Deep Dive: How CUs Can Prevent Members From Switching FIs For Mortgages And Other Loans

Credit unions have a long history of earning top ratings in member satisfaction — with good reason. CUs offer many of the same services and financial tools as traditional banks, but several advantages set them apart from competitors. CU members own a share of the CU and are compensated with benefits other financial institutions (FIs) often cannot match, including reduced costs, higher yields on interest-bearing accounts and lower rates on loans. CUs even may be able to provide members with quick financial relief and monetary aid during unexpected hardships.

Competitive checking and savings interest rates are common CU offerings, whereas some banks offer little to no interest on checking accounts. Texas-based Capitol Credit Union, for example, currently offers a 2.0 annual percentage yield on checking, as well as cash back on debit card purchases, early paycheck access and other incentives for qualifying members. Eligible CU members also can receive lower interest rates on education, auto and home loans.

One might think that such a list of perks would make credit union members have no desire to go anywhere else for their banking needs, but this is not the case. Recent reports by the American Customer Satisfaction Index (ACSI) show an ongoing decline in CU member satisfaction, falling behind that of bank customers for the last two years. One potential shortcoming is the ease of receiving or servicing a loan online, with more than one-third of CU members saying they have had trouble with these processes. This pain point may be influencing the growing number of CU members seeking loan services — especially first and second mortgages — from other FIs.

The following Deep Dive examines the services credit unions provide in the loan and mortgage space. It also explains how CUs can tailor their loan and mortgage offerings to stop members from seeking these services elsewhere.

Members Demand Better Services

Consumers traditionally have flocked to CUs for their personal touch, but members have become less satisfied with their CUs. This could reflect CUs’ difficulty in keeping up with the digital shift of 2020, but satisfaction already was sliding before the pandemic began. ACSI’s 2020 study reported CU member satisfaction dropped 2.5% year over year for a score of 77 out of 100, compared to banks’ score of 78 — CUs’ lowest score to date, following a similar drop in 2019 that represented the first time ever that banks scored higher in this category.

Other evidence also suggests that a lack of seamlessness in digital transactions is impacting CU member satisfaction. Banks and other FIs perform better than CUs in mortgage loan volume, for example, with CUs funding only a small minority of mortgages in the U.S. — despite CUs scoring 10% higher than banks on customer satisfaction with the loan experience. One reason is highlighted by the finding that 36% of CU members say they have experienced difficulty servicing or receiving a loan online. Even with an increase in staff and better outreach, CUs find that a large majority of mortgage loan seekers ultimately finance through other lenders.

Innovation is the key to member satisfaction

CUs offer a wide array of financial products, yet PYMNTS’ research shows that more than half of their members use another bank or FI for at least one product or service. This share is rising, moreover, driven by members turning to other FIs for key financial instruments, including mortgages, business lines of credit and equity loans. Eighty-four percent more CU members are obtaining second mortgages from other FIs this year than in 2020, and 16% more are fleeing to other FIs for business lines of credit, as are 11% for home equity loans. PYMNTS’ research also reveals why, at least in part: Almost half of members who took out a mortgage elsewhere said they would have done so at their CU if it offered more innovative products.

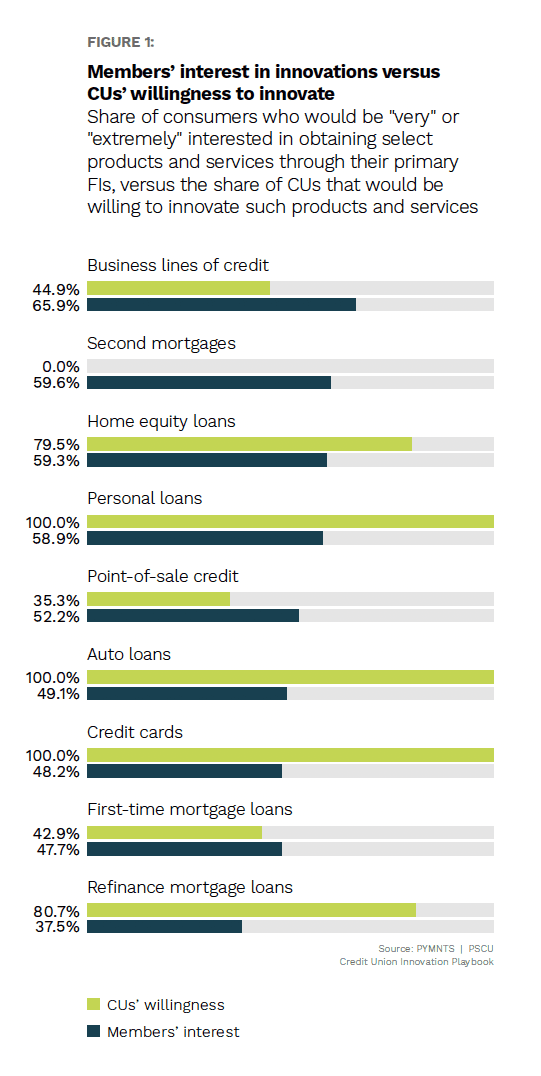

Consumer expectations are evolving rapidly, especially in the wake of the pandemic, but PYMNTS’ research shows that CUs are not always forthcoming with the products and services their members want most. Second mortgage options and home equity loans are in higher demand among members than most other products, yet none of the CUs surveyed showed a willingness to innovate second mortgage offerings. Sixty-six percent of members showed interest in using their CUs for business lines of credit, but less than half of CUs reported a willingness to innovate new products in this area to mitigate losses.

Despite CUs’ apparent lack of interest in these innovations, almost all CU executives surveyed said members refinancing mortgages at other FIs would negatively impact their institutions’ income. This share remains nearly as high regarding auto loans, at 85%. Financial products such as business lines of credit and equity are some of the most profitable services offered to members, and CUs’ hesitance to innovate these areas can lead to unwanted portfolio leakage. To remain top players in member satisfaction as well as profitability, CUs need to alter their mindset about new technology and express a greater willingness to adopt the services that their members demand.