Credit union (CU) customers are more than just customers: They are members of a wider community.

Credit union (CU) customers are more than just customers: They are members of a wider community.

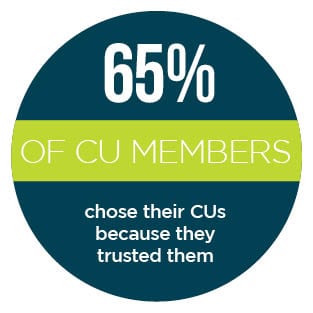

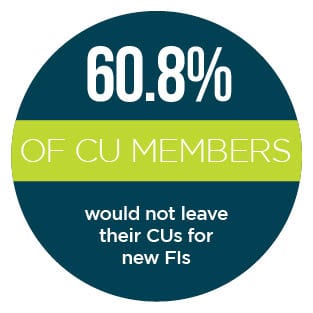

This sense of belonging and inclusion is precisely why consumers gravitate toward CUs. In fact, 65 percent of CU members choose to bank with their respective CUs because they trust them, and 60.8 percent said they would never leave their CU for another financial institution (FI).

This sense of belonging and inclusion is precisely why consumers gravitate toward CUs. In fact, 65 percent of CU members choose to bank with their respective CUs because they trust them, and 60.8 percent said they would never leave their CU for another financial institution (FI).

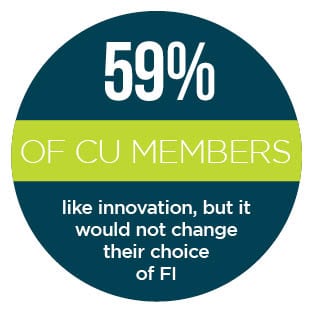

When it comes to innovation, though, are CUs investing in the technologies their members want, or are they putting their money into innovations that don’t align with their members’ priorities? In the Credit Union Innovation Index, and in collaboration with PSCU, PYMNTS takes a 360-degree view of the relationship between CUs and their members, with particular attention to how CUs are using innovation to enhance the CU-member relationship.

We surveyed consumers to assess the relationship between CUs, their members and the FinTech firms that often serve as solution providers to CUs looking to invest in payments innovation.

The findings highlighted a disconnect between the innovation priorities of CUs and the ones important to their members. For example, when it came to innovation, CU members’ biggest priorities were loyalty and rewards programs. In fact, 49 percent said they wanted their FIs to focus on these programs in the next three years. Yet, just 29  percent of CUs said they had focused on loyalty and rewards programs in the past three years.

percent of CUs said they had focused on loyalty and rewards programs in the past three years.

Further complicating this market dynamic are FinTech firms. About 77 percent of CUs consider FinTech firms to be one of their top-three most important service providers, but many FinTech firms said they would sell directly to their end customers if they could. In fact, 75 percent of FinTech firms that worked with CUs said they would benefit from selling directly to those CU members.

In the face of increased market pressure, it is up to CUs to help close their members’ satisfaction gap and get back to the customer-oriented services that inspired members’ trust in the first place.

To learn more about what’s driving CU innovation in the increasingly complex financial services ecosystem, download the report.