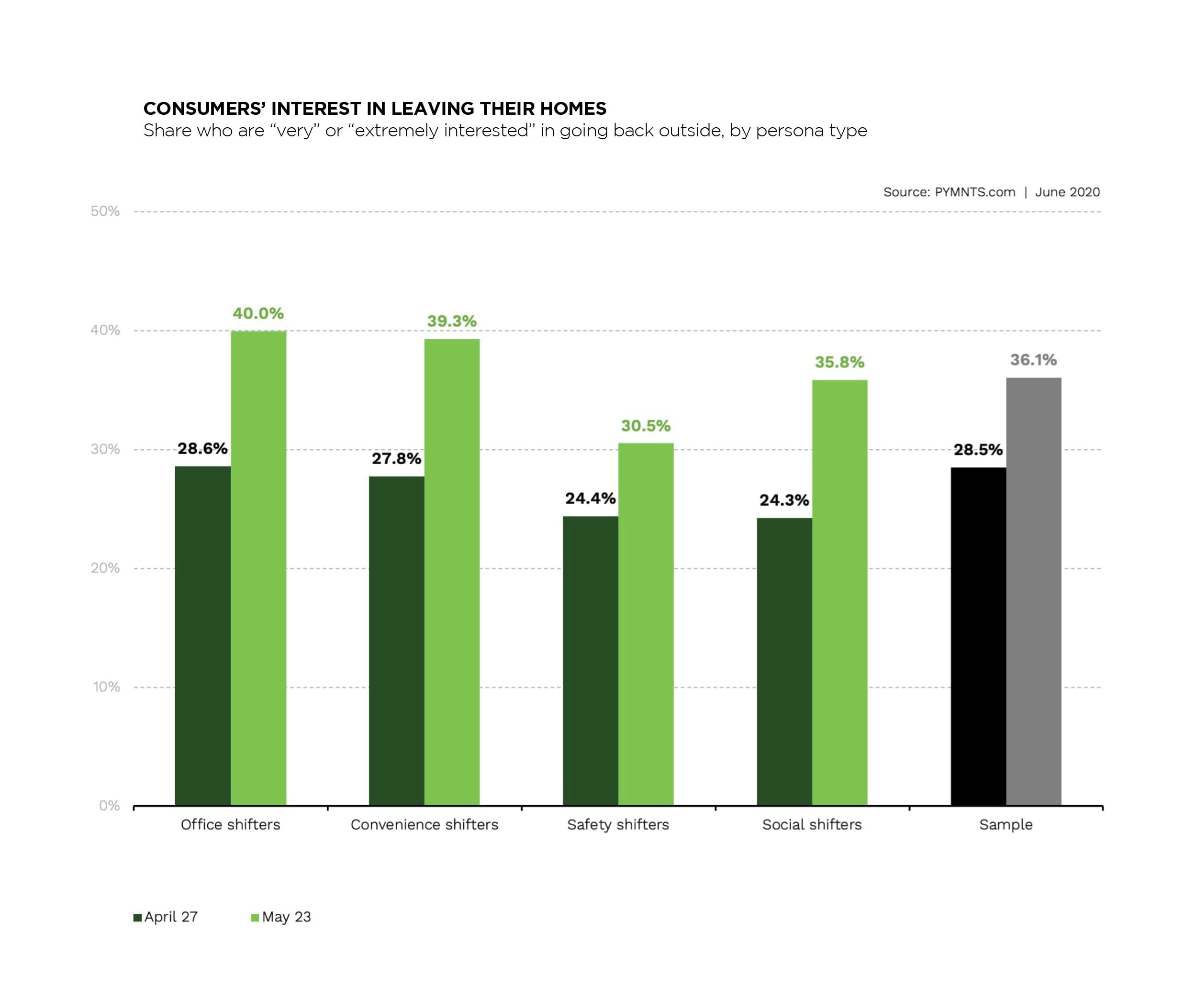

PYMNTS researchers found that what we call “social shifters” moved online fast but are most likely to rush back to physical stores and outside activities. That’s in stark contrast to “safety shifters” who fear COVID-19 more than any other group, who have embraced digital channels emphatically and are likely to stick. We’ve also got loveable “convenience shifters” who are like, “COVID is bad. Got it. So, do you offer instant credit? No? OK, bye!” They insist on digital choice, and their ‘loyalty’ is to payments optionality these days. Then there are the “office shifters” who hate their own houseplants at this point and are going outdoors in droves, praying for their offices to reopen.

