Although there are challenges to their widespread adoption, white-label store cards can benefit both consumers and merchants. For this reason, merchants should explore how to use these solutions further.

In considering what type of white-label store card to pursue, merchants have two options. The first is private label, meaning that the store card can be used only at that specific retailer’s locations. Co-branded cards are the second type, which consumers can use at various merchants on the same network. Both types come with advantages.

Perks Drive Consumers to Store Cards

On the consumer side of the equation, store cards can come with a variety of benefits. For example, consumers with lower credit scores are often more likely to be approved for store cards than general-purpose cards. If these consumers are careful with their spending and diligent in paying off their balances, store cards can help them build better credit scores.

Indeed, a PYMNTS report found that many consumers using store cards reported doing so because they believed these cards made it easier to track payments as well as make larger purchases. The report also found that many consumers who paid with store cards did so because payment was comfortable and fast.

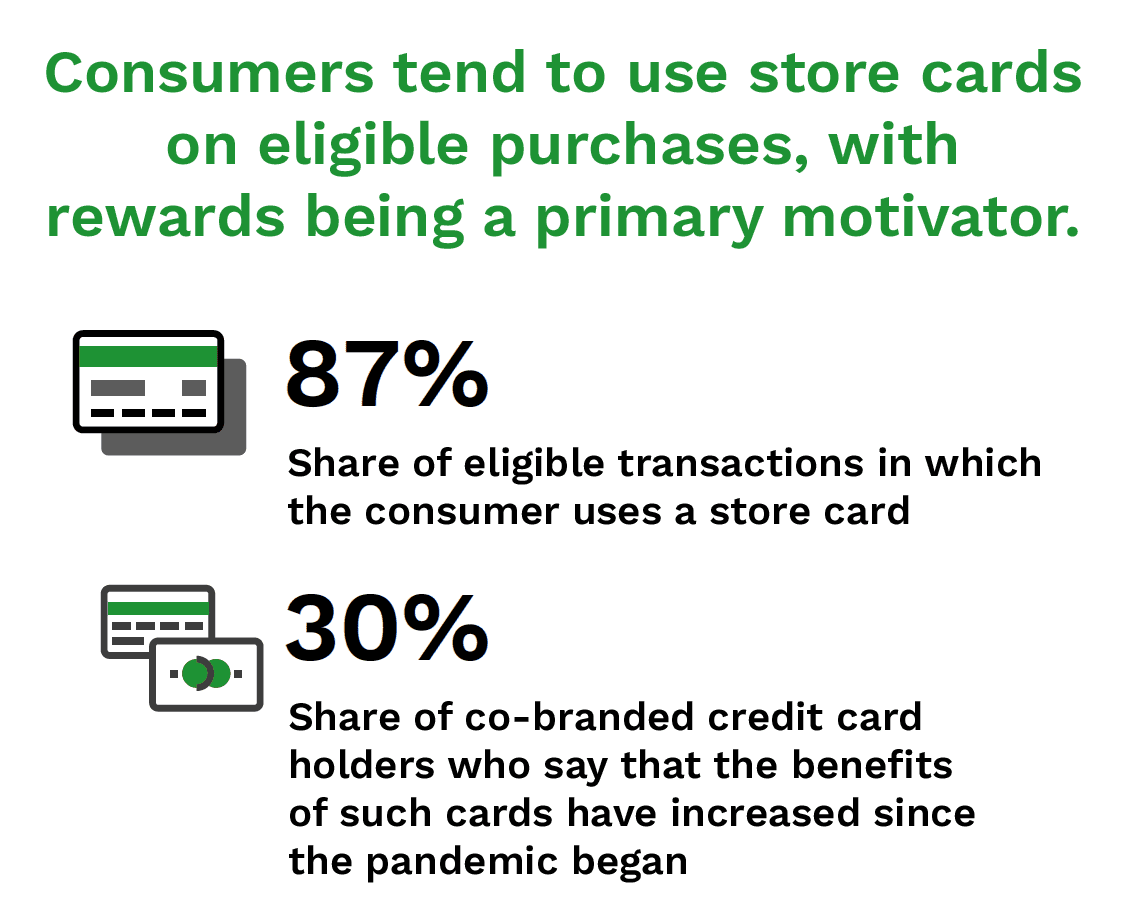

One of the biggest appeals of store cards is that they typically provide shoppers with exclusive rewards, discounts and other perks. PYMNTS found that 42% of consumers who used store cards reported doing so because it earned them more rewards than other methods. Interestingly, the draw of rewards may be getting stronger. According to a PwC survey, 30% of co-branded credit card holders said the benefits or rewards were more valuable now than before the pandemic. It is no surprise, then, that consumers with store cards use the cards 87% of the time when they can, according to PYMNTS data.

Merchants Can Realize Revenue Gains

The fact that store cards can be so appealing to consumers is good news for merchants. Both private-label and co-branded cards present merchants with an opportunity to build customer loyalty, which, in turn, can help drive revenue. PYMNTS found that nearly one-third of consumers will spend more with brands with which they have relationships.

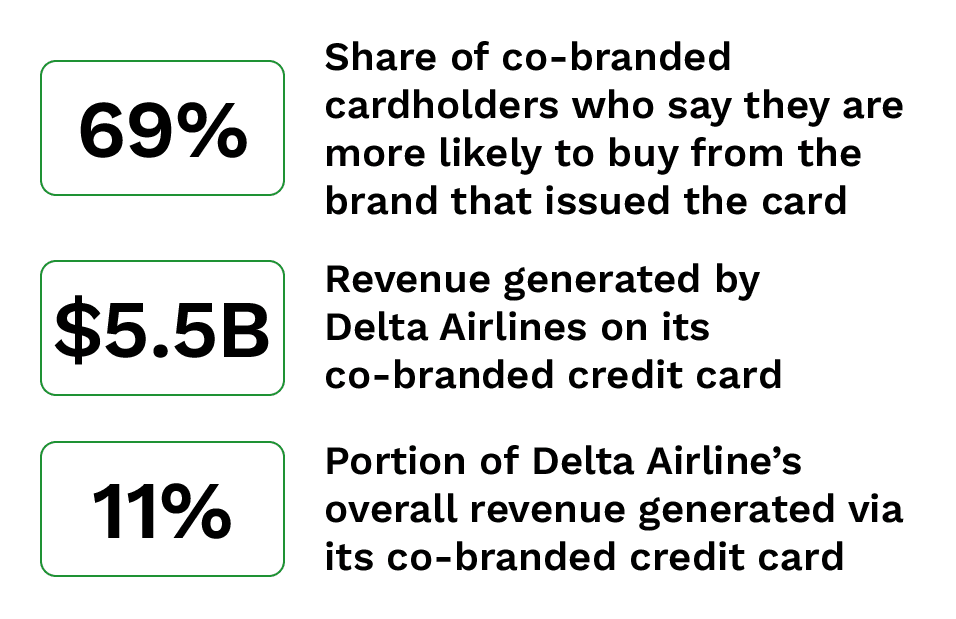

Since private-label cards can be used only at a specific retailer, consumers have an incentive to shop at that retailer more often. The same is true of co-branded cards, even though consumers can use these cards at other retailers in the network. In a PwC survey, 69% of co-branded cardholders said they are likely to buy from the brand that issued the card, and nearly one-third said they were very likely to do so. Delta Airlines, for example, generated $5.5 billion — 11% of its total revenue — from its co-branded credit card alone.