As consumers worry about financial wellness, 66% expect no improvement, and 29% expect their finances will worsen. Credit unions can stand out to existing and potential members with better rates than competitors on credit products and high-yield savings accounts.

At the same time, CU members have a much higher-than-average view of the ease and convenience of getting a loan from their CU compared to customers of other financial institutions. From lending rates to customer service, CUs have the qualities and values borrowers seek.

At the same time, CU members have a much higher-than-average view of the ease and convenience of getting a loan from their CU compared to customers of other financial institutions. From lending rates to customer service, CUs have the qualities and values borrowers seek.

The “Credit Union Tracker®” examines how CUs stand out during economic downturns with better lending rates and personalized financial resilience.

Around the Credit Union Space

CUs of all sizes will soon have to report more data to the federal government regarding small business loans. A Consumer Financial Protection Bureau rule affects lenders annually allotting more than 100 covered small business loans. The new rule requires these lenders to report lending decisions and the price of credit, including demographic and geographic information.

Year over year, the consumer debt held by CUs grew 18% in January. This increase compares to 11% for bank-held consumer debt, and car loans significantly boosted those gains. In total, CUs held more than 15% of nonrevolving consumer debt at the end of January. CU-owned credit card debt held steady at 6.3%.

Year over year, the consumer debt held by CUs grew 18% in January. This increase compares to 11% for bank-held consumer debt, and car loans significantly boosted those gains. In total, CUs held more than 15% of nonrevolving consumer debt at the end of January. CU-owned credit card debt held steady at 6.3%.

For more on these and other stories, visit the Tracker’s News and Trends section.

Economic Downturns Showcase CU Lending Advantages

CUs can offer more than better rates, using a personalized approach to work with new and existing borrowers. From finding ways to help borrowers rejected on their first try to keeping delinquency rates low by applying a personal touch, CUs can do what other FIs cannot.

To get the insider point of view, PYMNTS spoke with Kate Rogers, senior vice president of digital and payments and chief innovation officer at the University of Illinois Community Credit Union, about how the CU serves members and reminds them of CU membership advantages in a struggling economy.

The Best Lending Product Wins in Retention and Enrollment

The Best Lending Product Wins in Retention and Enrollment

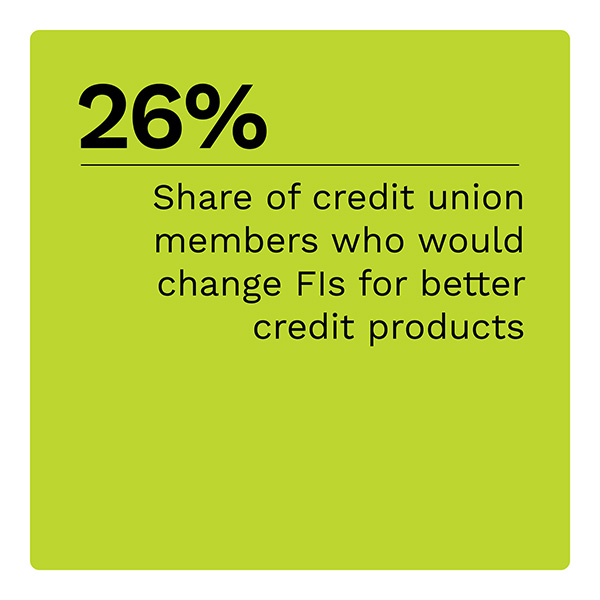

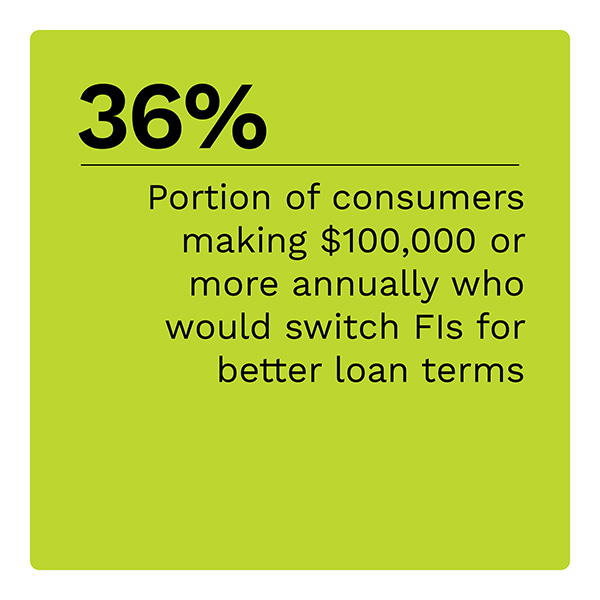

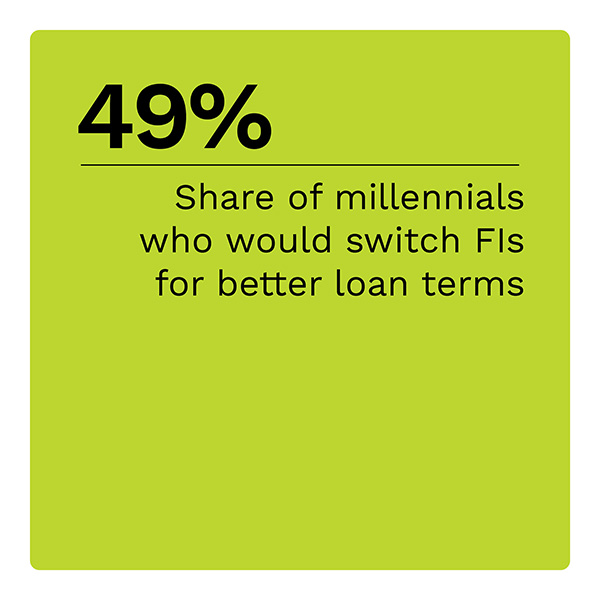

Most CUs consider convenience a feature they must maintain to retain and recruit members. Still, just 10% of CU members cited convenience as the most important trait in a lender. Instead, more than one-quarter of consumers would consider switching FIs to access better credit products. As many struggle in a down economy, CUs can mirror success with car loans by improving footing in other lending product markets.

To learn more about the lending opportunities CUs have in the current economic climate, read the Tracker’s PYMNTS Intelligence.

About the Tracker

The “Credit Union Tracker®,” a collaboration with PSCU, examines how CUs can use their better lending rates and consumer-friendly credit products to stand out during a recession.