Who’d have believed it? Credit unions (CUs), often thought of as behind the digital transformation curve, actually pulled ahead of it. All of that work means good things for CUs and their members, with one caveat: CUs may have painted themselves into a corner.

The PYMNTS February 2021 Credit Union Innovation Study, a PSCU collaboration, makes the somewhat startling discovery that “mobile innovations, while useful, have become so ubiquitous among credit unions that many CU members no longer consider them to be innovative at all. Only 23 percent of CU members say they would like to see their CUs innovate mobile banking capabilities, while a far larger share want them to focus on loyalty and rewards programs and contactless cards.”

It shows that CUs’ innovation agendas and member expectations need further alignment, and “underscores that mobile banking capabilities have become table stakes for many consumers. Only the most cutting-edge, innovative offerings will capture members’ attention.”

Defining The Next Wave Of Innovation

Surveying a census-balanced panel of over 4,800 U.S. consumers to learn about tech priorities for credit unions, as well as 101 credit union decision-makers and 50 FinTech executives from across the U.S. to get the industry insider perspective, a picture emerges of a CU member who is embracing the digital shift enthusiastically. They expect their CU and CUSOs to do the same.

As the popularity of physical branches continues to fall, digital desires are flowing in.

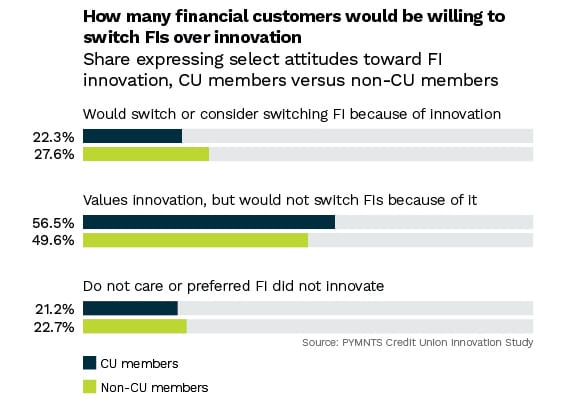

The new Credit Union Innovation Study found that 22 percent of all CU members “would consider leaving their CUs for competing FIs if their CUs do not innovate.” The less satisfied the member, the more likely the switch. “This makes innovation imperative for credit unions looking to retain their members — and aiming to attract even more.”

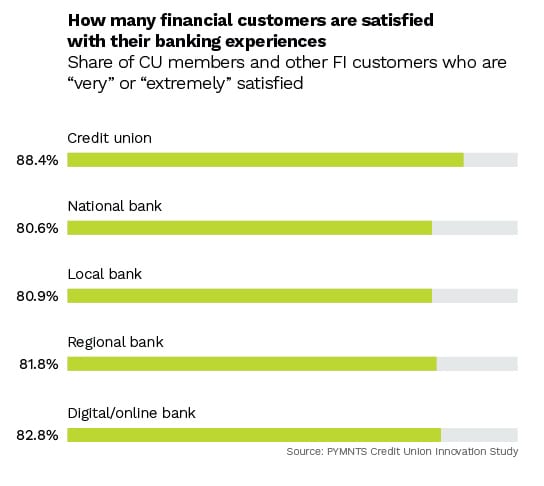

Make no mistake: credit unions got on the innovation train in earnest through 2020 and it’s paying off, as 88 percent of CU members now report being either “very” or “extremely” satisfied with their CUs, compared to 81 percent of traditional bank customers, per the study.

