NEW DATA: Three Quarters of Mass Payment Recipients Would Pay to Have Choice in How They Receive Funds

As the delta variant and an increase in COVID-19 cases push health and safety concerns back into the forefront, both government entities and private employers alike are turning to new strategies to promote vaccination among their workforces.

The Dallas Independent School District in Texas announced earlier this month it would offer its teachers, custodians or other staff members a one-time $500 bonus if they showed proof of full vaccination by Nov. 1, for example.

Such incentives are hardly rare as 41 million United States consumers received bonus  wellness program payments or other incentives from their employers just in June alone, collectively totaling $31 billion in payments. Employee incentives are just one piece of a larger mass payments ecosystem, which also includes bonuses, rebates, clinical trial participation compensation and other funds.

wellness program payments or other incentives from their employers just in June alone, collectively totaling $31 billion in payments. Employee incentives are just one piece of a larger mass payments ecosystem, which also includes bonuses, rebates, clinical trial participation compensation and other funds.

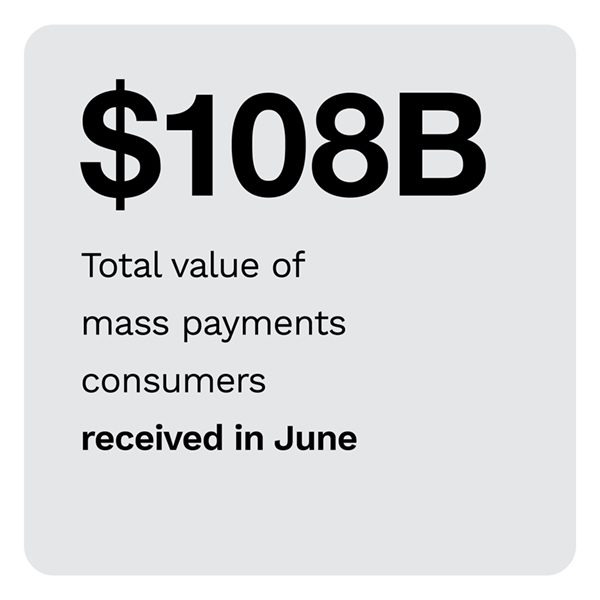

About 90 million Americans collected $108 billion in mass payments overall during the month of June, but while such payments can represent a welcome influx of funds for consumers, they do not always receive them in the way they may want or prefer. With the volume of mass payments growing — the $108 billion represents a 24 percent increase from the $88 billion consumers collected in December — this represents a key opportunity.

In The Mass Payment, a collaboration with Tango Card, PYMNTS takes a close look at how U.S. consumers receive mass payments, as well as the scale of the potential opportunity meeting their mass payment preferences could provide to employers and other entities. PYMNTS surveyed a census-balanced panel of 3,921 U.S. consumers between July 2 and July 8 to discover not only how these individuals received their mass payments, but if they did so in their preferred manner, and if they would be interested in paying fees to gain access to these funds in the way they would like.

Consumers today are not only receiving more mass payments than they were just seven months ago, but the average dollar value of such payments is on the rise as well. The average mass payment received in December was about $151.33, compared to the $157.34 recipients gained in June. This is incremental growth, but it still represents $21 billion in additional funds sent out over that time.

today are not only receiving more mass payments than they were just seven months ago, but the average dollar value of such payments is on the rise as well. The average mass payment received in December was about $151.33, compared to the $157.34 recipients gained in June. This is incremental growth, but it still represents $21 billion in additional funds sent out over that time.

Individuals are also expressing an increased desire to receive these funds in their preferred payment method, with 43 million U.S. consumers noting they would pay an added fee if they were able to gain access to their mass payments in the method they like. This figure is about 9 percent higher than those who would have paid such a fee in December, indicating choice of payment receipt is becoming more important to consumers. Americans are also leaning toward different types of digital-first payments as their method of choice when choosing how to receive mass payments, with 49 percent of all mass payment recipients claiming they would like to receive these funds through digital wallets or direct deposits if possible.

Monitoring how today’s consumers want to receive mass payments, including employee incentives, bonuses or other compensation — and more critically, how many are willing to pay to have their preferences met — may be key for firms looking to take advantage of the mass payment ecosystem opportunity.

To learn more about the status of mass payments today, download the report.