Senate Federal CEO On Protecting Member Trust During Digital Overhauls

Credit unions (CUs), as much as other financial entities, are seeing a boom in competition as banking moves to online and mobile channels. Customers today expect to be able to access financial services instantly, which can put pressure on CUs that need to stretch restricted technology budgets into innovative new features.

These CUs must also make sure that introducing new features does not offer up any openings to the many opportunistic fraudsters looking to swipe precious data and financial information. CUs must make sure these features both protect legitimate users and reject illegitimate bad actors, which is why many of them are experimenting with biometric tools to keep data accessible to only the correct individuals.

These CUs must also make sure that introducing new features does not offer up any openings to the many opportunistic fraudsters looking to swipe precious data and financial information. CUs must make sure these features both protect legitimate users and reject illegitimate bad actors, which is why many of them are experimenting with biometric tools to keep data accessible to only the correct individuals.

In the March “Credit Union Tracker®,” PYMNTS analyzes the latest developments in the CU space, such as how they are tackling fraud protection challenges in a growing online banking ecosystem.

Around the Credit Union World

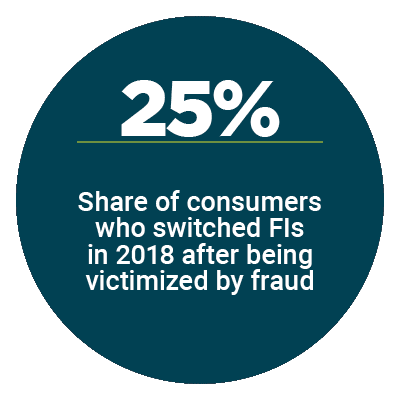

Competition to attract and retain members is fierce as ever as consumers are beginning to change what they value most in their CUs. Members have different banking preferences today than they have exhibited in the past, with 21.9% reporting in the PYMNTS Credit Union Innovation Index that they would switch financial institutions (FIs) due to a lack of innovation. This is a jump from the 17.3% that said the same in 2018, indicating that digital innovation should remain a critical concern for CUs over the next several years.

Fraud protection remains a top priority for CUs as well as innovation, with several beginning to integrate newer technologies such as biometrics into their platforms for further protection. The Navy Federal Credit Union recently introduced a voiceprint feature into its call centers, VoiceID, enabling customers to verify their identities. The solution allows users to authenticate themselves simply by speaking a pre-chosen passphrase, something that eliminates the need for lengthy verification that may frustrate these users. The CU hopes the tool will also reduce friction for call center employee s.

s.

CUs are also employing technologies for security and for consumer satisfaction. These include tools that use artificial intelligence (AI) and machine learning (ML), such as the Linked Analysis tool developed by financial technology provider PSCU. The feature uses AI to connect partner CUs with third-party entities, allowing them to more easily integrate security or other features onto their platforms for further competition.

To learn more about these and other stories, visit the Tracker’s News and Trends.

How USSFCU Secures Its Digital Infrastructure Makeover

CUs are searching for ways to satisfy new generations of consumers who view digital connectivity as a top priority by overhauling their online offerings. CUs need to keep up with their FI competition with digital transformations, but they must also make sure their users’ data is fully protected from opportunistic fraudsters. That is why entities like the United States Senate Federal Credit Union (USSFCU) is taking measures to protect member data while transforming its platform to better support digital customers, says Timothy Anderson, CEO of the Washington-based CU.

To find out more about how USSFCU is working to retain members and safeguard against fraudsters,  visit the Tracker’s Feature Story.

visit the Tracker’s Feature Story.

Deep Dive: Why CUs Must Innovate Or Fail Amid Industry Consolidation

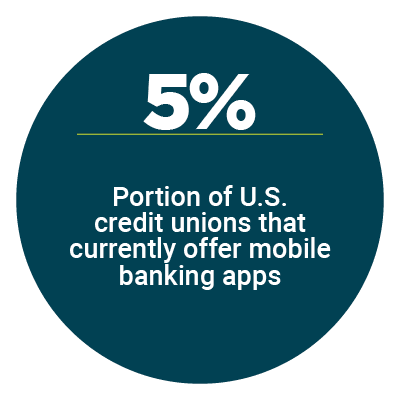

Consumers today seek ever-faster access to financial services. This represents a growing problem for CUs that may have somewhat fallen behind the online learning curve: Ninety-four percent of consumers say they use mobile banking apps, for example, and yet only 5% of CUs report that they have such apps in place. CUs must, therefore, find ways to innovate their online and mobile offerings to keep up, utilizing their often-limited IT and technology budgets to the fullest.

Find out more about how CUs are approaching online and mobile innovations in the Tracker’s Deep Dive.

About the Tracker

The “Credit Union Tracker®,” done in collaboration with PSCU, is the go-to monthly resource for updates on trends and changes in the credit union industry.