Card-linked offers — promotions intended to entice consumers to use their credit and debit cards — are incredibly popular with consumers. That is, once they use them. According to PYMNTS Intelligence’s report “Card-Linked Offer Growth Hinges on First-Time Users,” after their first experience with card-linked offers, 93% of cardholders say they plan to leverage them again in the near future.

However, the report, a collaboration with Banyan based on a survey of more than 2,100 U.S. consumers, found that 73% of those consumers who have never used card-linked offers in the past say they are either only slightly familiar or completely unfamiliar with these programs.

In fact, 34% of consumers in general say they have never heard of card-linked offers, and 25% of non-users say that either they do not understand how the offers work or are uncomfortable using them.

Consumers who are not currently using card-linked offers say two key factors would prompt them to consider using them: familiarity with the programs and getting offers relevant to their needs. Notably, non-users say they are open to these offers if they can spot them in the first place: 16% say greater visibility is the most important factor to initiating card-linked offer use.

These findings underscore the need to educate consumers about card-linked offers and the potential value they deliver. Education alone is not enough. Providers must make sure the offers are relevant to the cardholders to highlight their value. Thirty percent of non-users say that the offers they receive do not speak to them.

What is the best way to notify consumers about the card-linked offers, the value they can provide and their relevance?

Advertisement: Scroll to Continue

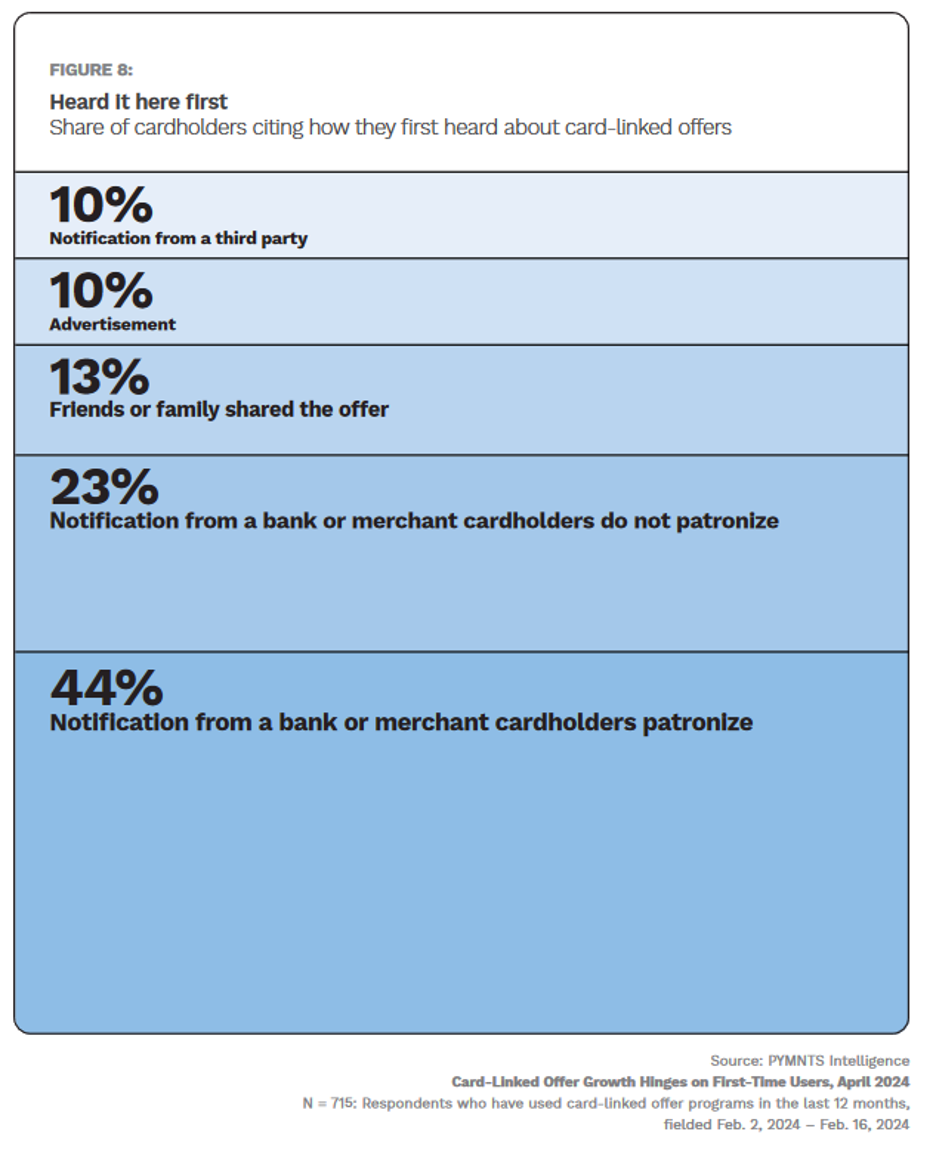

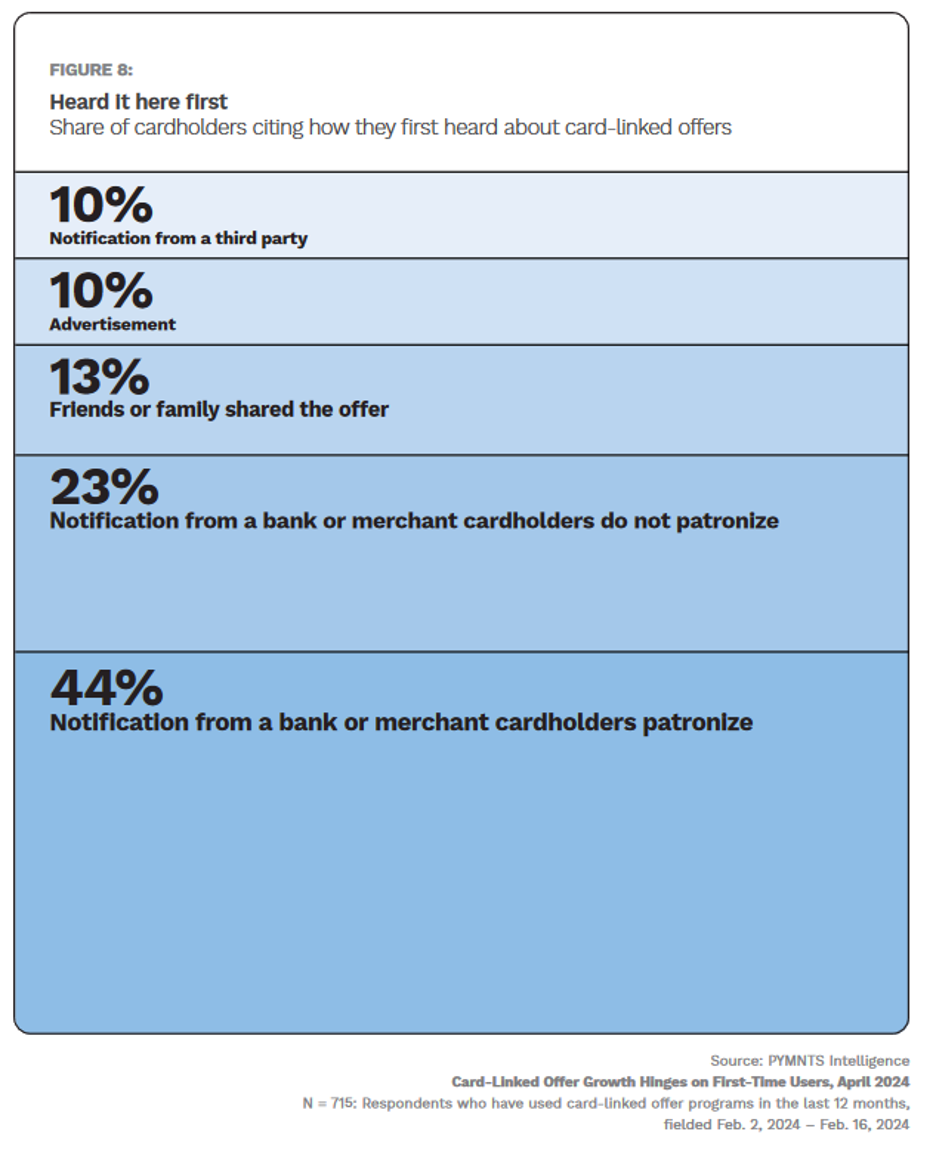

Who the messenger is and how trusted that messenger is appears to play an important part in getting consumers interested in card-linked offers.

Forty-four percent of cardholders told us they first learned about card-linked offers either from their primary financial institution (FI) or from a merchant they frequently patronize — in other words, messengers whom they trusted. And, because consumers are also likely to put stock in the recommendations they receive from their inner circle, another 13% of cardholders credited friends or family members for bringing card perks to their attention. Meanwhile, advertisements and third-party notifications touting card-linked offers resonated the least with cardholders, we assume because there was no trust factor.

Because nearly all card-linked offer users say they plan to continue using them in the future, it’s imperative that merchants and FIs inspire consumers to take that first step. And if that inspiration comes from trusted sources who explain their value and relevancy? Those providers may see an uptick in both card-linked offer usage and overall customer satisfaction.