However, their popularity doesn’t come close to that of general-use credit cards, which are owned by 68% of consumers.

These are key data points in the PYMNTS Intelligence study “The Role of Strategic Partnerships in Consumer Credit Cards,” which examined the unique role co-branded and store cards play in the average consumer’s shopping habits.

Additional PYMNTS Intelligence data not included in the released report suggested that the appeal of co-branded and store cards appears to be inching upward, perhaps to a degree that may start turning the tide.

How do co-branded and store cards differ from general-use cards? All prominently display the issuing company’s logo and brand name; however, general use and co-branded credit cards offer a wider reach and can be used anywhere that participates in the issuing card’s network. Store cards, meanwhile, can only be used for purchases at the merchant displayed on the front of the card.

The report — based on survey responses from more than 3,800 U.S. consumers — found that 27% of U.S. consumers own a co-branded credit or store card and, in most cases, these specialized cards are used for lower shares of their monthly spending.

Advertisement: Scroll to Continue

But the popularity and use of co-branded and store cards appears poised for an uptick.

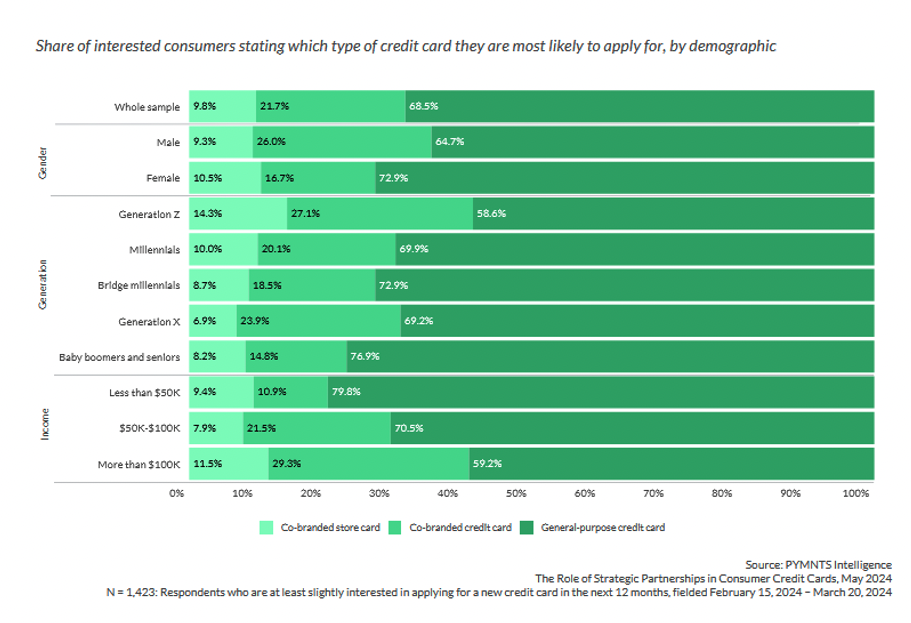

According to exclusive additional PYMNTS Intelligence research, 32% of consumers who are interested in applying for another credit card said their next credit card application will likely be for a co-branded or store card. This enthusiasm is particularly high for men, 35% of whom said they will most likely apply for a specialized card next. Only 17% of women said the same.

Generation Z shoppers appear to be especially eager to make their next credit card a co-branded credit or store card, with 41% saying they will most likely apply for one of the two card types. That enthusiasm is mirrored by consumers who earn more than $100,000 annually, as 41% said they will likely apply for a co-branded or store card next.

Generation Z shoppers appear to be especially eager to make their next credit card a co-branded credit or store card, with 41% saying they will most likely apply for one of the two card types. That enthusiasm is mirrored by consumers who earn more than $100,000 annually, as 41% said they will likely apply for a co-branded or store card next.

The popularity of these cards can be traced back to several key features. While consumers said they like that co-branded credit and store cards typically come with attractive interest rates and low or no annual fees, their biggest appeal is the perks that come from using the cards. Thirty-four percent of consumers said loyalty and rewards are the top reason they use store cards, while 38% said the same about their co-branded credit cards. Meanwhile, only 18% said loyalty perks drove their use of general-purpose cards.

The popularity of general-purpose cards will likely not be fully eclipsed anytime soon by co-branded and store cards, but PYMNTS Intelligence data indicated that consumers recognize their value. As perks and discounts remain in style, co-branded credit and store-card providers are in a unique position to take advantage of their growing popularity.