Merchants Seek Bottom-Line Benefits From Credit Card Surcharges

Legal obstacles to surcharges on credit card transactions have been dropping for much of the past decade as courts continue to rule that the surcharges are permissible. This is good news for merchants looking to increase their income by a few percentage points and cover their card processing costs, but other obstacles remain, including consumers’ aversion to paying surcharges.  Recent PYMNTS data found that there is an opening for merchants, however: Most consumers, when faced with a surcharge at the point of sale, will tend to pay it with relatively minor damage to their satisfaction with the merchant.

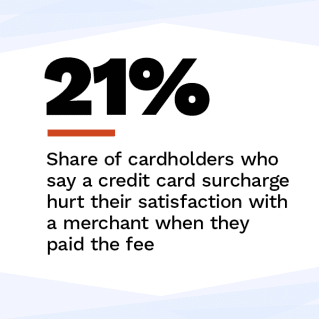

Recent PYMNTS data found that there is an opening for merchants, however: Most consumers, when faced with a surcharge at the point of sale, will tend to pay it with relatively minor damage to their satisfaction with the merchant.

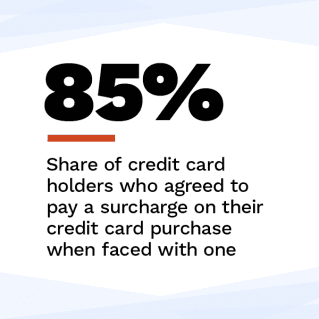

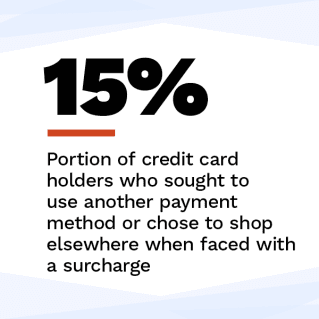

The merchants that best manage customers’ awareness of and opinions about surcharges will be well situated to maximize the revenue such fees generate. Despite the opposition most cardholders express toward surcharges, 85% of credit card users pay these fees when facing them. Cardholders in that situation find another payment method just 14% of the time and will leave the store only in rare instances. Our data indicates that merchants will need the right approach to reap the benefits from surcharges without compelling customers to switch their business to other merchants.

These are just some of the key findings in Credit Card Surcharges: What Merchants Can Do To Maximize Income, a PYMNTS and Payroc collaboration that describes how merchants can maximize their benefits and limit the customer fallout from the card surcharges. We surveyed 2,507 U.S. credit card users from Dec. 8 to Dec. 22, 2021, about the impact of surcharges on their card usage and whether the fees led them to use another form of payment — or pushed them to take their business to another store or restaurant to avoid the extra cost.

Some additional key findings include:

• Approximately 9% of cardholders who used their cards at restaurants or retail stores in the past month were asked to pay surcharges on credit card transactions. Cardholders tend to agree to pay surcharges, although the type of establishment impacts the rate of acceptance. When a customer is determined to avoid the surcharge, the merchants that offer a sufficient number of payment alternatives increase the likelihood they will retain the customers’ business.

• Thirty-seven percent of all credit card holders have knowingly paid surcharges on card purchases. Another 20% paid surcharges but did not realize they had done so until they reviewed their receipts or account statements. Cardholders who know what is happening are generally willing to go along with the surcharges.

• Seventy-one percent of cardholders who have not had to pay a surcharge when making a purchase, or do not know if they paid one, say surcharges would decrease their satisfaction with a merchant. But most of these cardholders, when faced with surcharges, tend to accept the extra fee.

• Seventy-one percent of cardholders who have not had to pay a surcharge when making a purchase, or do not know if they paid one, say surcharges would decrease their satisfaction with a merchant. But most of these cardholders, when faced with surcharges, tend to accept the extra fee.

Merchants need to compensate for consumers’ stated antipathy toward credit card surcharges if they are to get the most significant benefit from them. PYMNTS data found that 58% of cardholders say they will avoid card surcharges if faced with the prospect of paying them, but the reality is that surcharges are imposed on less than 10% of card purchases and that consumers pay them in 85% of those instances. Merchants that work to maintain good relationships with their customers can reap the extra income from surcharges with little disruption to their business.

To learn more about how merchants are maximizing their benefits from credit card surcharges, download the report.