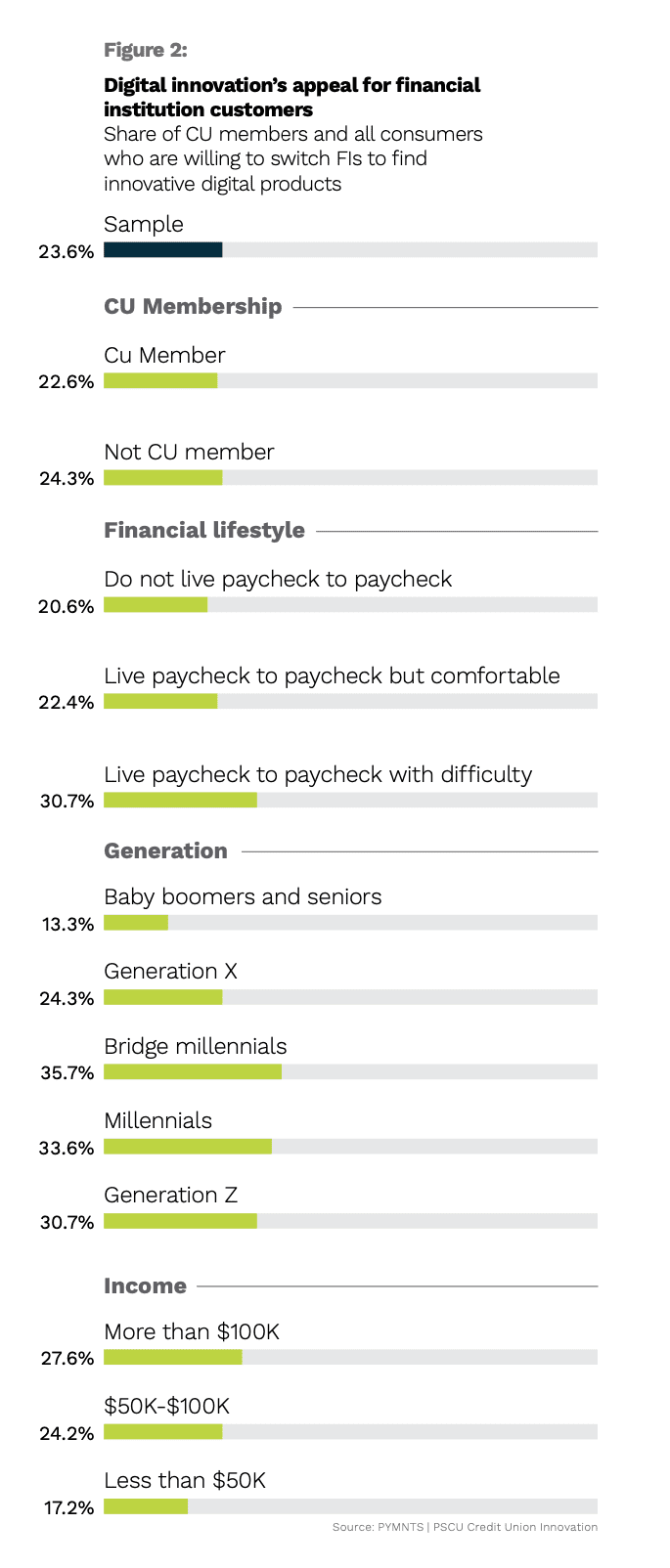

Twenty-three percent of credit union members would be willing to switch financial institutions for access to more innovative products, according to “Credit Union Innovation,” a PYMNTS and PSCU collaboration that surveyed 4,832 U.S. consumers, 101 credit union decision-makers and 51 FinTech executives.

Get the report: Credit Union Innovation

Among all financial institution customers — credit union members and non-members alike — the three youngest generations are the most willing to switch.

Thirty-six percent of bridge millennials, 34% of millennials and 31% of Generation Z are willing to switch financial institutions to find innovative digital products.

Members of the older generations are less likely to switch, with only 24% of Generation X and 13% of baby boomers and seniors being willing to do so.

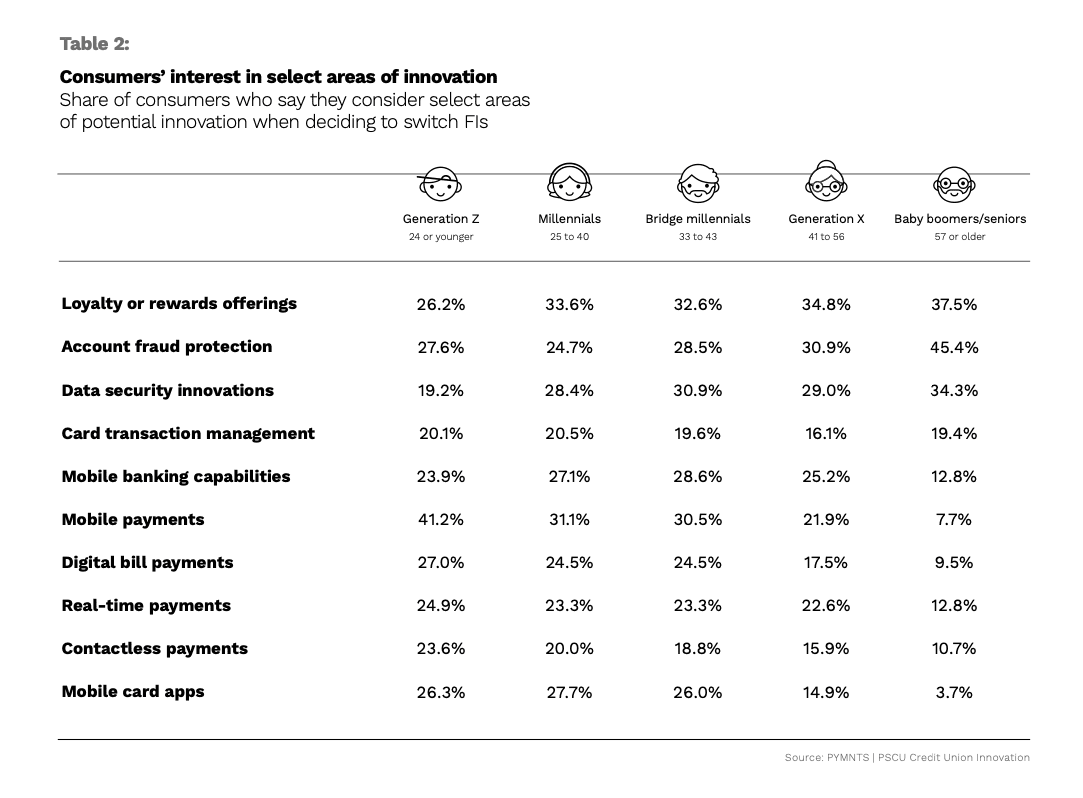

The innovations that customers would be willing to switch financial institutions for vary by generation.

Generation Z consumers are most interested in mobile payments. With 41% of these consumers saying they consider that innovation when deciding to switch financial institutions, they rate it high above their second and third choices: account fraud protection (28%) and digital bill payments (27%).

Millennials are most interested in loyalty or rewards offerings, followed by mobile payments and data security innovations.

For bridge millennials, too, loyalty or rewards offerings top the list, with data security innovations and mobile payments ranked second and third.

Generation X consumers are also most interested in loyalty or rewards offerings, but they rank account fraud protection and data security innovations next on their list.

Baby boomers and seniors are most interested in account fraud protection, with 45% of these consumers saying they would consider that innovation when deciding to switch financial institutions. Loyalty or rewards offering are second on their list, at 38%, followed by data security innovations at 34%.