Very recently, the fourth annual How We Will Pay 2020 study, done by PYMNTS in collaboration with Visa (more from that in a minute) gave new context to the shifters. Analyzing its findings, PYMNTS CEO Karen Webster wrote this week that, “[Long] after much of the physical economy [has] reopened, we now see a consumer who isn’t simply using apps and connected devices to save time or make the commerce experience safer by using touchless, digital channels. Rather, we see a consumer who is now using them to realign how they spend the 24 hours in their day, and the seven days of their week.”

She added, “consumers are making these conscious decisions about when, how and where they perform their day-to-day routines, while also reporting that seeing family and friends is the one activity they both miss and value the most.” If you dig economics read the piece, bringing our current mess into sharp focus using the acumen of Margaret Reid and her timeless “Economics of Household Production.”

It’ll be interesting to watch the COVID-era personas develop over time, as more physical businesses reopen. A recent PYMNTS study found that more than two-thirds of consumers see rescuing Main Street physical retail linked to the economic vitality of their local communities.

It’ll be interesting to watch the COVID-era personas develop over time, as more physical businesses reopen. A recent PYMNTS study found that more than two-thirds of consumers see rescuing Main Street physical retail linked to the economic vitality of their local communities.

There’s cautious optimism in the air, as shops open and people venture out to feel the old vibe again.

Speaking of bringing back the “vibe” of Main Street USA as crucial to recovery, Webster also recently wrote, “it’s why there is so much urgency to reduce the health risks for consumers, so they can more quickly get back to normal. At the same time, we must find ways to leverage the creativity and resilience of Main Street USA and develop creative ways to stem the shutdown of the stores and restaurants that people will no doubt seek out when they feel safe to return.”

Connected Commerce Calling The Shots

Creativity is a key ingredient in the COVID-era initiatives that are making headlines. The new report How We Will Pay 2020: Home As The Consumer’s Commerce Command Center report, a PYMNTS and Visa collaboration, surveyed nearly 10,000 U.S. consumers about life on lockdown and the resulting digital shift that has profoundly changed business in a matter of months. We learn that the creative innovation that’s capturing people’s imaginations more than anything now is the mighty spoken word.

Connected commerce is accelerating due to COVID, as many things are, and the digital-first consumer that all financial institutions (FIs) and merchants are seeking can be found at home. Home is the center of our world at present, and anything misaligned with that ‘home as digital command center’ ethos courts danger.

