While some of these consumers who do not have a credit card are wary of credit, most also know that secured credit cards can be part of a comprehensive strategy to build credit, achieve financial stability and manage emergencies, according to the PYMNTS Intelligence report “Decision Guide: Engaging Consumers Interested in Secured Credit Solutions.”

Financial institutions can convert these consumers by positioning secured credit cards as part of a consumer’s comprehensive credit strategy and by providing transparent terms, personalized offerings and strong customer support, the report said.

A Potential Market of 53 Million

Fifty-three million U.S. consumers do not have a credit card, the report found.

PYMNTS Intelligence identified four common personas among these consumers.

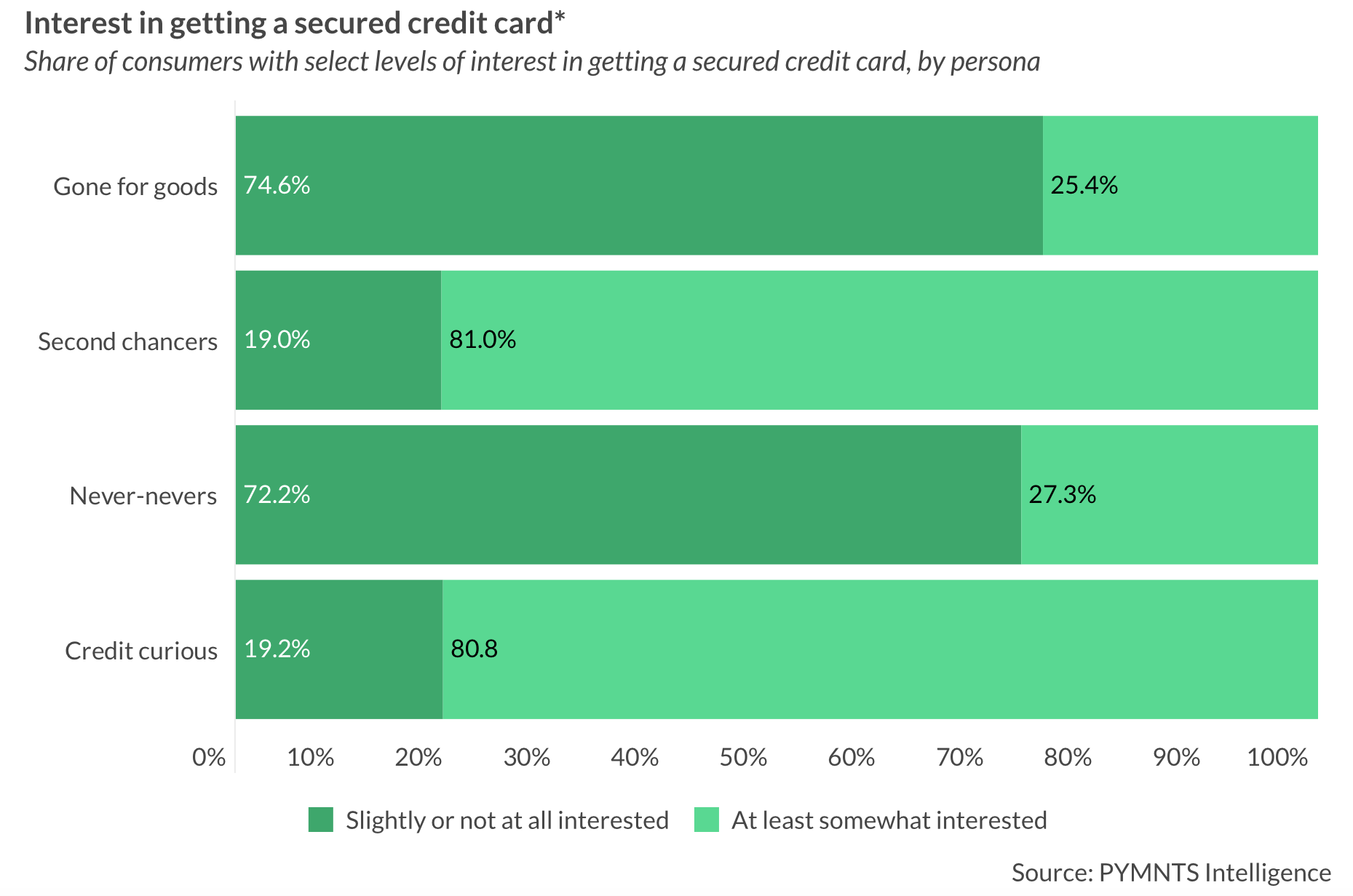

These personas include the “second chancers,” who previously had a credit card but may have encountered financial difficulties in the past; the “credit curious,” who have never had a card; the “gone for goods,” who used to have a card but are no longer interested in having one; and the “never-nevers,” who have never had a card and have no interest in getting one.

Advertisement: Scroll to Continue

An Interest in Long-Term Goals

Eighty-one percent of second chancers and the credit curious are at least somewhat interested in obtaining a credit card.

Even those who are more wary of credit said some factors make them interested in getting a credit card.

Over 50% of the consumers in each of the four personas said they would like to have a credit card available in case of an emergency.

Over 40% are interested in a card that would help them build credit and improve their credit score.

With one exception, over 40% of the consumers in these personas would like to have a credit card so that they could pay for purchases over time. Among gone-for-good consumers, however, only 34% are interested in getting a card for that reason.

A Common Strategy for Outreach

Because of these commonalities among the four personas of consumers who do not have a credit card, financial institutions can capitalize on this interest by offering secured cards as a way to gain these benefits while also having protective guardrails.

With these tools, financial institutions can become partners in helping consumers embark on a comprehensive credit strategy.

That is a message that will resonate with a large share of the consumers who are currently credit card outsiders.