It’s the $1 trillion milestone.

The Federal Reserve’s latest quarterly update on household debt shows that credit card balances crossed that milestone in a “first” that shows just how prevalent and preferred the payment method has become.

But: As of yet, even as balances are rising, delinquencies seem to be manageable.

The data show that credit card balances increased by $45 billion in the second quarter of 2023, as measured against the first quarter. Digging into the report, credit card debt increased at a 4.6% quarterly pace.

“Credit card balances saw the most pronounced worsening in performance in [the second quarter] after a period of extraordinarily low delinquency rates during the pandemic,” per the report. Aggregate delinquency rates were roughly flat in the second quarter of 2023, the central bank reported “and remained low.” As of June, 2.7% of outstanding debt was in some stage of delinquency, 2 percentage points lower than the last quarter of 2019, just before the pandemic hit.

No Distress?

And elsewhere, “despite the many headwinds American consumers have faced over the last year — higher interest rates, post-pandemic inflationary pressures, and the recent banking failures — there is little evidence of widespread financial distress for consumers,” the Fed noted in a blog.

Advertisement: Scroll to Continue

There were puts and takes in terms of other debt, as student loan balances declined by $35 billion to $1.57 trillion, in part to the impact of some forgiveness programs. Auto loans were up $20 billion to hit just under $1.6 trillion.

In a separate release, the Fed noted that overall revolving debt increased at a 7.1% annual rate in the most recent quarter, and the pace quickened into the end of the quarter, where during the month of June, the annual pace was 6%.

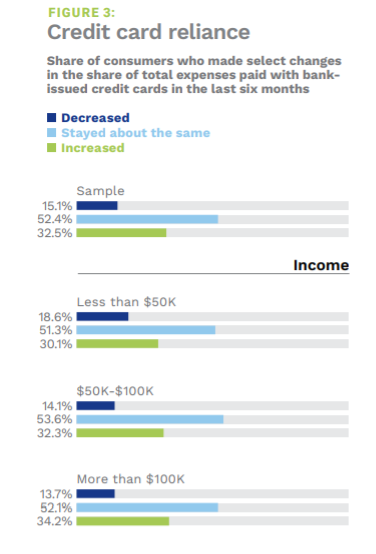

The latest PYMNTS Paycheck to Paycheck report notes that 74% of households surveyed have credit card debt. Other PYMNTS reports have found 55% of consumers are revolving their credit card debt, with a third of consumers increasing their spend on credit cards through the past several months as seen in the accompanying chart. A full 43% of Gen Z and millennial consumers have been shifting more of their spending onto their cards to get the goods and services they need on a daily basis.

There’s a broad range of credit card usage when linked to income level, per the households we’ve surveyed. Low-income consumers — those earning less than $50,000 per year — are more likely to consistently revolve their credit card balances, with 40% doing so. For the consumers who earn more, credit usage declines a bit. As many as 24% of those earning more than $100,000 per year revolve their balances.

Though the Fed contends there are no signs of widespread financial distress, millennials stand to lose as much as 6.5% of spending power when student loan payments resume later this year. The pressure may be on, headed right into the holiday spending season, and as credit card debt obligations increase in the meantime.