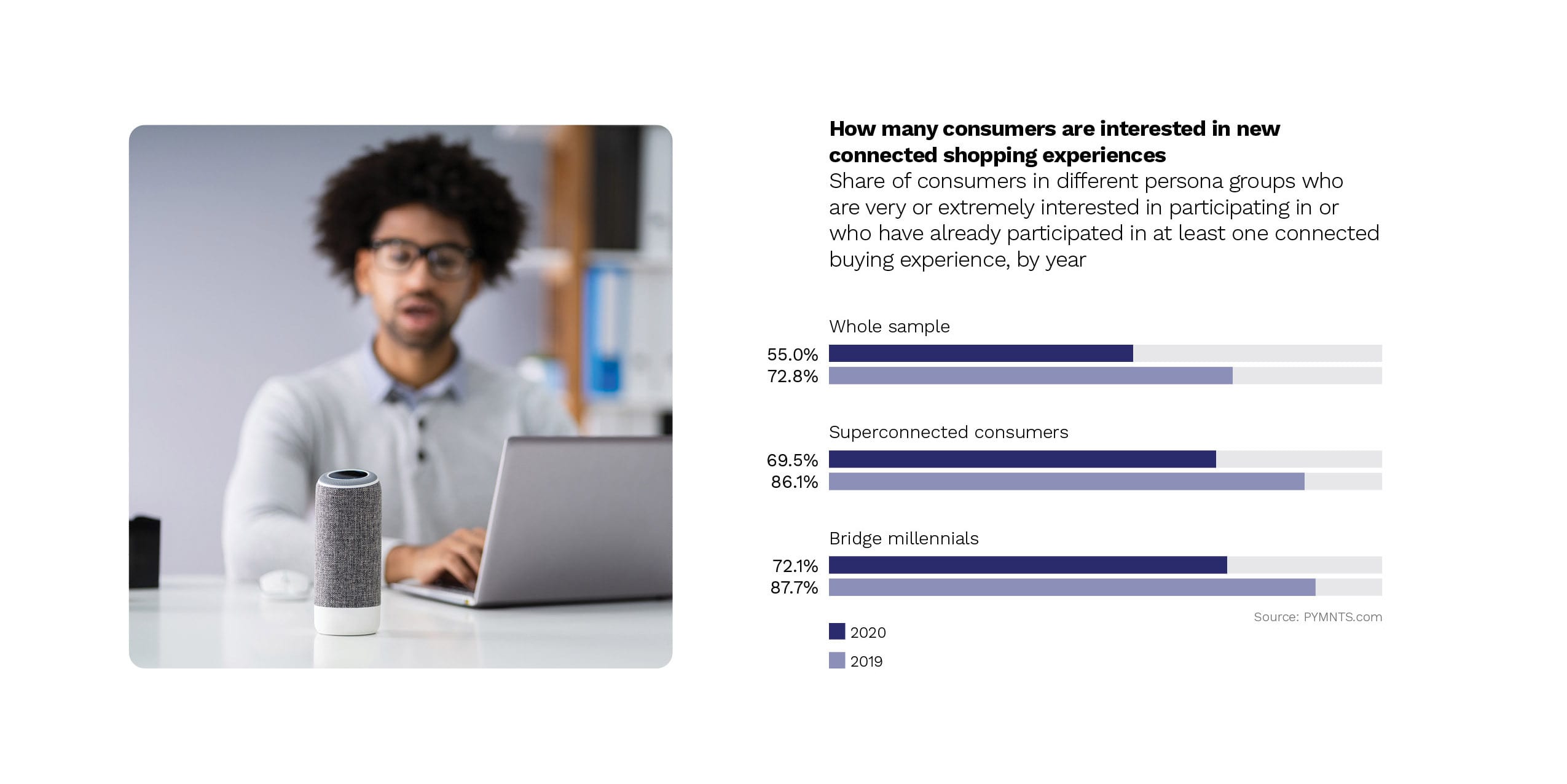

“Approximately twice as many consumers shopped for retail products from home in the summer of 2020 as they did in the summer of 2019, and three times as many grocery shopped from home this summer over last summer, too,” according to How We Will Pay. “Twenty-three million consumers, meanwhile, used voice assistants to make purchases. This means that the share of consumers making purchases who do so via voice assistant is up 42 percent since 2018 and up 10 percent since 2019.”

Connected commerce, specifically voice commerce, is obviously increasing, and How We Pay notes that, “Interest in new connected experiences is particularly high among bridge millennials and superconnected consumers for those same reasons,” adding that “both super-connected and bridge millennial consumers are 30 percent more interested than the average consumer in-store checkout experiences that use sensors to check out as they walk out, saving time.”

WFH, D2C And The Year Of The Office Shed

Reinventing how digital shifters pay necessitates a discussion of their changed shopping habits for the 360-degree view, as PYMNTS did for the How We Shop Report, in collaboration with and supported by PayPal.

