Report: Contactless Cards, Digital Wallets Keep Credit Union Members From Defecting To FinTechs

The data is in, and it is clear: Credit union (CU) members want access to digital payment tools like contactless cards, and they are willing to switch to other financial institutions (FIs) if their CUs fail to deliver.

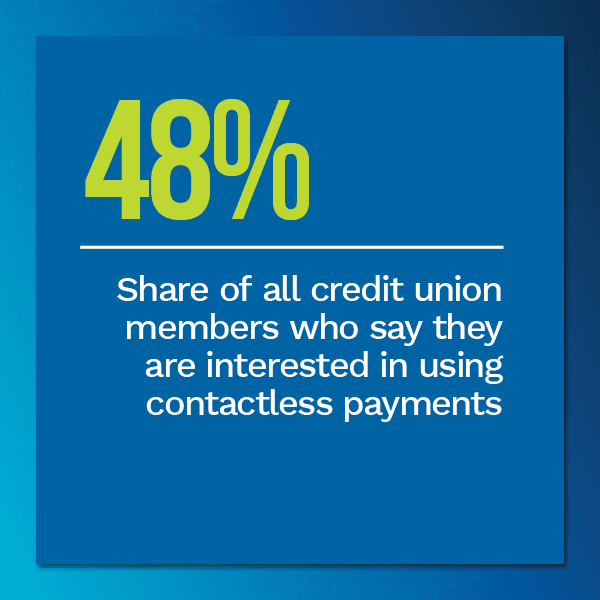

PYMNTS’ Credit Union Innovation Playbook found that more than two-thirds of CU members would be willing to switch to primary FIs that prioritized digital innovations, for example. The Playbook also found that 48% of CU members are more interested in touchless payments now than they were in March of last year.

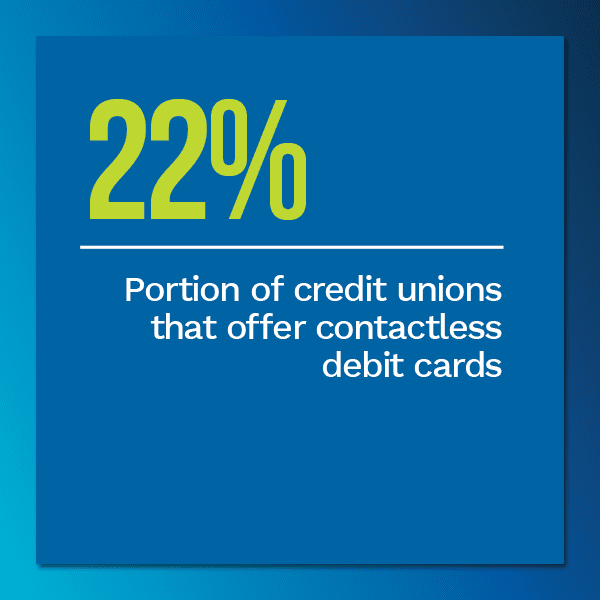

Unfortunately, CUs have a lot of room for improvement on this front. CU members are most interested in contactless cards, but CUs are putting more of their focus on mobile wallets. Eighty-six percent of CUs are focused on investing in mobile wallets, for instance, while just 34% of CUs are planning to invest in contactless innovations. This disparity is highlighting a notable gap in CUs’ perceptions of what they think members want versus what they actually want.

The June edition of the “Credit Union Tracker®” examines CU members’ desires for contactless payment solutions and why many CUs are missing the mark on delivering them. It also assesses the importance of providing these solutions to avoid seeing members defect to FinTechs and other digitally savvy FIs.

Around The Credit Union Space

Some CUs are choosing to work with FinTechs rather than against them to provide contactless payment solutions. In an interview with PYMNTS, Jeremiah Lotz, PSCU’s managing vice president of Digital and Data, said that these partnerships can grant CUs robust end-to-end solutions. These collaborations can also help CUs offer members financial knowledge they seek, thus potentially preventing them from seeking out other FIs.

Such collaborations can also come in handy for CUs that serve the needs of small- to medium-sized businesses (SMBs), as 82% of SMBs want to shift their operations to accommodate touchless payments. There is no shortage of FIs available to offer emerging solutions should CUs be unprepared to do so, which means the failure to prioritize these offerings could ultimately cost CUs key business relationships. Partnering with FinTechs affords CUs one way to maintain relationships with profitable business members.

Such collaborations can also come in handy for CUs that serve the needs of small- to medium-sized businesses (SMBs), as 82% of SMBs want to shift their operations to accommodate touchless payments. There is no shortage of FIs available to offer emerging solutions should CUs be unprepared to do so, which means the failure to prioritize these offerings could ultimately cost CUs key business relationships. Partnering with FinTechs affords CUs one way to maintain relationships with profitable business members.

If CUs needed any more incentive to go all in on digital innovation, research shows that doing so can bring them many opportunities to win over new members. One study found that at least 1 million consumers older than age 16 would be open to switching to CUs that offered a wide range of banking services. Fifty-three percent of consumers said that switching to a CU would ultimately come down to whether it would allow them to access banking services online or via mobile.

For more on these stories and other credit union headlines, read the Tracker.

Alliant Credit Union On Taking Members’ Word For It With Contactless Innovation

CU members are taking the guesswork out of digital innovation for their CUs. They want contactless payments, and they are willing to look elsewhere if CUs cannot deliver them. Despite this feedback, many CUs are still failing to make contactless cards and similar innovations a priority, even though doing so could put their membership numbers in jeopardy.

In this month’s Feature Story, Sumeet Grover, chief digital officer of Chicago-based Alliant Credit Union, explains why listening to members’ feedback has driven its approach to digital transformation and pushed it to implement contactless payment solutions.

Deep Dive: How Credit Unions Are Falling Short On Contactless Payments And What They Can Do To Fix It

CUs stand to benefit significantly from investing in contactless payment innovations, but many are still failing to meet members’ expectations because they believe they are less interested in these tools than they truly are.

This month’s Deep Dive examines why members’ demands for contactless payments are accelerating — and what CUs can do to keep pace with this trend.

About The Tracker

The “Credit Union Tracker®,” a PYMNTS and PSCU collaboration, is your go-to monthly resource on the trends and developments in the credit union space.