BECU on Why It Pays To Think Like a Challenger Bank

Consumers’ affinity for online banking solutions, especially mobile banking, is far from new. The COVID-19 pandemic is highlighting how necessary these solutions are for consumers’ banking needs, however, and how high their standards for these channels have become.

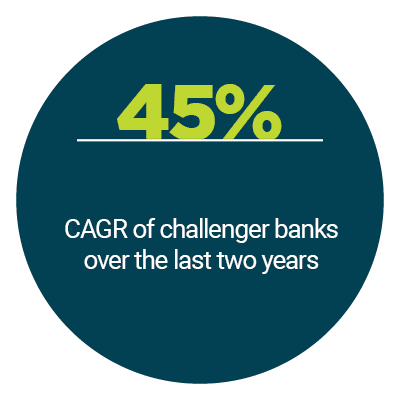

This represents a challenge for the banking sector, as financial institutions (FIs) including community banks and credit unions (CUs) have to both manage the negative impacts of the current crisis and keep online service seamless. One poor online or mobile user experience can dissolve consumers’ loyalty, sending them straight into the arms of the competition. CUs in the United States are having to compete against a growing number of digital-only  challenger banks, banks that are relying upon their proficiency with emerging technologies to nab new customers seeking digital conveniences.

challenger banks, banks that are relying upon their proficiency with emerging technologies to nab new customers seeking digital conveniences.

In the latest “Credit Union Tracker®,” PYMNTS analyzes how and why CUs are reexamining their use of innovative technologies and online channels, and why shifts in these strategies are essential for CUs to compete with challenger banks.

Around the Credit Union World

Franklin Mint Federal Credit Union is one CU that is examining how it can best shore up its digital channels during the ongoing pandemic. The CU will be integrating a chatbot that leverages artificial intelligence (AI) to answer customer inquiries on its customer service channels. According to the CU, it has partnered with third-party customer service solutions provider SilverCloud and will utilize the AI-enabled ‘bot to help its human employees better manage customer requests. This will free up the employees to answer complex banking questions, while the chatbot answers more routine or straightforward inquiries.

Numerica Credit Union is another CU that has seen usage of both online and mobile banking solutions jump. One recent report from the entity found there was a 200% increase in consumers signing up for mobile banking accounts in the month of April, for example. Mobile deposits have also increased, according to the CU. This shows that these channels are being easily adopted by customers, who are also becoming more interested in online-only tools that allow them to have quicker access to their funds or to finalize transactions more easily, such as remote deposit capture features.

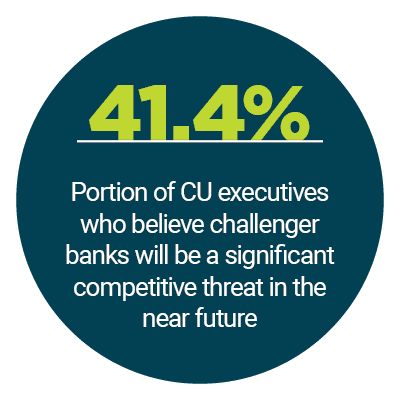

The pandemic’s continued effect on the adoption of online services means more CUs and FIs are examining their digital channels to be sure they can provide superior experiences to their customers. They are also working to fight against an expanding crop of digital-only banking entities at a time when it is growing ever-more critical, meaning challenger banks are starting to be viewed as a more significant competitive threat than ever. Recent research by PYMNTS found that 41.4% of CU professionals think of challenger banks in such a way, for example. Yet CUs should not throw away focus on their brick-and-mortar branches yet, advised Jeff Chambers, president of Lumin Digital in a recent interview. Branches could come to represent one of the competitive advantages CUs have over challengers, Chambers continued, despite the growing adoption of online banking tools. CUs will have to hit the balance between these two channels to use that advantage to its fullest, however.

The pandemic’s continued effect on the adoption of online services means more CUs and FIs are examining their digital channels to be sure they can provide superior experiences to their customers. They are also working to fight against an expanding crop of digital-only banking entities at a time when it is growing ever-more critical, meaning challenger banks are starting to be viewed as a more significant competitive threat than ever. Recent research by PYMNTS found that 41.4% of CU professionals think of challenger banks in such a way, for example. Yet CUs should not throw away focus on their brick-and-mortar branches yet, advised Jeff Chambers, president of Lumin Digital in a recent interview. Branches could come to represent one of the competitive advantages CUs have over challengers, Chambers continued, despite the growing adoption of online banking tools. CUs will have to hit the balance between these two channels to use that advantage to its fullest, however.

For more on these and other stories, visit the Tracker’s News & Trends.

Enhancing Credit Union Innovations to Challenge Challenger Banks

Monitoring what competitors are doing has always been sound business, especially when these competitors are basing their own appeal on cutting-edge tools and technologies. CUs should thus be carefully scrutinizing digital-only challenger banks and how they are using contactless solutions to help consumers bank remotely during the pandemic, says Doug Marshall, executive vice president, chief digital and product officer for BECU. Challenger banks are now well-funded entities looking to use their grasp on innovative tools and services to snag intrigued members from CUs, and CUs must be ready to meet them on that field. To learn more about how BECU is tackling rising competition and shifting technology strategies, visit the Tracker’s Feature Story.

Deep Dive: How CUs Can Respond to the Challenger Bank Threat

Deep Dive: How CUs Can Respond to the Challenger Bank Threat

CUs are used to a healthy amount of competition from other financial players. Yet CUs are now having to adapt to another piece on the banking board: that of digital-only challenger banks marketing themselves to consumers as swift, nimble alternatives to more traditional entities. Challenger banks have been settling comfortably across Europe for several years and some have now tentatively planted roots inside the U.S., meaning U.S.-based CUs are facing a new kind of threat to their ability to maintain customer conversion and loyalty. This, in turn, means what channels CUs are using to interact with their users, and what technologies they are integrating to do so, have increased importance. To learn more about how CUs are marshaling their product and technology energies to match challenger banks, visit the Tracker’s Deep Dive.

About the Tracker

The “Credit Union Tracker®,” done in collaboration with PSCU, is the go-to monthly resource for updates on trends and changes in the credit union industry.