Two weeks into social distancing — and unfortunately it is not possible as of yet to say the end is near. As of this weekend, President Donald Trump confirmed that the nationwide social distancing guidelines put into place two weeks ago in response to the coronavirus pandemic and initially set to expire today will be officially extended for another 30 days until the end of April.

“Nothing would be worse than declaring victory before the victory is won. That would be the greatest loss of all,” Trump said. “The better you do, the faster this whole nightmare will end. Therefore, we will be extending our guidelines to April 30, to slow the spread.”

Trump, however, remained optimistic that there is a visible light at the end of the tunnel and that by June 1 the U.S. will be “will be well on our way to recovery.”

But is that prediction optimistic?

From a public health standpoint PYMNTS cannot comment. We’re not experts and refer our readers to the CDC (Centers for Disease Control), NIH (National Institutes for Health) and WHO (World Health Organization) for the most current verified health data available on the coronavirus and COVID-19.

But PYMNTS has surveyed thousands of consumers and hundreds of SMBs about their lives in the new normal — and what they believe is coming next. And that data indicates that while it is to be devoutly hoped that things will be back to normal in time for the start of summer, there is reason to temper that optimism with a fair mix of caution. Consumers are worried, that fear is showing up in their consumption patterns and the bar that will have to be cleared for things to go back to the old normal is high, according to most reports.

