In today’s economic landscape, steep interest rates and increased borrowing costs have made accessing credit more challenging. This economic reality is causing heightened concern among consumers, particularly among younger generations.

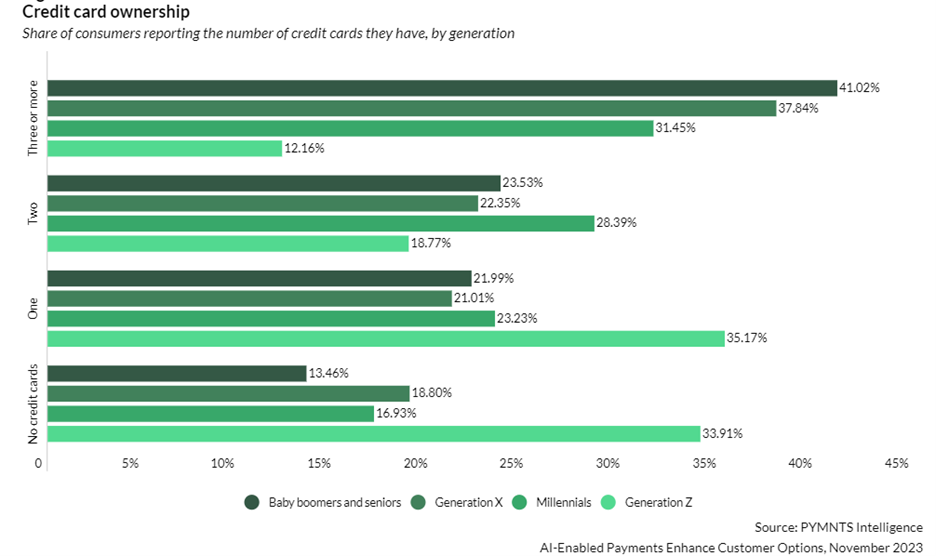

Examining credit card use sheds light on this concern, as 12% of Generation Z consumers report owning three or more credit cards. That’s a stark contrast to the 41% reported by baby boomers and seniors, data from PYMNTS Intelligence shows. Additionally, 35% of Gen Zers have just one credit card, while 34% do not possess any credit cards.

Millennial and Gen Z consumers are also the most likely age groups to use noncard credit products for their most recent purchases. This is supported by the fact that, among the generations tracked by PYMNTS, these two cohorts displayed the lowest credit card use in the 90 days prior to March.

Against this backdrop, younger consumers are veering away from credit options and favoring noncard credit alternatives in response to worries about interest rates, fees and overspending.

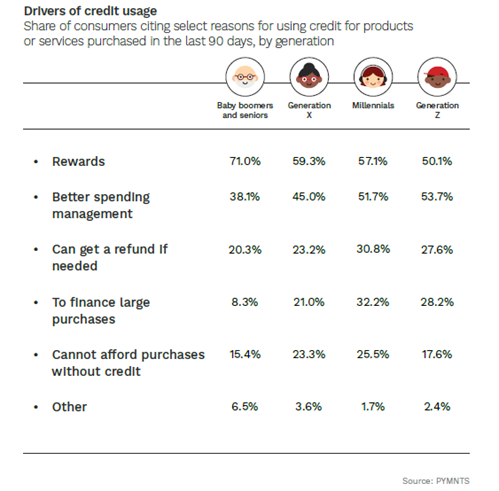

The data shows that Gen Z consumers, for instance, are the most likely to use credit products or services to better manage their spending and cash flow, at 54% — the highest share across all age demographics. Millennials come second at nearly 52%. In contrast, 45% of Generation X consumers and 38% of baby boomers and seniors prioritize the same.

The fact that millennial and Gen Z consumers are the most likely to have increased their use of credit products in the last year further “suggests finding ways to better manage their spending is increasingly important,” per the study.

Artificial intelligence (AI) has the potential to reshape how younger generations view credit, playing a role in encouraging them to adopt a more receptive approach toward credit tools.

Per findings detailed in the study “AI-Enabled Payments Enhance Customer Options,” a PYMNTS Intelligence and ACI Worldwide collaboration, younger consumers are more open and familiar with AI compared to older generations, with 65% of Gen Z considering themselves very or extremely familiar with AI and nearly 50% stating that AI technologies play a prominent role in their daily personal activities. Millennials also exhibit strong familiarity with AI, with 51% considering themselves very or extremely familiar with the technology.

This adoption of AI among younger consumers offers a strategic window to harness the technology in reshaping their reservations about using credit. As the study noted, the technology could help younger consumers identify the most suitable payment methods that align with their goals, even if these options are typically met with hesitation within this demographic.

For instance, AI-powered financial management apps can provide real-time insights into spending habits, helping young individuals make more informed decisions about their purchases and credit use.

Moreover, AI-driven predictive analytics can offer personalized recommendations for suitable credit options, suggesting a tailored credit card with lower interest rates or benefits that align with a young user’s spending patterns, for example. Additionally, AI-enabled budgeting assistants can help younger consumers in setting and tracking financial goals, offering proactive alerts and nudges to stay within budgetary limits.

Startups like Credit Sesame using AI-driven simulations and educational content can help young users understand credit and financial concepts through interactive tools and games. Earlier this year, the firm launched a credit-building debit card to help individuals build and enhance their credit scores through their everyday debit purchases.

AI tools can enhance financial literacy and empower individuals to navigate credit more responsibly while gaining better control over their finances and ultimately overcoming their hesitations about accessing credit.

For all PYMNTS AI coverage, subscribe to the daily AI Newsletter.