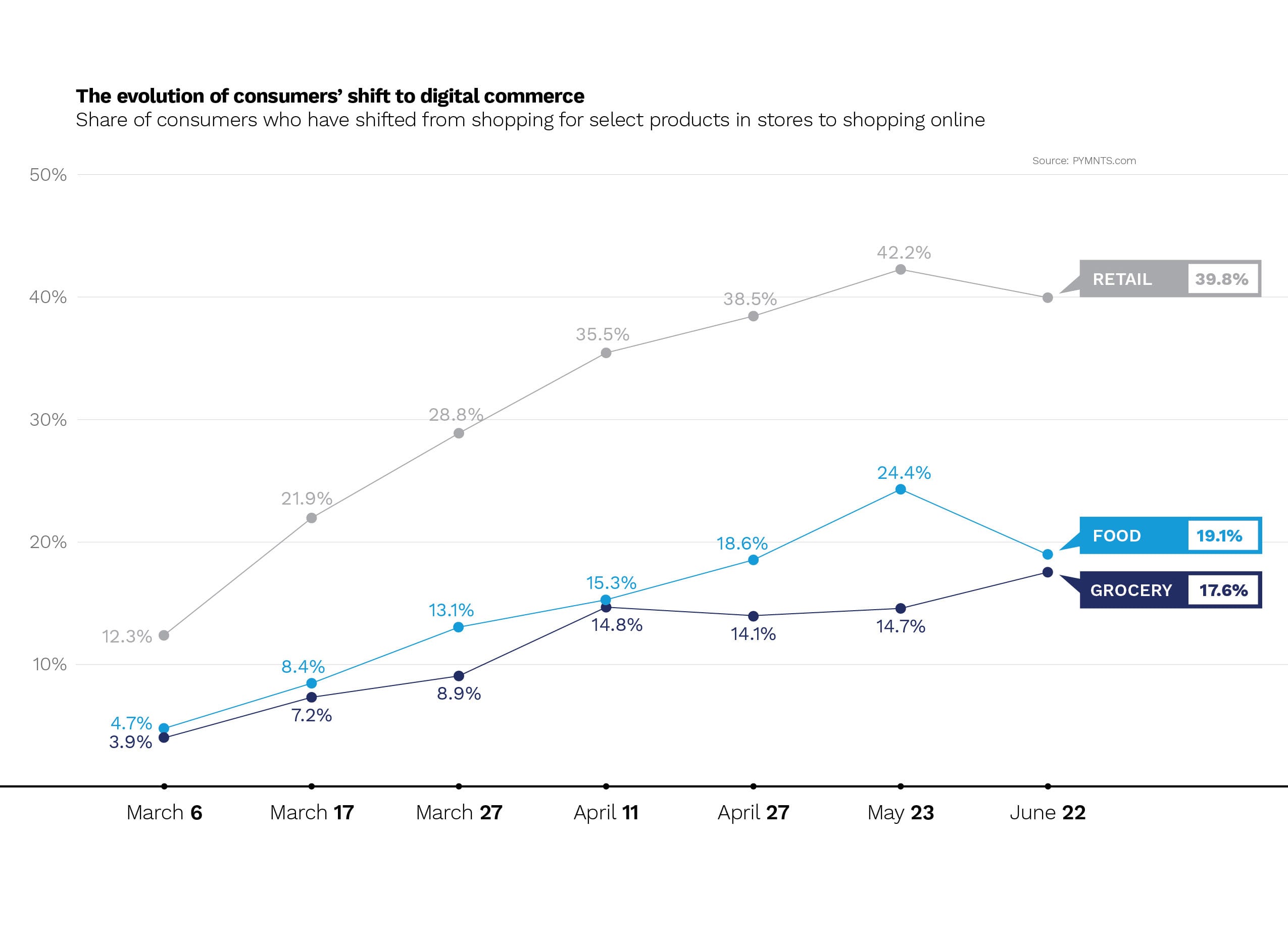

At least in 2020, we know where people are shopping. “Consumers’ propensity to shop for retail goods online has been the biggest shift. The share of consumers shopping less for retail goods in stores and more online increased 28 percentage points since March, and the share ordering from restaurants online instead of at physical locations increased 14 percentage points during the same time frame,” according to the September 2020 How We Shop Report.

As the situation with physical retail locations from giant malls to tiny Main Street shops sorts itself out, the COVID-era consumer — all four types of them, actually — can be found mostly on eCommerce sites and online marketplaces, with some contactless curbside or buy online, pick up in-store (BOPIS) thrown into the mix to keep it real.

Of digital businesses that are getting out in front of changes and new trends are direct-to-consumer (D2C) brands, who see eCommerce and the absence of physical retail as a very rare growth opportunity.

The digital-first consumer needs no additional reason to shift, but they’re getting some anyway.

PYMNTS’ latest research study, D2C And The New Brand Loyalty Opportunity, a collaboration with order management and recurring billing platform sticky.io, notes that the confluence of factors that created the COVID economy and the resulting digital shift has driven over 51 percent of consumers to make “direct purchases from new brands since the start of the pandemic,” adding that “58.4 percent of Generation Z consumers have bought new food and beverage brands during the pandemic … while 47.7 percent bought new retail product brands.”

It’s as if folks are digging in and embracing that “next normal” we keep hearing about.

On that count, among the final COVID leftovers to be dealt with will be a return to offices and the mothballing of work-from-home (WFH). Except that the average consumer is now saying that pandemic disruptions won’t end for another year, many of the WFH crowd are building office sheds in the yard.

Clearly, we’re not done shifting yet.