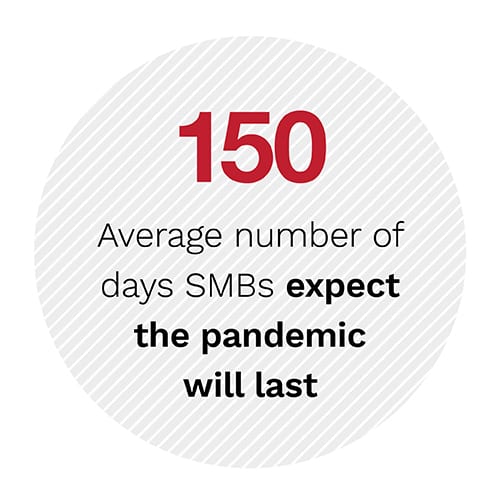

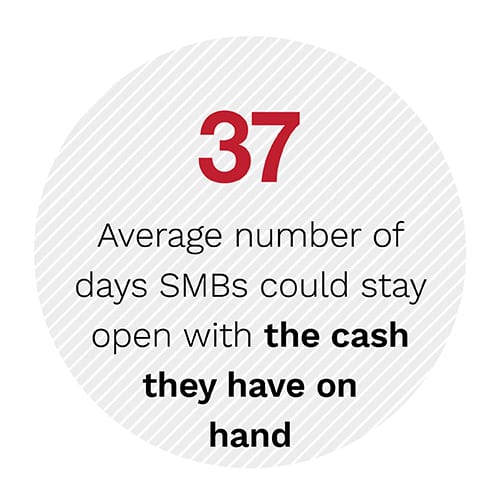

It may not be enough, though. Retail sales in the United States fell by almost 9 percent in March alone, and PYMNTS research suggests that the average SMB expects to run out of cash two months before the pandemic ends — even with government assistance.

It may not be enough, though. Retail sales in the United States fell by almost 9 percent in March alone, and PYMNTS research suggests that the average SMB expects to run out of cash two months before the pandemic ends — even with government assistance.

What measures are SMB owners taking to stay afloat when emergency funding is not enough to sustain them?

This is just one of the questions PYMNTS set out to answer in the Main Street On Lockdown: The COVID-19 Cash Chasm edition. We surveyed 502 SMBs in various sectors from across the United States to learn how much cash they have at their disposal, how long it will last them, how long they expect the pandemic to last and how they are working to close the cash gap between the two.

Our research shows that only one-third of all SMBs have already applied for loans from the Small Business Administration (SBA) as of April 6, despite two-thirds of them feeling they could run out of cash before the pandemic ends.

This is not true for SMBs in all industries, however: the share of SMBs that have applied for loans is highest in the technology industry, for example, where business owners believe government funding can make a major difference. Our research shows that 54.8 percent of technology SMB owners have applied for SBA loans. This makes sense, as the average technology SMB owner believes government aid can keep them open for 95 days and that the pandemic will last just 99 days. In other words, these business leaders believe additional funding  can all but close their COVID-19 cash gaps.

can all but close their COVID-19 cash gaps.

Advertisement: Scroll to Continue

Yet, businesses in other industries are less optimistic. How are they looking to stay in business, even as their local economies begin to collapse?

To find out more about how SMBs are working to keep their doors open as the pandemic deepens, download the report.

The Paycheck Protection Program (PPP) began accepting applications on April 3. Lawmakers and business leaders alike have high hopes for the program, believing it will help provide the funds small- to medium-sized businesses (SMBs) need to keep their operations running and their staff employed for the duration of the COVID-19 pandemic.

The Paycheck Protection Program (PPP) began accepting applications on April 3. Lawmakers and business leaders alike have high hopes for the program, believing it will help provide the funds small- to medium-sized businesses (SMBs) need to keep their operations running and their staff employed for the duration of the COVID-19 pandemic.