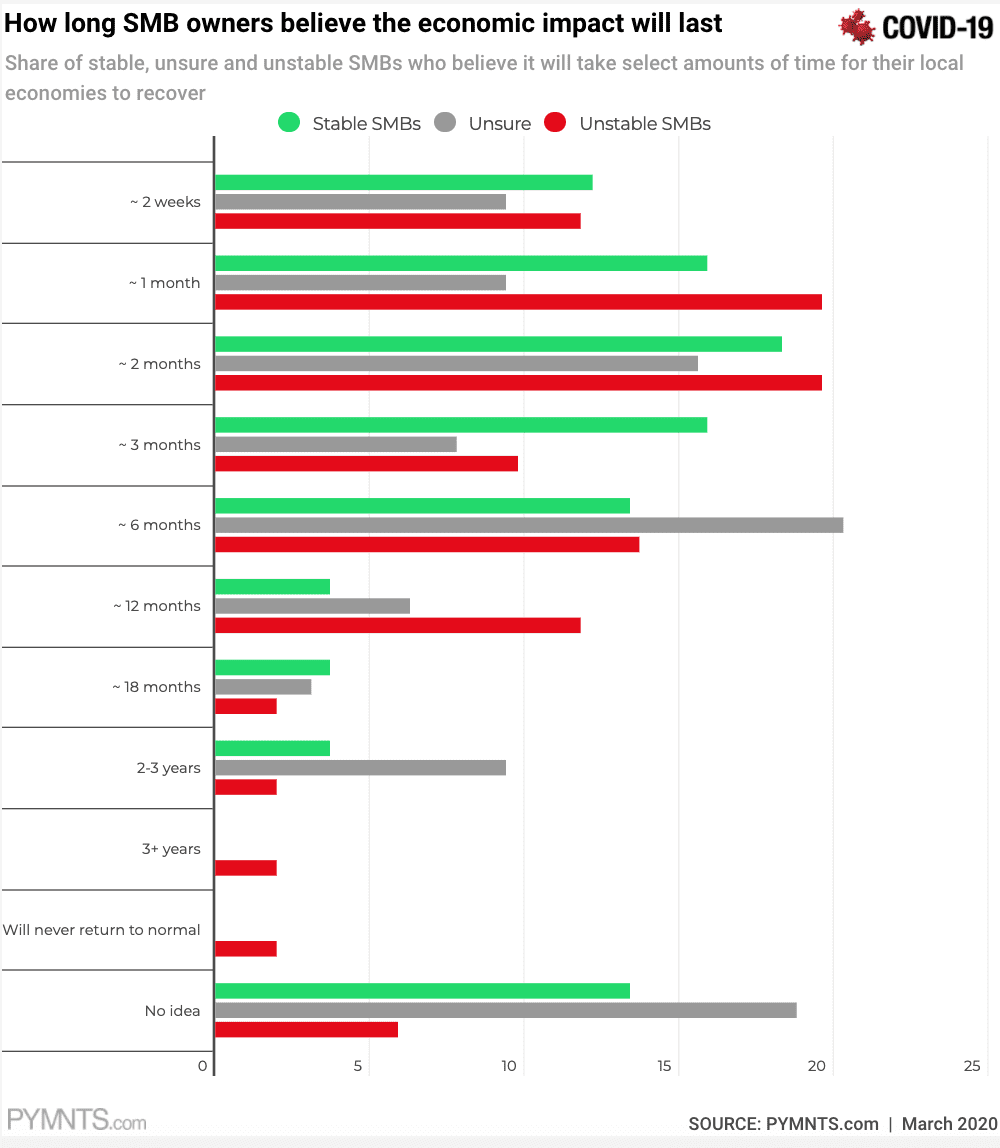

And while small and medium-sized businesses (SMBs) are doing everything they can to stay viable for the next eight weeks and be able to open up again, a majority are unsure if they’ll ever reopen, and only 37 percent report being confident that they’re going to recover from the systemic contagion COVID-19 shaped up to be.

When Consumers Will Be Ready

The effects of COVID-19 have been swiftly devastating economically as consumers have largely rewritten their routines and shopping habits overnight to adapt to the coronavirus crisis. Brick-and-mortar commerce outside grocery has ground to a screeching halt — and while online shopping has ticked up slightly, it is not coming close to picking up the slack.

According to PYMNTS research, just 25.4 percent of consumers were shopping more online and 16.3 percent were doing so more via mobile than they did before the COVID-19 outbreak. This is compared to the 22.1 percent who reported shopping online and 16.7 percent shopping via mobile less often now than before the pandemic. The largest share of both online and mobile shoppers — 41.6 percent and 32.8 percent respectively — reported no change at all. And given that last week unemployment filings set a new record, with another record-breaker forecast for this week, it is not unreasonable to infer that those spending numbers might fall more before they increase as Americans’ financial positions become more precarious.

And, according to PYMNTS data, almost half of all consumers (46.4 percent) reported that the event most likely to get them back to their normal work routines was the development of a treatment or vaccine for COVID-19. A vaccine, notably, was the preferred choice with 31.7 reporting showed that 31.7 percent believed a vaccine must be made available before their work lives could return to normal, for example, and 26.6 percent felt the same before they could return to their normal leisure activities outside the home.

Given that those medical advances on the most optimistic timelines are six to 18 months in the future, that could have profound effects on SMBs that after approximately three weeks of an economy slowly spinning down are already feeling pushed dangerously close to the brink.

What It will Mean for SMBs

As Karen Webster pointed out in her commentary this week, in PYMNTS conversations with roughly 200 SMBs running across verticals and sizes the concern is real, deep and in many cases heartbreaking. Firms dotting main streets across America that started the year with every reason to be enthusiastic about the next 12 months are finding themselves fighting tooth and nail to survive the COVID-19 pandemic.

A little over a quarter, or 26 percent, don’t believe they will survive the pandemic at all, while a third (33 percent) are unsure about their future.

And even among the 37 percent that think they are going to make it, many don’t think they are going to emerge healthy on the other side.

The most confident guess that recovery will take 141 days — about 4.5 months. Those least optimistic say it will be 224 days — about 7.5 months. And the fight to stay open has necessitated hard choices, and deep cuts. According to PYMNTS research, 29.4 percent of all SMBs we surveyed said they closed their doors temporarily, 27 percent asked their employees to work fewer hours, 8.6 percent reduced employee salaries and 22.3 percent laid off their workforce. And the less certain businesses are of their future — the 27 percent that believe they will not be able to reopen — the more likely they are to have made the deepest cuts, being twice as likely to cut employee wages (15.7 percent) than either those businesses that are unsure about their future or those that are confident in their survival.

Congress passed a $2 trillion stimulus package on Friday (March 27) that includes $350 billion being allocated to SMBs — which Webster noted might be enough of an influx of funds to pull businesses back from the brink if those funds can get flowing quickly enough into the right hands.

It won’t be enough to save every business — some are already too far past the point of no return after a few weeks to ever recover. They will simply be a casualty of COVID-19.

“But hopefully, enough money will flow quickly to enough SMBs — the ones that lend character to our cities, towns and Main Streets — so that when consumer demand comes back, they’ll be ready,” Webster wrote.

As for when that consumer demand will return — that’s another known unknown. But for all the data in the PYMNTS report that indicates it might be a bit of a wait before broad-spectrum confidence returns, the data also shows that nearly two-thirds of consumer believe things will return to normal — and fairly soon. Within three months to be specific.

The challenge of the next two weeks will be keeping the SMBs that employ the majority of those consumers stable enough so that optimism has some chance of paying off when the public health battle has been won.