How One Nevada Credit Union Secures Its Self-Service Innovations

Credit unions are performing well as the new decade dawns, with a recent study finding that CUs increased their loan originations by 29% from Q4 2018 to Q4 2019. Though still strong, this industry growth has slowed in recent years, with another survey finding that total loans only increased by 6.6% in 2019, compared to 10.5% in 2016.

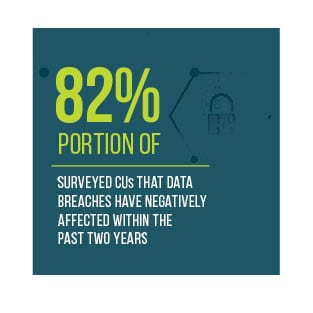

Another perennial challenge the industry faces is the ever-looming threat of data breaches. One of the more recent incidents took place at the Desjardins Ontario Credit Union, revealing the names, social insurance numbers and transaction information of all 4.2 million CU members.

In the February “Credit Union Tracker,” PYMNTS explores the latest in the world of CUs, including new co llaborations between CUs and FinTech firms, initiatives to appeal to Generation Z and how CUs are working to protect against the ongoing threat of data breaches.

llaborations between CUs and FinTech firms, initiatives to appeal to Generation Z and how CUs are working to protect against the ongoing threat of data breaches.

Developments From Around The World Of Credit Unions

One recent collaboration came from Texas-based Randolph-Brooks Federal Credit Union (RBFCU), which partnered with Fiserv’s subsidiary Raddon to integrate the FinTech’s Predictive Analytics solution. The new platform provides dynamic marketing campaigns based on members’ transactional, lifestyle and behavioral data. The partnership is also intended to help RBFCU staff provide targeted products and services to members.

Other CUs are placing an emphasis on attracting new members, particularly from Generation Z, a group rapidly entering the workforce. Digital banking provider Bankjoy and financial literacy education app Zogo are partnering to that end by shifting CU offerings to focus less on sales and more on financial education, which Generation Z customers tend to value more. Another key draw for this customer segment is quick account opening  times, which the partnership plans to reduce to 90 seconds or less.

times, which the partnership plans to reduce to 90 seconds or less.

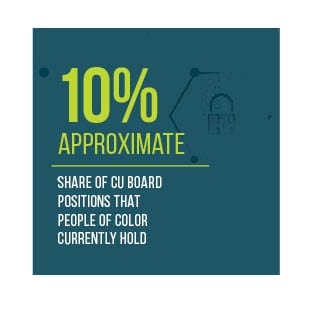

Another key priority for many credit unions is diversity, with the African-American Credit Union Coalition and human capital solutions provider Humanidei partnering to increase the presence of women and people of color on CU executive boards. The collaboration aims to fill one-third of CU leadership positions with diverse individuals by 2030, and plans to provide education services, referrals and consulting services to execute this diversity initiative.

For more on these and other CU news items, download this month’s Tracker.

Inside One Nevada Credit Union’s Self-Service Transformation

The onset of digital banking has drastically changed the way CU customers interact with their financial institutions (FIs), placing a much greater emphasis on self-services like mobile and online banking. Many credit unions, including One Nevada Credit Union, are undergoing extensive changes to cater to this desire, but these transformations invariably bring challenges of their own.

In this month’s feature story, PYMNTS spoke with One Nevada’s EVP and CFO Steve  O’Donnell about why educating CU staff on the benefits of this model proved difficult, and how the CU is leaning on extensive training to overcome this obstacle.

O’Donnell about why educating CU staff on the benefits of this model proved difficult, and how the CU is leaning on extensive training to overcome this obstacle.

Deep Dive: Credit Unions Face Data Breach Challenges

Credit unions, like any FI, are sitting on a trove of valuable personal information, such as credit card data and Social Security numbers, that hackers would do anything to get their hands on. This makes data security of utmost importance to CUs, but even attacks on unrelated third parties can be devastating to CU members.

This month’s Deep Dive explores how these third-party data breaches can negatively affect CUs, and how both CUs and oversight agencies are devoting considerable resources to keep that data safe.

About The Tracker

The “Credit Union Tracker,” done in collaboration with PSCU, is the go-to monthly resource for updates on trends and changes in the credit union industry.