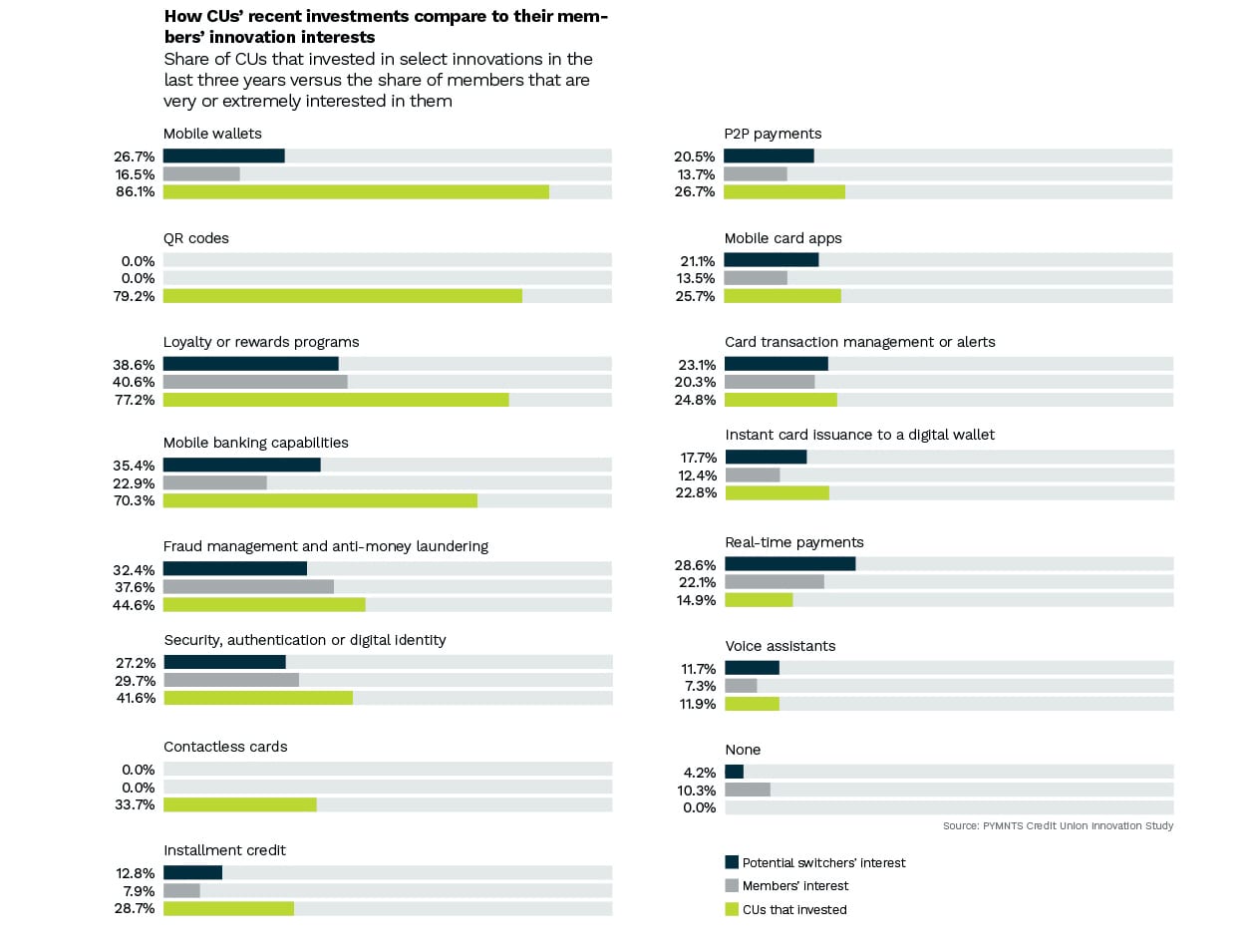

Here’s the thing: people and institutions don’t define innovation the same way. “Many CU members do not consider the technologies their CUs developed in 2020 to be innovative at all — they see them as basic requirements,” per the new Credit Union Innovation Study. “One of the most common innovation areas on which CUs focused in 2020 was mobile wallet capabilities, with 86 percent of all CUs citing it as one of their innovation areas. Only 17 percent of members, however, expressed interest in mobile wallet innovation.”

A big risk there, researchers found, is the incursion of other FIs. Per the study, “The portfolio leakage problem may also be more widespread than many CUs realize. Sixty-two percent of CU members who have personal loans currently obtain them from their CUs’ competitors … and 66 percent of those who have mortgages have obtained them from other FIs.”

Give CU Members What They Want

Focusing on areas of innovation that CU members value most seems the obvious path, and it is. A good way to approach that is finding out what they don’t like and fixing it pronto.

February’s Credit Union Innovation Study found that CU members are “roughly three times more likely than unsatisfied bank customers to be discontented with their CUs’ failure to innovate. Ten percent of all dissatisfied CU members say their CUs do not provide sufficient online banking capabilities, in fact — three times the equivalent share of dissatisfied banking members. Frustrations with data security and needing to visit brick-and-mortar branches too often are also more common among dissatisfied CU members” than other groups surveyed.

For a number of CUs that’s a call to action: give your members what they want, or else.

“Online and mobile capabilities are, after all, areas in which CU members most commonly believe their credit unions are falling short,” according to the Credit Union Innovation Study.

“The data strongly suggests that while members want their CUs to provide mobile wallets, mobile banking capabilities, P2P payments and other similar services, they simply do not see such products and services as innovative. To most CU members, these products and services are less cutting-edge and differentiating than they are essential.”