Subprime account holders may be driven toward banking innovations in their quest for financial wellness.

It’s difficult enough to tread water as a consumer with subprime credit, whose 600 or below score often means they face higher borrowing costs and fees than consumers with prime or super-prime credit. And that’s before the Federal Reserve hikes interest rates, which is still on the table at least through the end of the year.

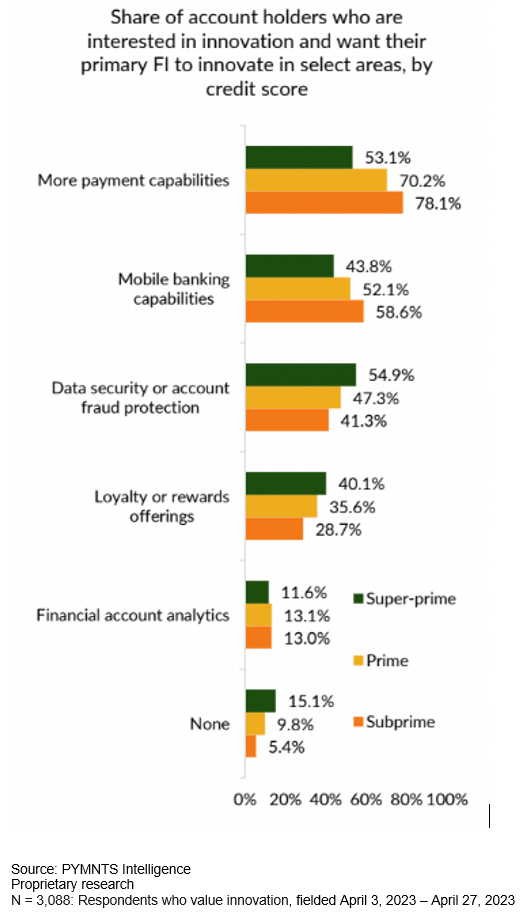

So it may be a small wonder that consumers with subprime credit are looking for banking and payment innovations to assist them in managing their finances, per proprietary data prepared for “Credit Union Innovation: Credit Union Membership and Credit Profiles,” a PYMNTS collaboration with PSCU. Here, we see that a large 78% majority of subprime account holders want more payment capability innovations — which may include options such as Zelle or other real-time capabilities — from their financial institution (FI). This suggests a stronger sentiment for these innovations among these account holders, as the corresponding shares are 70% for prime and 53% for super-prime members. When it comes to mobile banking capabilities, which include innovations such as mobile check deposit, 59% of subprime account holders seek further innovations from their primary FIs, compared to 52% of prime and 44% of super-prime account holders.

Additional PYMNTS Intelligence research also finds that innovative financial products are increasingly considered must-haves by consumers when it comes to their primary FIs. The share of account holders who would switch or would consider switching FIs if their institution did not offer innovative financial products had jumped by nearly half since 2018 when only 19% of account holders said the same. That figure had risen to 29% by 2022.

In a PYMNTS interview, PSCU Growth Chief Brian Scott addressed how credit unions and other FIs may help their younger members struggling to get their finances on track. “They just have not had the same amount of time to create a savings ‘pool’ or even to create good financial habits, so they struggle more than other groups during a challenging economic situation. Creating programs that are specifically designed for financial education for younger consumers is one area that I think credit unions can really excel at and should be excelling at in this case…there’s a role for credit unions to play as influencers in financial services and financial wellness in particular. That’s something the credit unions should grasp onto — and own it.”

Subprime account holders may be seeking innovations towards financial wellness. Primary FIs seeking to keep these consumers may seek to provide these tools.