In a world where managing finances has become a challenge, it is important to explore strategies to avoid accumulating debt and prevent overspending. An effective tactic adopted by consumers is abstaining from credit card ownership, a recommendation corroborated by findings in the “New Reality Check: The Paycheck-to-Paycheck Report — The Credit Card Use Deep Dive Edition.”

The report, a collaboration with LendingClub reveals that despite a drop in inflation, a significant portion of consumers continues to live paycheck to paycheck. As of November, 62% of consumers fell into this category, with 20% struggling to pay their monthly bills.

Interestingly, consumers living paycheck to paycheck own nearly 60% of credit cards in the United States. This suggests that a large share of individuals who are already facing financial challenges are relying on credit cards as a means to manage their finances.

Furthermore, the report highlights that financial distress does not necessarily correlate with poor creditworthiness. In fact, 40% of consumers living paycheck to paycheck and struggling to pay their bills have super-prime credit scores, suggesting that even individuals with seemingly good credit can find themselves in a precarious financial situation.

While credit cards are commonly used by consumers to manage their cash flows, the report emphasizes that financial distress is associated with a higher frequency of reaching credit limits and carrying balances from month to month. Paycheck-to-paycheck consumers are more likely to value features such as higher credit limits and split payment plans when choosing a credit card.

The correlation between financial distress and credit card usage is further evident in credit limits and revolving balances. The report shows that paycheck-to-paycheck consumers with issues paying bills are more likely to hit their limits and revolve their balances. This indicates that relying heavily on credit cards can exacerbate financial strain and lead to debt accumulation.

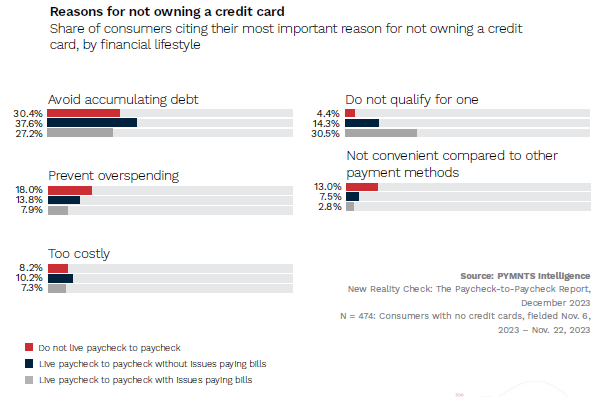

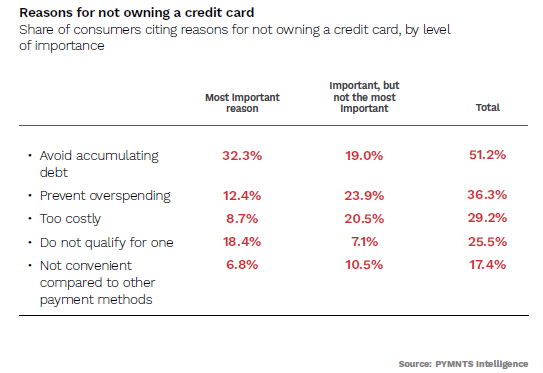

The report also sheds light on the reasons why some consumers choose not to own credit cards. Concerns about accumulating debt and preventing overspending are the top reasons cited by non-cardholders. Specifically, 51% expressed a desire to avoid accumulating debt, while 32% identified this as their primary reason for not owning a credit card. Interestingly, only 26% mentioned not qualifying for a credit card as a deterrent.

Overall, the report findings highlight that despite offering financial flexibility, refraining from credit card ownership is an effective strategy for consumers, particularly those living paycheck to paycheck, to sidestep debt accumulation and control overspending.

By prioritizing financial wellness and adopting responsible spending habits, these consumers can steer clear of the debt pitfalls often linked with overreliance on credit cards, ensuring greater control over their finances.