PYMNTS Intelligence: How CUs Can Use Innovative Digital Offerings to Grow, Retain Membership

Innovative digital banking technologies, including peer-to-peer (P2P) payments, mobile wallets and instant cards, offer CUs important avenues for attracting and retaining members, particularly younger consumers. A recent PYMNTS study discovered that nearly one-quarter of credit union (CU) members would consider switching financial institutions (FIs) to access more innovative products such as P2P payments and mobile deposits. The shares of these “potential switchers” were as high as 36% among consumers under age 45.

The opportunity to gain and keep members by investing in innovation is one that CUs cannot afford to miss. This month, PYMNTS examines the factors driving FI primacy for consumers and how CUs can implement technology to prevent portfolio leakage and bring in new members.

Unmet Demand for Innovative Services

Consumers demonstrated a high rate of P2P payment adoption during the pandemic, with 79% of respondents in a 2021 survey reporting using a P2P service during Q4 2020. Despite this interest, 47% of consumers said they did not know if their FIs offered these services.

PYMNTS’ data also suggests that credit unions may be overlooking P2P payment innovation opportunities. While CUs’ investments in P2P payments nearly doubled year over year in 2021, just 50% invested in P2P payment services — albeit up significantly from 27% in 2020. By comparison, 74% of credit unions invested in mobile banking in 2021, up from 70% in 2020. At the same time, however, CUs investing specifically in mobile wallets dropped precipitously from 86% in 2020 to 64% in 2021, giving a somewhat contradictory picture of CUs’ mobile banking innovation priorities during the period.

Digital innovations such as these represent a significant opportunity for CUs, as they are some of the primary determinants of where consumers choose to bank. P2P payments, mobile remote deposit capture, cashless card withdrawal, digital wallets and instant card issuance to digital wallets lead as areas in which CU investment and product promotion can have the greatest impact.

Digital innovations such as these represent a significant opportunity for CUs, as they are some of the primary determinants of where consumers choose to bank. P2P payments, mobile remote deposit capture, cashless card withdrawal, digital wallets and instant card issuance to digital wallets lead as areas in which CU investment and product promotion can have the greatest impact.

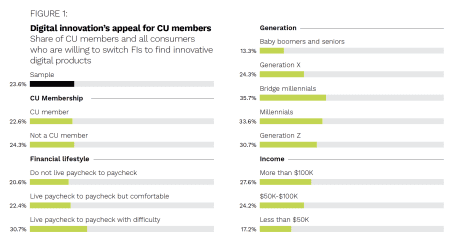

PYMNTS’ research revealed that 23% of CU members would consider switching their primary FIs for innovative digital banking products. These included 38% of CU members who would switch for access to mobile check deposits, 38% for digital cards that can be issued directly to their digital wallets, 35% for P2P payments and 35% for cardless cash withdrawals.

Even higher shares of younger consumers would switch for such innovations, including 31% of Generation Z, 34% of millennials and 36% of bridge millennials. As a result, digital innovation in these areas could offer credit unions the chance to limit portfolio leakage and attract new members in desirable demographics for CUs’ long-term viability.

Fifty-five percent of CU members already turn to a secondary FI for at least one financial product or service, yet 45% of members would prefer to have all their financial products provided by a single FI. This reinforces the opportunity available to credit unions to stem portfolio leakage through innovation.

By implementing technologies and services that address a wider array of consumer preferences, CUs can make themselves more competitive in the eyes of both existing and potential members.