Credit cards have become more than just a means of payment. With the rise of travel credit cards, consumers now have the opportunity to earn rewards and benefits while making everyday purchases like groceries, restaurants or gas. Some of the most common perks include free travel tickets, discounted baggage fees, rental car discounts or free travel insurance. These perks can be particularly valuable for frequent travelers or those who take a few trips a year, but PYMNTS Intelligence research has found that they are especially so for travelers with children.

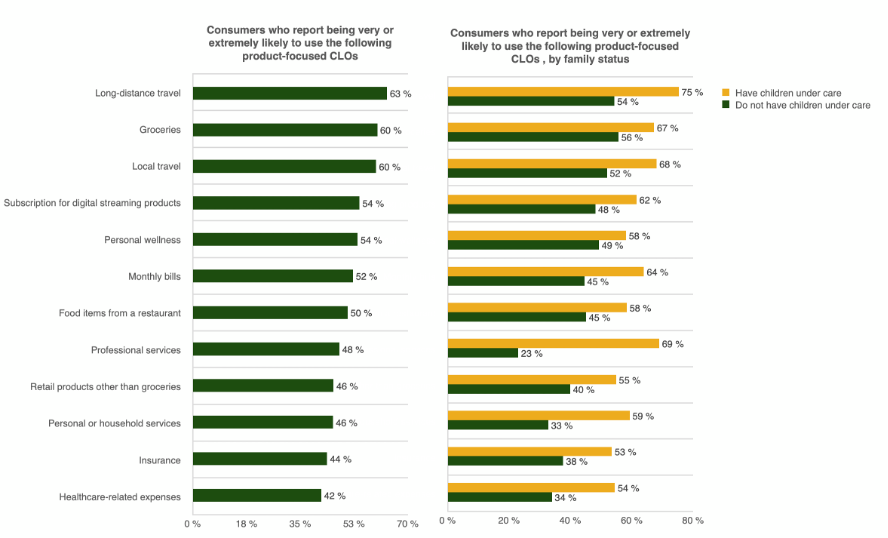

“Leveraging Item-Level Receipt Data: How Merchants Engaged Holiday Shoppers With Card-Linked Offers,” a PYMNTS Intelligence research study in collaboration with Banyan, reveals that nearly 64% of consumers are likely to use card-linked offers (CLOs) for local travel purchases in the next three months, while 60% plan to do the same for purchases related to long-distance travel. This indicats travel is a top consumer choice when using CLOs, exceeding other categories like groceries, streaming subscription services or personal wellness.

The intention to use CLOs is even higher among those consumers with children under care, specifically, 38% higher for long-distance travel and 30% for local travel benefits. All these figures highlight the potential of travel industry merchants to enhance customer loyalty through personalized CLOs that align with customers’ needs that can be enjoyed with their family members.

The PMYNTS/Banyan study revealed that nearly 6 out of 10 cardholders were interested in switching to a merchant that participates in specific CLOs for their holiday shopping. So, offering relevant CLOs is paramount to retain customers. In this regard, Eric Dean, head of platform partnerships at Banyan, told in an interview in July that receipt-level data help improve the precision of merchants’ card-linked offers so that the latter can target consumers by spending vertical or even specific products. “Customized, contextual card-linked offers,” he told PYMNTS, “can improve the returns on investment and profitability within and across all channels of commerce — online and offline.”

He also explained that flexibility must govern marketing programs as merchants and financial institutions seek to improve customer engagement and extend life-time-value. “Flexibility might indeed be the top of the list”, he said. “the one thing that can help firms shift as needed to serve customers where they want to be met, and when.”

Within the travel industry, one of the companies that seems to take flexibility of their rewards program seriously is Delta Air Lines. In September, the company announced modifying its frequent flier program in response to negative feedback from customers. The company recognized it had gone “too far” with the changes announced in the rewards program a few weeks earlier. The changes shifted the criteria for earning frequent-flier status and limited Sky Club access for credit card holders. Travelers expressed their dissatisfaction through online travel forums, social media and direct messages to the company, forcing Delta to redefine its strategy.